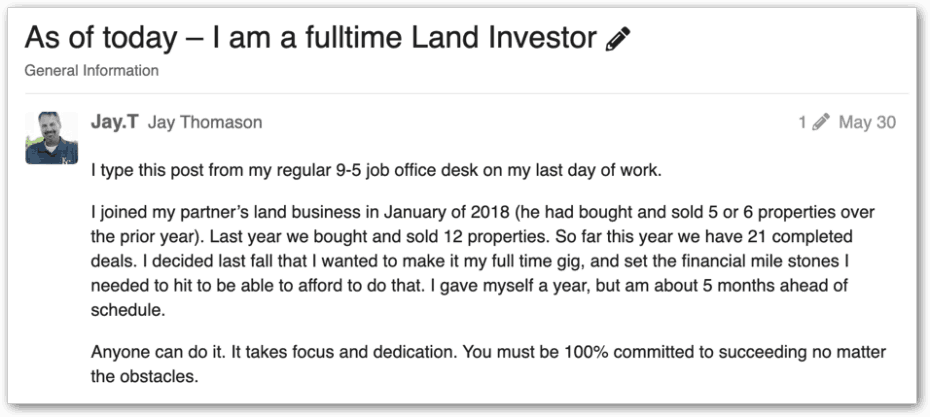

A few months ago, I saw a forum post in the Land Investing Masterclass forum from a guy named Jay Thomason. Here's a quick excerpt of what he said (this wasn't the full forum post, but enough to convey the gist of it):

When I saw this, I thought a couple of things:

- “That’s amazing!”

- “Hmmm… I bet there are some people in our crowd who would love to hear more details on how he did this.”

So, we reached out to him, and he was happy to come on our podcast with his business partner Daniel Earhart, to talk about how their business works, how they were able to speed-grow their operation in just a few short years, and the role both of them played in taking a HUGE step towards financial freedom.

Links and Resources

- Royal Investment Properties (Jay and Daniel's website)

- Profit First by Mike Michalowicz

- Parlay Mapping Software

- Mossy Oak Properties

- REI Landlist

- How to Build a Land Selling Website With WordPress

- Tim Ferriss

- RELATED: How Land-Specialized Real Estate Agents Can Change The Game For Land Investors

- RELATED: Finding Your Groove As A Land Investor – Interview w/ Karl James

- RELATED: How Willie Goldberg Went from 0 – 20 Deals Per Month and Quit His Job in 2 Years

Share Your Thoughts

- Leave your thoughts about this episode on the REtipster forum!

- Share this episode on X, Facebook, or LinkedIn (social sharing buttons below!)

Help out the show!

- Leave an honest review on Apple Podcasts. Your ratings and reviews are a huge help (and we read each one)!

- Subscribe on Apple Podcasts

- Subscribe on Spotify

Thanks again for listening!