REtipster features products and services we find useful. If you buy something through the links below, we may receive a referral fee, which helps support our work. Learn more.

If you've been working in the land flipping business for any length of time, there's a good chance you've heard of PRYCD.

PRYCD is an online software created by two guys who set out to solve some of the biggest problems land investors have to deal with:

- Researching markets.

- Valuing land.

- Formulating offer prices.

- Scrubbing lists.

These things have always been a challenge in the land investing business. Doing these tasks accurately takes a lot of time and a bit of guesstimation to get most deals done.

Disclaimer: Unfortunately, when valuing land, I've seen PRYCD's results often be wrong rather than right. If you use the ‘Comp Report' tool, be very careful about taking these results at face value. There is usually some nuance hiding beneath the surface that won't be seen until you look closer at the details and understand the validity of its chosen comps.

What Does PRYCD Do Exactly?

PRYCD has created some online tools that compile data from various sources to provide fast answers with some degree of accuracy.

- The First American API, which includes gobs of data on nearly every parcel in the United States.

- Sold comps (dating back 12 to 36 months) from websites like Lands of America, Zillow, and Realtor.com (among others).

- For Sale comps from the public listing websites like Lands of America, Zillow, and Realtor.com (among others).

- Economic data and population statistics from government databases.

It compiles this data to help land investors do a few things:

- Research markets. Determine which markets they want to pursue based on the availability of data in that market, the reliability and consistency of comps, and the economy's health. See the “Research” process shown in the video review above.

- Value properties. Their system can evaluate any individual property and generate several “comps” in the area based on sizes, zoning, and location. See the “Comp Report” process shown in the video above.

- Generate, scrub, and price lists. Using the combined data from First American and other public listing sites, users can determine which types of properties they want to pursue in a given area and how they want to price their offers (and this can be done at a pretty granular level). See the “Price Land” process shown in the video above.

PRYCD pulls in a lot of data from these sources to help land investors qualify the markets they want to work in and come up with an estimate of what properties are worth, which is a critical component of making the right offer and having confidence that you're buying at the right price.

Why Is Land Valuation So Difficult?

To understand the need for something like PRYCD, it helps to articulate why these problems with land research and value analysis exist in the first place.

Vacant land properties are often much more difficult to appraise than other real estate types.

You can read more about the problem (and some solutions) in this blog post, but here's the gist of it…

When an appraiser comes up with a value for a “normal” property (like a house, office building, or apartment complex), they have a lot of data to work with. These include recent sale prices of similar properties in the area, the amount of revenue generated by the building, and/or the cost it would take to reconstruct the building if it was destroyed. This information allows an appraiser to come up with a legitimate and accurate value for most properties.

But with the vast majority of vacant land properties, this data doesn't exist.

Vacant land doesn't have a building, so there's no estimated cost to rebuild.

And unless it's an active farm, most vacant lots aren't generating revenue.

The only information we have to work with when valuing land are the comparables or “comps” in the area (similar properties, what they sold for, and/or what they're listed for)… but the problem is, even those can be very difficult to find.

What Is an Appropriate Land Comp?

Since comps are the only data point we have to work with, it's important to ask the million-dollar question,

“What is an appropriate comp?”

If the right kinds of sold comps are available and plentiful, you can get an accurate read on what a single vacant land parcel is worth.

But if they aren't (as is often the case), the only choice is to find recent sales or listed properties that aren't very similar to your subject property and do the best you can with the incomplete information you have.

As is often the case with vacant land, there may be two or more parcels right next to each other that are similar in size but have different intrinsic values because of differences in their physical features and characteristics.

Sometimes we can get lucky. In certain markets, with certain property types, you may find large quantities of similar lots (similar in size, located nearby, with most of the same physical features, characteristics, accessibility, uses, etc.) that have recently sold.

For example, if you're looking at a one-acre infill lot in a huge, undeveloped subdivision with dozens of other infill lots around it (some of which have sold in the past year, or are currently listed for sale), this is your best-case scenario because you have current, relevant data you can use to draw rational conclsthat ions about what your property is likely going to sell for.

This can also happen in rural counties in the southwestern U.S., where you'll find thousands of similar-sized parcels that are flat, with very little variation in their physical features. It's easy to make an apples-to-apples comparison when everything in the area is very similar.

My problem is, I rarely get this lucky.

Case in point: one of the properties I bought this year doesn't have comps.

According to the local assessor, my lot is the only one of its kind in the entire township with its size and zoning.

It's not just a lack of recently sold or listed properties. There aren't any similar properties in existence, period.

So this begs the question,

“How do you value land when there are no usable comps?”

It can be done, but not without looking deeper at a property's characteristics (beyond what you can find in an online property database).

This usually means sending someone to your property to do an on-site inspection and/or spending some money to do some assessments to verify its uses and buildability. It also helps to get input from someone who is familiar with land transactions in that market (like a land specialized agent), and those people aren't always easy to find.

It's not hard to justify the time and expense to do these things when the property is valuable enough to warrant the investigation, but it's a bit harder to justify these costs on properties that aren't worth much, to begin with.

Does PRYCD Really Work?

With all the data gaps that exist in the world of vacant land, can a tool like PRYCD really make any difference in getting a more accurate read on property values?

I think the answer is both yes and no. I'll try to explain…

When the right data is available, PRYCD has the potential to be very accurate.

When the right data isn't available, it's going to be less accurate (obviously), and luckily, there are some indicators you can follow to figure out whether PRYCD has enough of this “right data” for you to rely on.

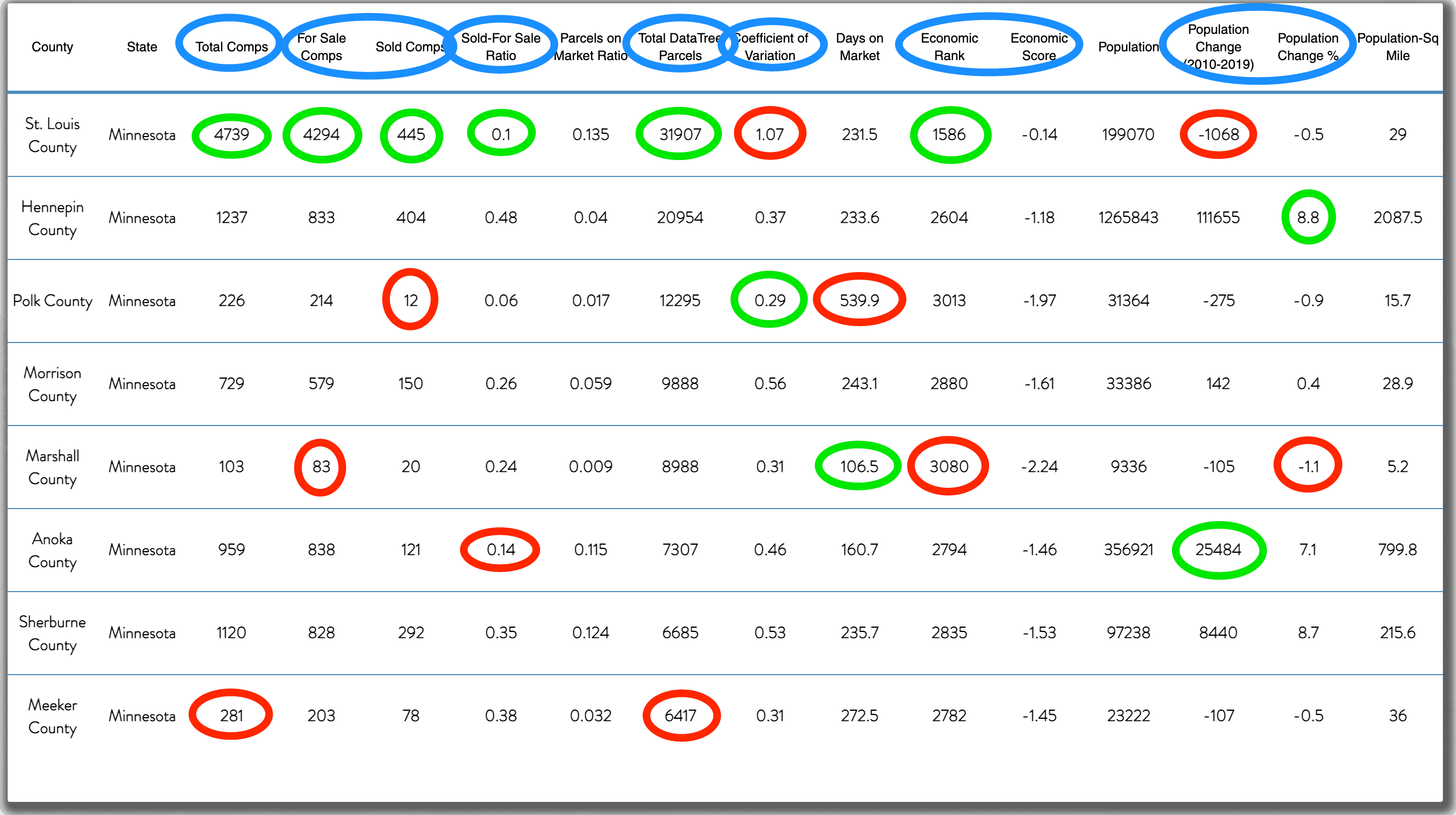

For example, when using the Research tool to identify a market, there are several variables that can be used to measure the number of comps available (Total Comps), how much variation there is between the prices of those sold comps (Coefficient of Variation), how quickly properties are selling (Days on Market), how many of the comps are actual Sold comps vs For Sale comps (Sold-For Sale Ratio), the economic rank of the county, the population change, and a lot more.

I think the real value PRYCD has to offer is in time savings and in some cases, pulling in data that you would normally miss on your own (because one set of human eyes can only see so much without the benefit of software).

PRYCD is doing a good job trying to tackle the land valuation problem with the data that's available, but in many markets around the country, this is a very tough nut to crack. If you're trying to value land in a market where the most important data simply doesn't exist, it still can't be done with much certainty in those areas.

While this isn't perfect data and doesn't tell the whole story, I would still be looking through most of the same data if I didn't have access to PRYCD, and it would take me a lot longer to compile everything and draw conclusions from it. From a time-saving standpoint, this brings huge value to the table.

In a perfect world, we would have a huge, nationwide database that includes accurate information about every aspect of every property, not just its size and location, but also its physical features, characteristics, uses and restrictions, soil types, buildability, and a lot more.

Unfortunately, this kind of detail simply doesn't exist in the world today, which means we have to make some assumptions, and those assumptions won't always be correct.

It's not that PRYCD “fixes” the land valuation problem (because nobody can provide perfect answers when there are such large information gaps), but when it comes to making the best of a tough situation, they're doing the best job I've seen so far.

If you're working in a market where most vacant lots have similar physical characteristics and features, this kind of “size vs. sold price” data can give you a pretty accurate portrayal of property values because there aren't many variables to throw a wrench in the numbers (this is common in rural counties in the southwestern desert that has thousands of similar-sized parcels that are flat because they're all pretty much the same thing).

Unfortunately, there are many counties (I might even say the majority of counties) where two lots can look identical on a spreadsheet (the same size and relatively close to each other), but still have vastly different values because of their different features, accessibility, build-ability, restrictions, etc.

And don't forget, even if PRYCD does nail the valuation perfectly, it's still your job to determine the right offer percentage, which can be a whole other challenge in itself. PRYCD will make this fast and easy, and it will price your offers at 25% of market value by default, but this will usually need to be adjusted higher or lower based on what you determine to be most appropriate for the market.

You really can't get this information about a vacant lot unless you look much deeper at a property (beyond what First American or other public records will tell you). You have to send someone to the property to do an on-site inspection and/or spend some money to do some assessments to verify its build-ability, and it also helps to talk with a few local land specialists who have seen land transactions in that market, and these people aren't always easy to find.

What I Like About PRYCD

I like how PRYCD can save a lot of time in distilling down the right markets to pursue.

When I got familiar with their Research tool and realized how quickly I could narrow down specific counties on a nationwide basis, just by sorting them by the filter of my choice, it was one of those “wow” moments for me. The information they're using is already out there in various forms, but the way they've been able to set up filters that highlight certain markets characteristics that matter to land investors is a big innovation.

You can certainly dredge up this data on your own and crunch the numbers yourself for free, but you can do it a lot faster with this kind of software at your disposal.

Even though it won't see every conceivable factor that goes into making a good or bad market, it will see at least 80% of what matters. PRYCD can do in a matter of seconds what it would take any normal human many hours to do manually.

I think the blind offer pricing feature is nice to have, but I actually wouldn't consider it to be the most important thing PRYCD has to offer.

Not every land investor sends out direct mail with blind offers in the first place, and of those who do, blind offers can be priced relatively quickly by anyone who knows their way around a spreadsheet and understands the logic of how they want to price their offers.

It certainly makes sense for PRYCD to build this feature into the software (given everything else it can do), but in the overall scheme of what PRYCD is capable of, I would consider this to be more of a side benefit than the main feature. Granted, there are other land investors who send out FAR more blind offers than I do. They may disagree with me and if so, I respect that. This was just my take on it.

I've also noticed that Max and Ryan (the founders of PRYCD) take feedback from their customers very seriously and actually use it to add new features. I saw this first-hand when I provided my feedback and saw that they had made updates based on my feedback within 48 hours of me sending an email to them! This isn't always the case with companies that don't pay attention to the needs and wants of their customers but PRYCD seems to be doing a good job of it.

What I Don't Like About PRYCD

Valuation tools like PRYCD appeal to people because it feels like an easy answer to a difficult question (and if a county doesn't have much variation in property features or sale prices, sometimes it really is that easy), but when there are huge differences in physical features between properties that PRYCD can't account for and these attributes have a huge impact on value, you can only get so far using a tool that doesn't have all the information.

It's not so much a problem with the software; it's a problem I have with people who recommend tools like this as an easy, fix-all solution to the HUGE challenge of valuing and pricing land.

PRYCD works the way it does because it really is the best way to estimate property values with the limited information available, but that doesn't mean it will tell you the whole story.

You don’t want to look at a PRYCD valuation and assume it’s the gospel truth. Just look at it from the perspective of,

“That’s interesting. Now let me see talk to some local land specialists and see if they think this number is accurate.”

Now, keep in mind that this lack of data and the challenge of valuing land are a huge part of what scares banks away and keeps the land flipping business relatively low in competition because it's difficult to value land with absolute confidence.

This isn't PRYCD's fault, they're doing a good job trying to tackle the problem, but it's still a very complicated issue to solve, and it can't really be done with certainty when the data just isn't there.

This goes back to the business model of a land flipper and it underscores the importance of keeping your offers low because even if you’re wrong, if you keep your original offer low, there will be a big enough profit margin to protect you if you overlooked something in your due diligence.

Is PRYCD Worth It?

For the research, analytics, and list scrubbing capabilities of what PRYCD can do, and considering the cost of subscribing to the service, the value is absolutely worth it.

When you consider how many hours this can save you in sizing up which markets fit your criteria, this is a crazy low price. This is especially true if you are sending large, county-wide mail campaigns (over 5,000 – 10,000 units per campaign).

If you use PRYCD to pull lists, the cost is about the same (if not cheaper) as that of most other data services.

As someone who has long used DataTree and recommended it to other land investors, some people have asked me,

“Can I drop my DataTree subscription and just use PRYCD instead?”

Maybe. It depends on what you use DataTree for in the first place.

If you have a tight budget and you use DataTree only for pulling lists, then yes, you can probably quit DataTree and use PRYCD instead, because this is exactly what PRYCD does. In some ways (especially if you're only pulling lists of vacant land properties), it arguably does a better job by offering more relevant filters that DataTree doesn't have in its system and eliminating some of the less-useful DataTree filters that land investors never use.

PRYCD also has the ability to scrub lists from anywhere, whether you obtain your lists from PropStream, The Land Portal or another source. PRYCD can help you scrub these lists (but not price them) for free.

However, if you use DataTree for individual property research on specific properties or neighboring properties (not just for valuation purposes, but to find owner information, property tax amounts, zoning, prior transactions, sending out neighbor letters, etc), this isn’t really what PRYCD was designed is for. DataTree is still a very useful due diligence tool to have available when needed.

Additionally, if you use DataTree to retrieve document images or conduct title research, PRYCD doesn’t offer this functionality either.

Final Thoughts

As long as a land investor understands what they're getting when they see the results from PRYCD (it's not a perfect, “gospel truth” answer to the question of land values), then it's a fantastic tool to use.

With the cost of a monthly subscription, it's kind of a no-brainer for an active land flipper who will be using it regularly. Even for the hobbyist land investors who don't use it every week, it's still pretty easy to justify the price, considering the time it will save you in the research process.

The bottom line is, we can complain about the difficulties of valuing properties or we can be grateful that it’s so difficult because this ongoing challenge is part of what scares a lot of people out of the land space.

With a tool like PRYCD on hand to assist in navigating the situation, we can make the best of it (especially if you take the time to watch all of PRYCD's training videos so you understand how to fully utilize the web application). And as long as we have a healthy understanding that PRYCD is a helpful assistant, not a complete problem-solver, we can have proper expectations about its role in the overall market research and land valuation process.