REtipster does not provide tax, investment, or financial advice. Always seek the help of a licensed financial professional before taking action.

When I graduated from high school, one of the first things my dad did was take me to a Dave Ramsey seminar.

Being an 18-year-old “man” with my entire adult life ahead of me, I wasn't crazy about spending an entire Saturday listening to someone yell at me about getting out of debt and saving for retirement. Nevertheless – my dad seemed to think it was important, so I went along.

By the end of the day, my mind was blown. I walked away from that seminar with a radically different outlook on my financial future. It was one of those rare, life-changing experiences where all the information instantly resonated with me because the truth behind his message was impossible to deny.

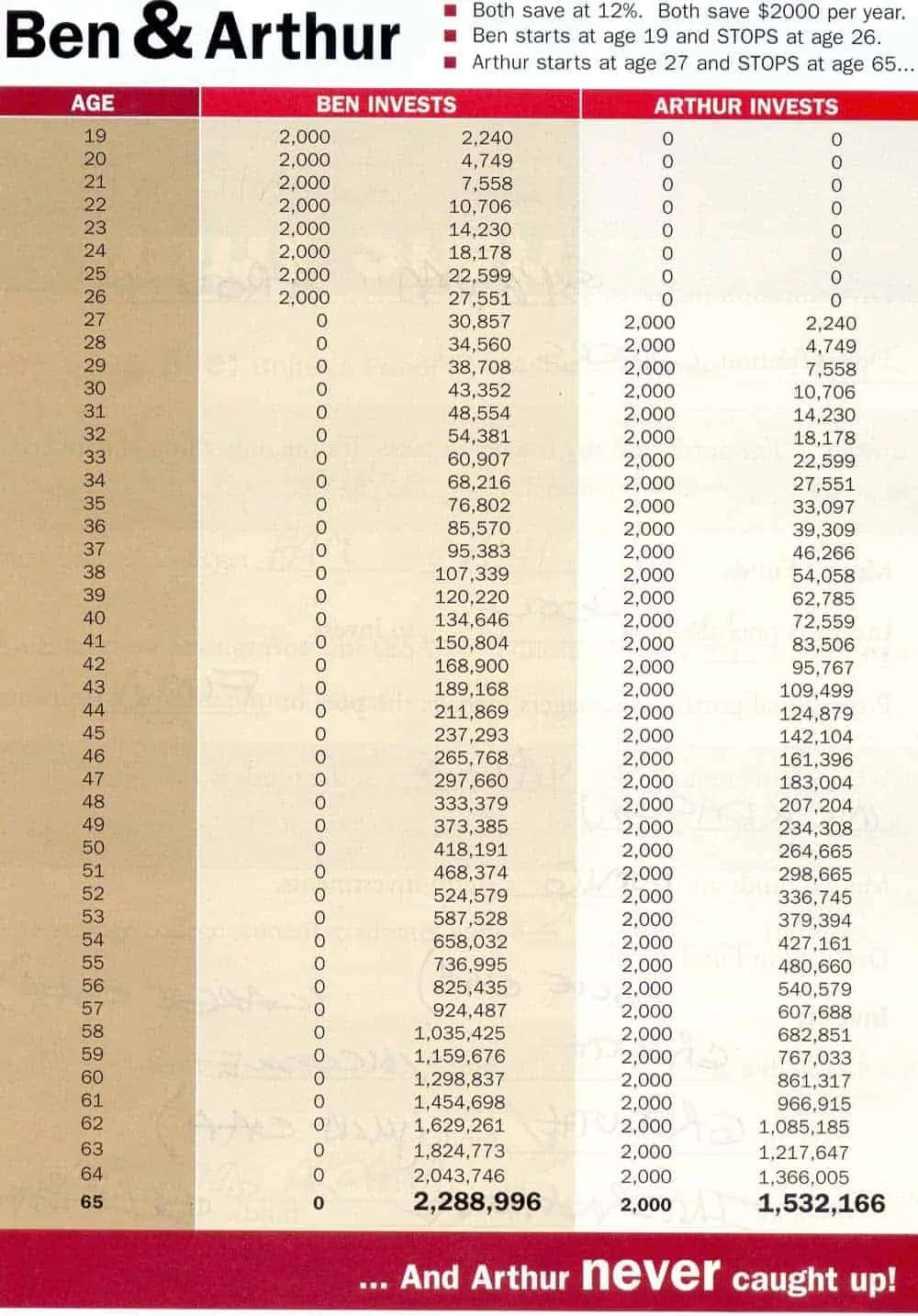

One of the biggest “aha moments” from that day was an illustration of the power of compound interest. I tore the page out of my program (over a decade ago now), and I still have it:

The real significance of this illustration is that it shows the power of starting early. When a person starts saving for retirement at a young age, their result will FAR EXCEED a person who starts later in life, even though the person who started later will have invested far more principal over the long haul.

The paradox is that most 18-year-olds couldn't care less about saving for retirement. It's one of the last things on a young person's mind (especially when they don't have such an obvious illustration showing them what to do).

I was extremely lucky because when I first saw this illustration, I was 18 years old, AND I decided to implement it.

Some people try to downplay this illustration with the argument that a 12% ROI over the course of 40+ years is totally unrealistic. Still, even with a less-optimistic assumption about your average return on investment, the undeniable power of compound interest remains the same.

Starting early and sticking to it is far more powerful than starting late.

Real Estate as a Retirement Vehicle

Not long after I developed an interest in real estate, I started wondering,

What would Dave Ramsey's illustration look like if we invested in real estate instead of stocks and mutual funds?

Most of the retirement calculators on the internet assume that your money is getting plugged into a mutual fund (or another boring investment product you don't have to think about).

There are certainly some benefits to investing in mutual funds (namely, the fact that someone else is doing all of the work and management), but the investment growth will be very, very slow. People don't get rich quickly by investing this way.

If you're willing to invest in your real estate portfolio, there is the potential for FAR higher returns because real estate allows an investor to use other people's money (OPM) to leverage their investment dollars. Real estate also offers tax advantages and plenty of opportunities to increase the value of each property.

So what would an investment calculator look like if we applied it to real estate instead of the stock market?

Real Estate Retirement Calculator

I spent many hours putting together a real estate retirement calculator to show what the path to retirement could look like for a real estate investor.

This calculator ended up being more complex than I thought it would be because a lot of assumptions need to be clearly defined for it to work properly and show a realistic end result.

For example, some of the basic assumptions are things like:

- What is our target cash on cash return each year over the long term?

- How much principal are we planning to invest each year on average?

- Are we going to reinvest our after-tax cash flow or not?

- What will be the interest rate and amortization term of our financing?

- What percent of each purchase price will our lender require us to contribute?

- How much will we need to live off of once we retire?

- Will we keep investing in real estate indefinitely or will we stop at some point?

These are all important considerations, but it doesn't stop there. There are even more assumptions that will have a BIG impact on the end result:

- How much do we think our real estate will appreciate each year?

- How much are we planning to increase rent year-over-year?

- Which federal and state tax brackets will we fall into?

- How much will we be able to depreciate each year for each property?

The Imperfections of a Real Estate Calculator

And even after we've defined all of these things, it's still impossible to avoid some generalizations with this kind of calculator.

For example, if a person plans to invest $10,000 per year in real estate, it's highly unlikely they will find properties that require this exact principal investment every year. In the real world, they'll probably have to set aside this $10,000 amount each year and buy one property that requires a higher down payment when the opportunity presents itself (perhaps every 2 to 4 years – for example).

Every real estate transaction is different. The interest rates will fluctuate with each deal, as will the cash on cash return, the appreciation, the rent increase, and even the federal and state tax brackets.

Most of us simply won't know these things with 100% accuracy from the outset, but at the very least, we can make some reasonable assumptions with the understanding that this kind of calculator isn't a crystal ball; it's just a way to see some possible outcomes based on very basic assumptions.

The Retirement Calculator in Action

Let's dive into a hypothetical example.

Suppose I want to retire in 20 years, and I want an annual income of $70,000 when I get there.

If I'm starting from zero, how much will I need to invest each year to get there? What will my returns on each property have to be? What kind of financing terms will I need to get?

What things would have to be true in order for me to accomplish this goal?

This calculator allows us to get very clear about what we'll need to do to reach the desired outcome.

How to Reverse Engineer the Desired Result

Not surprisingly, there are many different ways to achieve the end goal. It's just a matter of deciding what I'm willing to sacrifice to the table to get there.

As I play around with this calculator, I can come up with one set of assumptions that will get me there.

Assumptions:

- I can consistently find deals with an average cash-on-cash return of 12%.

- I will be financing all of my properties with 30-year mortgages that require 25% down and a fixed interest rate of 5%.

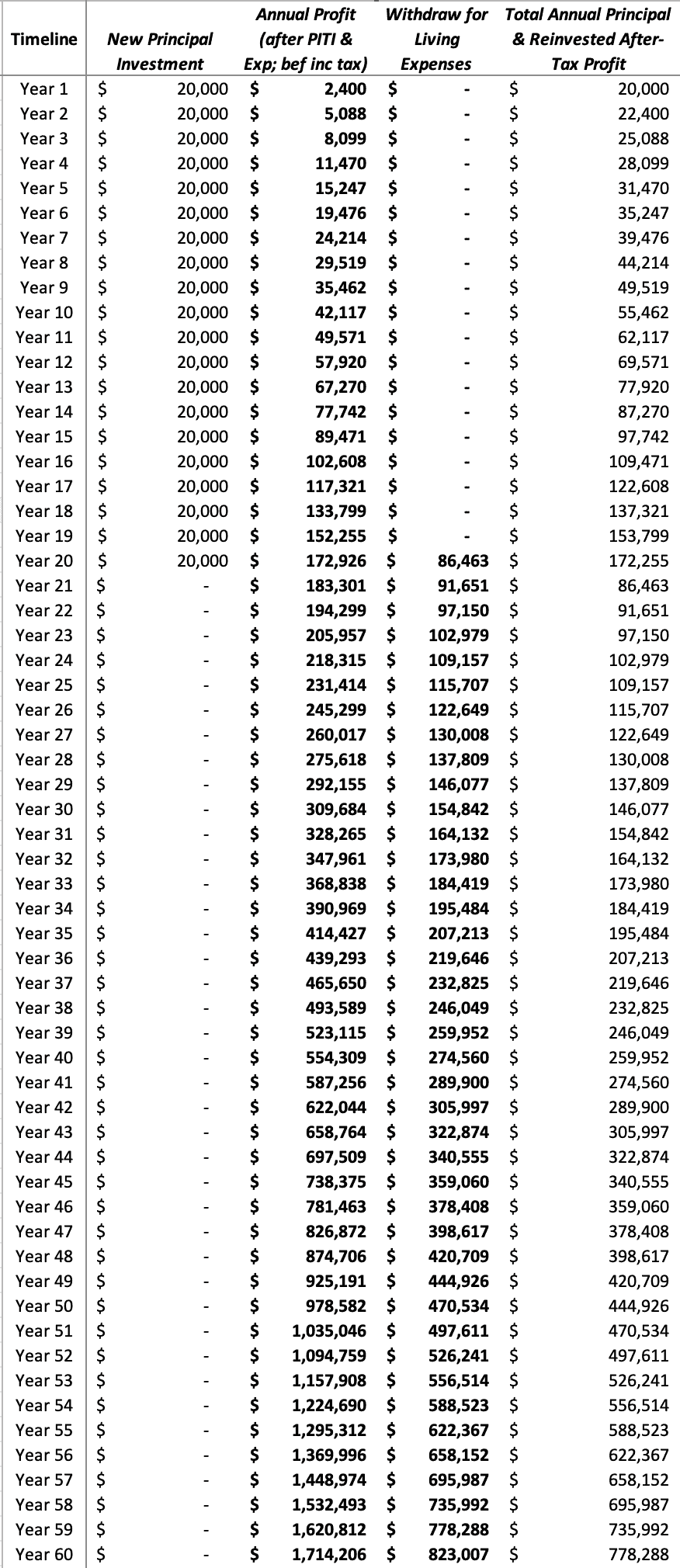

- I will invest $20,000 of new principal into my yearly portfolio for 20 years.

- I will reinvest all of my after-tax cash flow into buying more properties during this 20-year period.

- When I hit the 20-year mark, I will STOP all new principal investments, and instead, I will start withdrawing 50% of my annual pre-tax profit to cover my living expenses.

- The remaining 50% of my profits (after taxes) will be continually reinvested into my portfolio in the following years. In this way, my real estate portfolio will continue growing without any new principal investment from me (so in theory, my income and net worth will continue to grow as I get older).

Here’s how this model would look:

How Each Column Is Calculated

- Timeline: This shows the number of years I am actively investing in my real estate portfolio (i.e., if I were 18 years old in Year 1, I would be 78 years old in Year 60).

- Principal Investment: This is the amount of new principal (outside money, directly from my pocket) I invest in new properties each year.

- Annual Profit: This is the annual net income (after PITI and expenses, but before taxes) I am earning from my real estate investments by the end of each year (the example above assumes I am earning a 12% annual cash on cash return on my investment to date).

- Withdraw for Living Expenses: This is the amount I am pulling from my annual profit to cover my living expenses (or to spend wildly on whatever my heart desires).

- Total Investment: This accounts for my annual principal investment PLUS the sum of my prior year's annual net profit minus my withdraw for living expenses (i.e. – my total investment, plus my reinvestment into new properties each year).

The challenge with creating a retirement calculator for real estate is that it's not always feasible to buy rental properties in precise, predictable chunks of $20K each year (or however much you feel like investing). Mutual funds DO allow for this kind of flexibility, but rental properties have many more factors and variables involved, like:

- Am I able to find the right properties, in the right areas, at the right prices?

- Is the real estate market going in the right direction, or do I need to discover a new market?

- Is my property manager doing their job to keep the cash on cash return at 12% or above?

- Are there any other external factors that might skew these numbers in some other way?

In order to create this kind of calculator, you really have to make some big assumptions – but even so, it doesn't necessarily mean the calculations are unrealistic.

For example – if you can't consistently find a deal each year that requires exactly $20K of new money – perhaps you can find one deal every other year that requires $40K? Perhaps you can find one every three years that requires a $60K injection? The chart above certainly oversimplifies the formula, but it still points you in a reasonably accurate direction.

The Added Benefits of Rental Properties

When my objective is to retire on real estate, I am focused almost entirely on the cash flow of each property (because this is precisely what is going to pay my bills – now and in the future). Even with this objective in mind, there is FAR more to the story.

There are a few important factors that should undoubtedly make rental properties a more compelling investment than other conventional retirement vehicles (on paper, anyway). The following perks of real estate are commonly known among real estate investors, but I think they're still worth reiterating here.

1. Real Estate Offers Significant Tax Advantages.

Thanks to “phantom expenses” like depreciation (assuming you're buying a property with improvements on it) and interest (assuming you're buying each property with financing), you are practically guaranteed to pay fewer taxes on the passive income you generate from rental properties. This is a HUGE motivator for many real estate investors.

2. Real Estate Almost Always Appreciates in Value.

Almost always. I say this with three basic assumptions in mind:

- You bought your property at the right price (i.e. – one that allows for at least a 12% annual cash on cash return).

- You didn't acquire it during an obvious bubble in the market.

- You're planning to hold each of your properties for a period of at least 20+ years.

In most cases, even if you're unable to check all 3 of these boxes, your portfolio of rental properties is still very likely to increase in value over the course of a few decades (and in most cases, it will increase significantly).

3. The Majority of Your Portfolio will be paid for by Other People's Money.

Probably the most beautiful aspect of rental properties is that in most cases, the investor (aka – YOU) only needs to pay for a small portion of the total value of each property. This is possible through the use of OPM (other people's money).

Conservatively speaking, most conventional lenders will require an investor to cover at least 20% of the purchase price for a single-family home and 25% of the purchase price for a multi-unit apartment building or commercial property.

Assuming you did your homework upfront and bought a property that actually makes a profit after all expenses are paid, 100% of your outstanding loan balance should be paid off by your tenants. It's as easy as 1-2-3:

- Your tenants pay their rent to you.

- The rent payments end up in your bank account.

- Your lender will deduct a portion of these monthly payments from this pool of rent money, leaving the remainder of that cash for you to:

- Pay your property manager.

- Make improvements to the property.

- Pay yourself (in the above example, this would come out to at least 12% of the money you originally invested – hence the 15% cash on cash return).

If your properties are profitable, there should be more than enough to pay everybody (including yourself) each month.

There is no other retirement vehicle on earth that boasts all 3 of these benefits (and each of these benefits is a big deal in its own right).

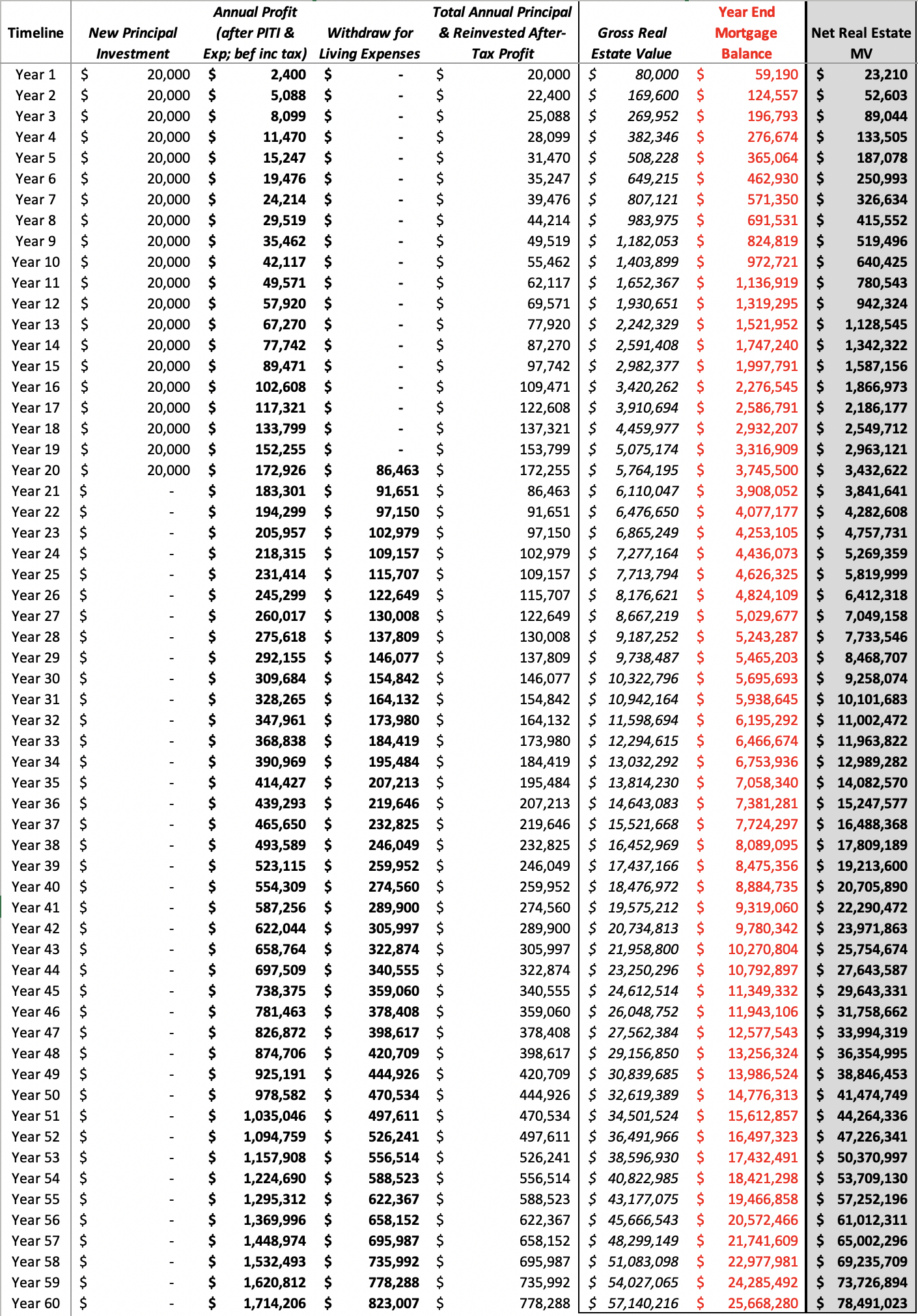

Let's take a look at the same illustration above, only this time, we're going to add in the collective liquidation value of your real estate portfolio (this shows the entire cash value that you could theoretically pull out of your properties if you decided to liquidate everything at any given year in the timeline). Again, here are our assumptions:

- There has been 3% average appreciation on all properties since the date of purchase (this is a fairly conservative assumption, by the way)

- Your lender(s) required you to inject 25% into each property (another conservative assumption – since many properties will require a smaller down payment if you're only buying single-family homes)

- On average, you will be able to obtain 30-year mortgage financing on all your properties with an interest rate of 5% (interest rates have been all over the place over the past 40 years, so this one is kind of a wild-but-not-completely-unreasonable guess).

- We will be deducting the collective mortgage balances on all of these properties in each given year (so you can see both the gross value and the net value of the entire real estate portfolio during each year).

It's a lot of numbers – I know… but there's an important point here.

Do you see that grey column on the right? When you isolate any particular year in the timeline, this is the “liquidation value” you feasibly have at your disposal. There are, of course, a few caveats to keep in mind:

- Liquidation Speed: Real Estate is NOT a “liquid asset”. In other words, you should never assume that you can instantly convert a property into cash (whereas, you CAN do this with publicly traded stocks and mutual funds). While these numbers for “Net Real Estate Market Value” may look impressive, keep in mind that the speed at which you can convert each property to cash will depend greatly on the supply and demand for housing your market when you try to sell.

- Market Value: A property's value is contingent on the market and time in which you try to sell it. There will be times when a property is worth MORE than it was when you bought it, and there will be times when a property is worth LESS than it was when you bought it. With this in mind, the chart above assumes that each property's value is appreciating at a perfectly consistent rate of 3% each year. While this is a reasonable assumption based on historical numbers, this appreciation comes in waves over time, and won't happen in these exact increments each year.

Calculate Your Road to Retirement

The excel spreadsheet I used above is a bit more complicated than the typical retirement calculator you'll find on the internet. This is because it factors in several assumptions that most retirement calculators don't need to account for:

- Your required injection for each property

- Your average interest rate for each mortgage

- The amortization schedule for each mortgage

- Your assumed cash on cash return for each property

- The length of time until you retire

- The amount you'll consistently invest each year

- The amount you'll withdraw for living expenses – and the amount that will be re-invested

- The Gross Value, Mortgage Balances AND Net Equity for your entire portfolio in any given year

- The average annual depreciation that will be written off on each property (and whether the properties will be commercial or residential)

- The federal and state income tax brackets of the investor

- The average annual appreciation for each property

In the real world, the numbers will rarely (if ever) work out this simply. Nevertheless, this kind of calculator can be a helpful way to illustrate what inputs will be required in order to achieve your desired result.

At the very least, it should give you a ballpark idea of what you can reasonably expect to see at the end of your career if you follow your projections until the day you retire.

Want to Use My Spreadsheet?

If this is something you're interested in, I wanted to make it available to you in a more automated fashion. If you sign up as an REtipster Email Subscriber, you can get instant access to it, right here on the site. I hope you find it helpful as you're planning your retirement strategy. Best of luck!

Note: I only send emails to my list when they're particularly relevant and important – so don't worry, signing up for this email list will NOT result in piles of junk emails in your inbox.

Conclusions

A few things come to mind as I look at these numbers:

- For the average investor, building a huge source of passive income from rental properties is usually not going to be a fast process. It's either going to take a lot of time or a lot of money (or both), but it can result in some CRAZY increases in wealth if both of these ingredients are there.

- buy-and-hold real estate, you need to start sooner rather than later.

- Any ONE of the assumptions we're making in this calculation will have a very big impact on the end result. This can work to one's advantage. If you aren't able to find properties with a 12% cash on cash return, you can offset this by finding cheaper financing, increasing your principal investment, investing for a longer time, withdrawing less, etc. There are MANY different ways to make the numbers work for you, but you need to bring something to the table. Whether it's access to great deals, access to capital, access to the best financing terms, it makes a huge difference when you have some kind of competitive edge that others don't have.

- Changing the interest rate and/or term of each mortgage has a surprisingly small effect on the rate at which real estate equity grows.

- The amount withdrawn for living expenses (and the time an investor chooses to wait before they start doing this) can greatly fuel or diminish the growth of cash flow and real estate equity over this timeline.

Want to speed up the process? You will have to do at least one of the following things:

- Throw a significantly larger sum of cash into your real estate portfolio each year (especially in the earlier years).

- Buy properties with significantly higher cash on cash return (note: you'll also have to find a sustainable source of these deals that you can pull from year after year).

- Find a lender who will allow for an injection of 20% or less (rather than the 25% assumption shown above).

- Find a lender who will charge an unusually low-interest rate (this will be difficult since most lenders are tied to whatever prime rate is at the time).

- Wait as long as possible before you start withdrawing money to spend on yourself.

- Wait as long as possible before you stop investing new dollars into your portfolio (however, once you've consistently invested for 10 – 15 years, this starts becoming a smaller and smaller issue).