It is no secret that a well located, reasonably priced real estate investment can effectively generate more revenue than the cost of the money used to finance it.

Many who have held on to single-family homes in good areas for 10 years or more have built up substantial amounts of equity, and a lot of savings.

Before deciding to write this article, I did some research online but was unable to find a concise explanation for “how a single-family rental property makes money”.

To answer this question, I think it helps to simply think of a stool with 4 legs.

- Cash Flow

- Amortization

- Appreciation

- Tax Benefits

Let’s look at each of these legs in a little more detail.

#1 Cash Flow

The main way a rental property can make money is through cash flow. Simply put, this is the difference between the rent collected and all operating expenses.

For example, let’s say you buy a house for $200,000 and rent it for $1,500 per month. If you get a great interest rate and put down a healthy down payment, your “PITI” (Principal, Interest, Taxes, Insurance) would be about $985 per month. This leaves you with a $515 difference between the rent you collect and the monthly “PITI” payment.

Is it really that simple? Of course not! To understand how much money we're ACTUALLY making here, we need to talk about something called Net Operating Income.

RELATED: The Beginner's Guide to Buying Rental Properties (A Case Study)

What is Net Operating Income?

Net Operating Income (NOI) is the rent you collect, minus all operating expenses. The most common operating expenses are:

- Vacancy (when your property sits empty)

- Repairs (when your property needs fixing)

- Management fees (for finding/evicting tenants and paying attention to the details)

- Delinquency (when tenants pay late or stop paying altogether)

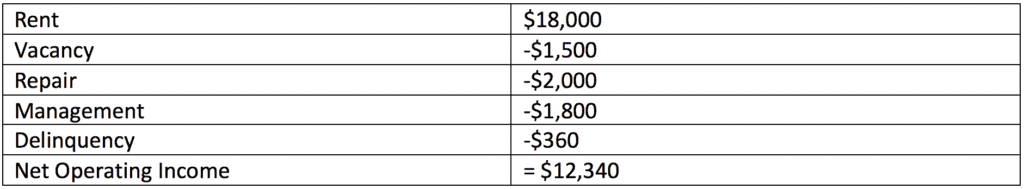

To calculate Net Operating Income, we can multiply the monthly rent by 12 ($1,500 x 12) = $18,000; this is often referred to as Gross Scheduled Rent.

Now let’s look at the expenses.

Vacancy Allowance

A vacancy is the time in-between tenants. When one tenant moves out, the property must be “turned over” into rent-ready condition. You'll have to recognize that no rent will be collected during this period, and as such, you need to realistically budget for lost rent. To be conservative, I like to assume that my property will sit vacant for one full month out of the year.

So let's deduct one month's rent of $1,500 from our Gross Scheduled Rent above.

$18,000 – $1,500 = $16,500

RELATED: Road to Renting: Rental Property Marketing Guide

Repairs

These are the day to day maintenance items such as faucets, appliances, doors, locks, light fixtures, HVAC repair, etc. This amount can vary depending on the size and age of the property, but as an average, a decent benchmark for a newer home in good condition is about $2,000 per year.

Let’s deduct another $2,000 from our Gross Scheduled Rent.

$18,000 – $1,500 – $2,000 = $14,500

Management fees

Unlike vacancy and repairs, this is a discretionary expense. You are not required to hire a property manager, however – somebody will have to manage every property you own (even if it's YOU), so it's wise to acknowledge this very real cost.

I like to manage my own properties, so I'm not paying this money out to a third-party property management company – but I have a lot of experience, and I do pay the price in my time.

You must decide for yourself if you want to go it alone or hire a manager. Many property management companies will charge about 10% of the gross rent ($18,000 x 10%) = $1,800.

Let’s deduct another $1,800 from the GSR.

$18,000 – $1,500 – $2,000 – $1,800 = $12,700

Delinquency

This cost is a little harder to predict when compared with vacancy and repairs. Assuming you are buying a good house in a good area of town, and your tenants are being screened properly this should not be an issue. However, even the best screening process won't make a landlord immune to the occasional delinquent tenant. Things happen – so let’s budget for 2% of the gross rent ($18,000 x 2%) = $360

Let’s knock off another $360 from our gross rent for the year.

As you can see above, your Net Operating Income is the Gross Scheduled Rent subtracted by all operating expenses (and keep in mind, the mortgage is not part of this calculation).

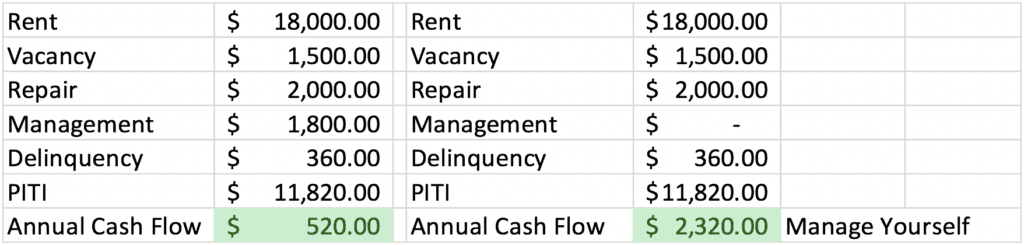

Mortgage (PITI)

The Principal, Interest, Taxes and Insurance payment (or “PITI” for short) will be your greatest expense and will include the total amount of Principle, Interest, Taxes, and Insurance for the year.

Now let’s look at the numbers…

After these expenses, you will have $520 profit for the year – which isn't a lot of money.

However, it's important to recognize, if you had a management company doing all the leg work, this would be passive income that required virtually no time or work from you.

Also, assuming rent prices rise as time goes on, your gross rents will increase while your principal and interest payments remain the same.

Ending the year with $2,320 isn't a bad deal (assuming you didn't put a huge amount of your time into managing the property), but what else do you get for your investment?

#2 Amortization (Principle Pay Down)

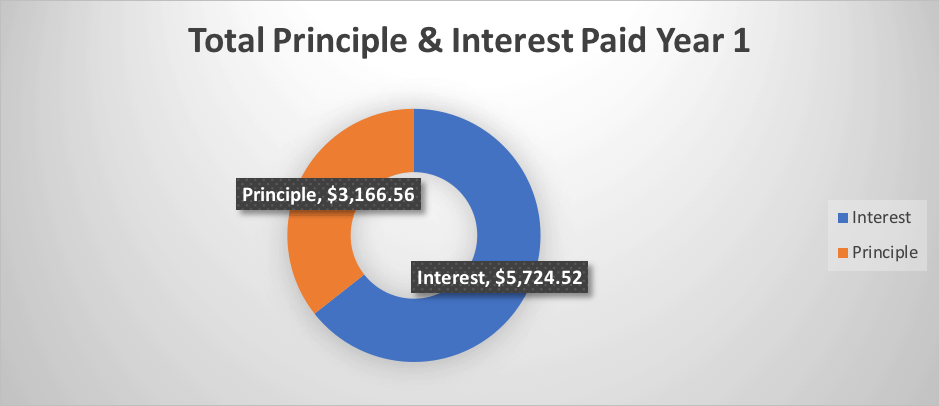

With every monthly payment made toward your loan, a portion of that payment goes to pay down the principal amount owed on the property.

The key point to remember here is that you will be paying down your mortgage with someone else’s money (the rent you get from your tenant).

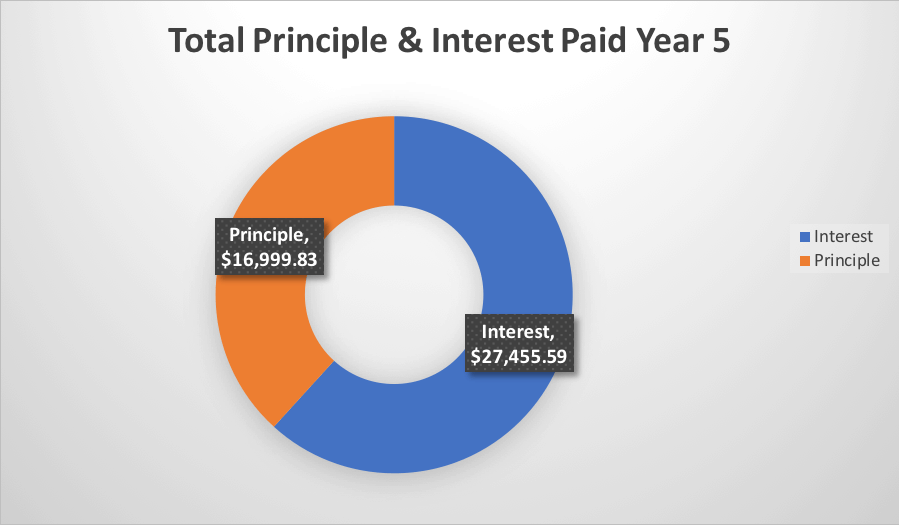

If you've ever looked at how a 30-year fixed mortgage is calculated, you'll see that with every year that goes by, you pay down progressively more principle than the previous year. This means you are building equity (the difference between the value of the property and the principal balance of the loan) each year with someone else’s money.

The specifics of how mortgages pay down is another subject – for now, all you have to remember is that every time a rent payment comes in, a progressively larger portion of your Principle & Interest payment goes toward paying down your mortgage, which effectively builds up your equity with your tenant's money.

As you can see in chart 1 below, you would be paying off $3,166.56 of principle in year 1, effectively increasing your net worth (all your assets minus your liabilities) by a little over $3,000.

Again, not a lot of money—I get it!

But remember, buying and holding real estate is a long-term strategy. Let’s look at things around the 5th year.

As you can see above, at the end of the 5th year you have added an additional $17K to your net worth, and you have done so with the rent from your tenant.

RELATED: Cash on Cash Return Calculator

Appreciation

The average appreciation rate for homes is heavily dependent on local factors as well as some booms and busts of the U.S. economy. Zillow gives an estimate of 3% – 5% annually, depending on local factors and Appreciation is the increase in the value of an asset over time.

In Wake County, North Carolina, where I currently invest, we have experienced some of the most competitive appreciation rates in the area. The average appreciation rate in Raleigh between 2016 and 2017 is 5%.

To avoid getting mired down in complicated economic data, I like to be conservative in assuming a good house in a good area will appreciate on average of 1% per year.

Why does the value of a home appreciate?

Home appreciation isn't always a guaranteed thing – so it helps to start with an understanding of why appreciation happens in the first place.

Fixed Supply

There is a fixed supply of land to put houses on in the United States. The increase in population gradually increases the demand – and with a fixed supply of land, this will naturally drive up the price.

Population Growth

The United States has seen a steady increase in population over time. More people means more roofs are required to house them.

In July 2015, Wake County was listed as one of the fastest-growing counties in the country. According to the Wake County Demographics Study, Raleigh is growing at a rate of 14% per year. This surge in the population increases the demand for housing which increases the price. Do your research on local appreciation rates in your city and state. Many counties like Wake County NC, will publish demographics data that they share with the public. Zillow.com is another good resource for average appreciation rates in local areas.

Equity

Amortization and appreciation contribute to profit by virtue of another concept called equity. Equity is defined as the difference between the value of an asset and any debt on it.

When we combine appreciation with the gradual paying down of the principal balance of the loan (amortization), we are left with the equity.

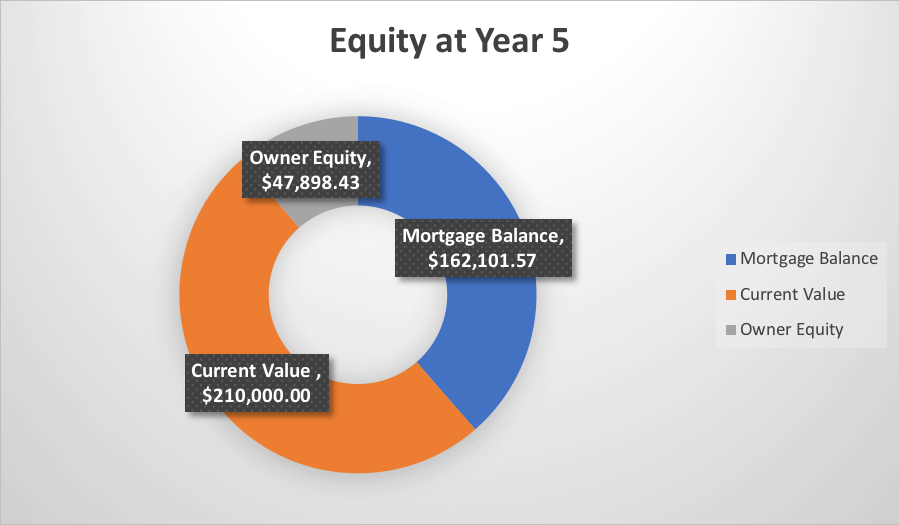

Look at the chart below.

As you can see, the amount of equity in the property 5 years after purchase, assuming a 30-year amortization schedule and 1% per year appreciation, is $47,898. As an owner of rental property, your net worth would now be almost $48,000 higher due to your investment decision.

Tax Benefits

Real estate offers some of the most generous tax advantages of the asset classes. Rental properties can be depreciated each year to offset any cash flow, and all maintenance and expenses can be deducted against any profits received.

Remember the $5,700 in mortgage interest that you paid the first year? All of it is tax-deductible. So, any cash flow you made at the end of the first year, whether it be $500+ (managed by a professional company), or $2,000+ (if managed yourself) would be offset by the mortgage interest that you paid. You also have the option to deduct that mortgage interest against any personal income you made that year.

There is another benefit called depreciation. Basically, you can depreciate the fixtures of the house to offset any income that you have. Even though you don't literally have to pay out of your cash reserves to pay for this expense, the IRS will allow you to count this as an expense all the same, because they recognize that all physical assets will eventually wear out.

1031 Exchange

Remember the $47,000 in equity at year five? If you decided to sell the property, you could use a 1031 Exchange to defer paying any taxes on that money so long as you use it for another investment property. There are other criteria that must be met that we will not be addressed here.

RELATED: Doing a 1031 Exchange (the Easy Way) with RealtyMogul

Books have been written on this subject and this article is meant to be a brief overview. Hopefully, you can see that owning a rental property, when held for the long term, can be a very profitable and low-risk investment strategy.

While it can be difficult to get a single-family home to show cash flow when bought for “retail” price (the example used in this article assumes that the property was bought at a substantial discount), it is possible when using an effective marketing approach.

Sources

https://www.zillow.com/research/zillow-home-value-appreciation-5235/

http://www.econ.yale.edu/~shiller/data.htm

Irrational Exuberance: Revised and Expanded Third Edition by Robert J. Shiller