What Is Cash-on-Cash Return?

REtipster does not provide tax, investment, or financial advice. Always seek the help of a licensed financial professional before taking action.

Cash-on-Cash Return Calculator

How to Calculate Cash-on-Cash Return

To understand how the calculator above works, it helps to know how cash-on-cash return is calculated in the first place.

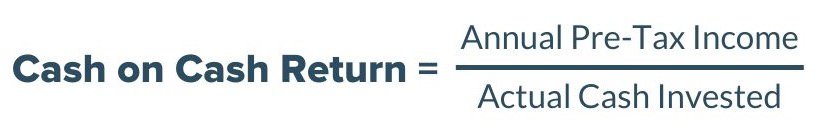

Start by dividing your annual income from an investment (before taxes) by the amount of cash you’ve invested in it, like so:

For example, if you put up $10,000 of your cash to buy a property, and the money you actually put in your pocket is $1,000 from this investment, then you’ve earned a cash-on-cash return of 10%.

Cash-on-Cash Return Explained

Cash-on-cash return is the yearly income you’ve gained from an investment as a percentage of the cash you initially invested.

Ultimately, cash-on-cash return is just a ratio of two numbers: how much actual cash you’ve invested vs. how much you’ve gotten back in a given year.

You can measure the returns on any real estate investment: flips, rental properties, raw land, mobile homes, you name it. However, investors in other fields use cash-on-cash return as a benchmark for other types of investments. While there are many ways of calculating returns, CoC return is usually the most straightforward way to measure the success of your investment.

Why Does Cash-on-Cash Return Matter?

Cash-on-cash return is important because it provides insight into what you can expect to earn from an investment.

Many investors use CoC as a barometer for how good the initial performance of an investment is, particularly in real estate. However, they also use other metrics in conjunction with CoC, such as return on investment (ROI), internal rate of return (IRR), yield, and cap rate, to paint a clearer picture of an investment’s long-term performance.

Alternatively, you can use CoC to compare how much money you can make from two different rental properties. For example, you may determine that, in your current market, it’s difficult to find a rental property that yields more than 4%. But then you find another market a few counties over where the CoC is 10%. In this case, the choice is clear—the 10% CoC wins, even though you may need to travel further to visit it in person.

This is one reason why more investors are looking further afield to buy real estate long-distance.

Cash-on-Cash Return vs. Cap Rate

CoC and cap rate are similar metrics, but with an important difference: the latter doesn’t account for how the investment was financed.

Cash-on-cash return concerns itself with how much actual cash was invested in a property. It’s determined by dividing the annual pre-tax cash flow by the total cash invested (which typically includes the down payment, closing costs, among others).

On the other hand, cap rate measures the potential rate of return on a real estate investment, regardless of how it’s financed. It’s calculated by dividing the property’s net operating income (NOI) by its current market value.

In other words:

Your cash-on-cash return is based on how you choose to finance the deal (plus how well you manage the property and how well you can market it), but cap rates ignore financing and are based on the raw property values and thus income potential. A property’s cap rate is universal, regardless of who buys or owns the property.

In addition, cap rates only apply to income-generating properties, such as single-family rentals, apartment buildings, or rented office buildings. They’re helpful when comparing two such properties, but they can’t be used to analyze other investments.

By contrast, you can apply cash-on-cash return to any investment, real estate or otherwise, because cash-on-cash returns measure any type of profit, not just income.

Analysis of Cash-on-Cash Returns vs. Cap Rates

Say you have $10,000 to invest, and you’re trying to decide whether to invest it in an S&P 500 index fund or a rental property. You look at the average returns of the S&P 500 over the last 80 years and see that they were around 10%, including both dividends and capital growth.

Then you run the numbers on the rental property, and determine that after expenses, the property will yield around a 10% cash-on-cash return just in rent revenue. Because appreciation will likely push your total returns higher than 10% (by both the CoC and the S&P 500), this means owning and operating the rental property can ultimately bring more revenue.

(And it may also be because rental cash flow is more predictable than stock returns, but that’s another conversation!)

What Affects Cash-on-Cash Returns?

Costs and revenue affect cash-on-cash returns.

Costs have an inverse relationship with CoC, while revenue has a proportional relationship with CoC.

In other words, when you lower your costs or increase your revenue (or both), expect higher CoC. Conversely, if you increase your costs or lower your revenue (or both), you will have lower CoC.

Here’s how these numbers can play out.

Cash-on-Cash Return Case Study A

Let’s say you want to buy a property for $100,000, intending to flip it. You manage to secure $90,000 of the purchase price with financing, and plan to invest $10,000 of your own cash as down payment and another $2,000 out-of-pocket in carrying costs. In this scenario, your total cash outlay would be $12,000.

Then you turn around and sell the property for $160,000. After all rehab, financing, and closing costs are paid, you’ll walk away with a $6,000 profit.

Your cash-on-cash return would be 50%:

$6,000 earned / $12,000 cash invested = 50%

Cash-on-Cash Return Case Study B

Consider the same example above: $100,000 purchase price, $90,000 financed, $10,000 down payment, and $2,000 out-of-pocket for carrying costs.

This time, what if you sold the property for $155,000 instead? Then, somehow, you walk away with only $1,000 for your troubles.

Your new CoC would be 8%:

$1,000 earned / $12,000 cash invested = 8%

In summary, every expense affects your cash-on-cash return because it presumably comes out of your pocket and is not financed with OPM (other people’s money). That includes property taxes, insurance, repairs, maintenance, and closing costs. If you buy a rental property, your vacancy rate and property management expenses will also affect your returns.

The silver lining is you actually have some control over many of these expenses. For instance, you can reduce your repair costs with preventative maintenance.

If you’ve noticed by now, cash-on-cash returns are affected by how you acquire the property using leverage (i.e., financing terms).

How Financing Impacts Cash-on-Cash Returns

Leverage means using other people’s money to finance the purchase of an asset, such as income-producing property. Investors use leverage to accumulate their assets, wealth, and sources of ongoing passive income.

In the case of cash-on-cash returns, the more financing you secure for the investment, the less cash outlay you’ll make, which (as we’ve seen above) can increase your CoC.

In the example above, the investor earned a 50% cash-on-cash return flipping a property over the course of a few months. That kind of return and turnaround time are unheard of in most other investments. This is possible only with leverage.

However, leverage is a double-edged sword. While leverage reduces your cash investment, it also raises your expenses in the long run—every extra dollar you loan means higher interest and fees.

Below is an example of how this complex relationship works out.

Leverage vs. Cash-on-Cash Returns Case Study C: No Financing

Consider a rental property. You buy this property for $100,000, all in cash, and rent it for $1,200 a month.

Also assume your non-mortgage expenses come out to $500 per month (or $6,000 annually), even accounting for vacancy rates, property management fees, taxes, repairs, and insurance. For the sake of simplicity, we’ll ignore closing costs and say you got a seller concession to cover them. This gives you a take-home pay of $700 per month.

Using this figure without financing, your annual net revenue is $8,400 (your $700 over 12 months).

$8,400 of revenue in a year relative to $100,000 of an initial cash investment means your CoC is 8.4%:

$8,400 earnings/$100,000 cash investment = 8.4%

Not bad at all!

Leverage vs. Cash-on-Cash Returns Case Study D: With Financing

Now, imagine instead of buying this $100,000 property with cash, you take out an $80,000 loan at 7% interest over 30 years. You take care of the rest with $20,000 in cash.

However, due to amortization, you’re now saddled with $532.24 for mortgage payments every month, on top of the $500 you make for all carrying costs every month (bringing your total expenses every month to a whopping $1,032.24).

This eats at your monthly income of $1,200, now down to $167.76 per month ($2,013.12 annually).

Based on these figures, your cash-on-cash return changes to 10.07%:

$2,013.12 earnings/$20,000 cash investment = 10.07%

This indicates that even though your annual return is lower, your smaller $20,000 cash investment is working harder than if you had purchased this property without any financing at all.

Remember, your options for leverage aren’t limited to mortgages; this is just an example. Try one of these creative ways to fund your next real estate deal, and some of these financing options can even be more worthwhile!

How to Improve Your Cash-on-Cash Returns

As outlined above, one option for improving your cash-on-cash return is to finance your investment properties.

If you’re financing your properties, keep in mind that changing the financing terms will also impact your cash-on-cash returns. In Case Study D, suppose you loaned at 6% interest instead of 7%. Your monthly payment would drop to $479.64, leaving you with an annual profit of $2,644.32 and a CoC return of 13.22%.

Or, again, with Case Study D, what happens if you’ve negotiated a lower down payment, like 10% instead of 20%? Or even 3.5%, such as with an FHA loan? This means your cash-on-cash returns would be even higher because your actual cash outlay is smaller. Granted, your earnings would be proportionately lower, but cash-on-cash return is merely a measure of how hard your cash is working for you.

Here are other ideas to improve cash-on-cash returns:

- Reduce expenses. For example, rental investors can reduce vacancy rates and repair costs by steering clear of horrible tenants or avoiding these expensive real estate investing mistakes.

- Pay less for the property. Try these negotiation techniques to get a better deal on your property purchases.

- Raise revenues. Look for ways you could lift the asking price for flips or the asking rent for rentals. What amenities are hot right now in that market? What could you do to attract higher-end buyers or renters?

Fundamentally, these concepts apply to every type of investment: buy low, sell high, and keep ongoing expenses low. Simple enough, but it takes experience to master the execution.

Common Mistakes With Calculating Cash-on-Cash Returns

Two common mistakes when calculating cash-on-cash returns are under- or overestimating costs vs. returns.

In a fix-and-flip scenario, new investors often underestimate repair costs and carrying costs. For example, what looks like an 8% return when you buy could turn into a -10% loss if you start renovating only to discover that the renovation will cost twice as much as you estimated. Things can also go sideways if the property sells for less than you expected.

On the other hand, amateur rental investors tend to underestimate vacancy rates, property management costs, and ongoing maintenance and repairs. If the property rents for less, if the vacancy rate proves higher than expected, or other unexpected problems may dent your calculations. Worse still, some rental investors, when starting out, often tell themselves that they don’t need to budget for property management since they can do it themselves. This is all well and good until they take a job in another state, have triplets, or realize they hate managing rentals.

Always use conservative numbers when forecasting your expenses and revenues to avoid nasty surprises in your CoC returns. Remember that lost time is lost money (and in the case of flipping, this could even be in the literal sense).

Also, keep an eye out for these all-too-common real estate number-crunching errors.

What’s a “Good” Cash-on-Cash Return?

There is no universally accepted standard for a good cash-on-cash return. What is “good” may vary per investor.

That said, I personally use the S&P 500 as a benchmark for returns. Over the long term, I can earn 7% to 10% by parking money in an index fund and leaving it alone.

Therefore, I expect to see at least comparable cash-on-cash returns when I invest in a rental property. And since rentals require ongoing management, I always include generous property management expenses in my calculations. Otherwise, it’s like comparing apples to oranges: one is completely passive, while the other requires labor.

I also ignore appreciation in my CoC return calculations for rentals. I consider it a bonus and compensation for some downsides and risks associated with owning real estate (such as poor liquidity and diversification).

Meanwhile, flipping requires a different calculus. The raw cash-on-cash returns for flips can be outstanding, often 100% or higher, since it’s an investment held for a shorter time. But they take significant labor on your part, so you must find a way to account for the time and effort spent.

RELATED: How Much Should You Offer For That Property?

One option is setting an hourly rate for yourself and estimating your labor hours required from start to finish. Another is to outsource the labor to an assistant or general contractor. Just make sure you don’t end up spending as much time overseeing your contractor as you would have doing it yourself, which can render the time savings moot!

Summary

Cash-on-cash return is a measure of the investor’s immediate cash flow relative to the amount of money they initially put into the investment. It’s a simple and effective way to analyze and compare any investment, real estate or otherwise.

But they can also be deceptive, particularly when it comes to the cost of labor, time, and headaches. You can earn a great financial return on a flip, and easily waste hundreds of hours of your time in the process.

Likewise, low-end rental properties can look great on paper, promising excellent cash-on-cash returns. Yet experience has taught me they come with hidden hassles and expenses that aren’t easy to anticipate.

As a new investor, be conservative in your expense and revenue forecasts to avoid surprises. Most of all, educate yourself on oft-overlooked expenses and get as much feedback from similar investors as you can.