What Is a Blanket Mortgage?

REtipster does not provide tax, investment, or financial advice. Always seek the help of a licensed financial professional before taking action.

Shortcuts

- A blanket mortgage is a type of financing arrangement that covers multiple properties, allowing them to act collectively as collateral.

- Properties under a blanket mortgage can include land, residential, and commercial spaces, and the total loan value is based on their combined worth.

- It can be more efficient compared to individual property loans due to the larger amount and combined collateral.

- However, defaulting on a blanket mortgage means all properties used as collateral are at risk of foreclosure.

- There are alternatives to blanket mortgages, such as portfolio loans, commercial loans, HELOCs, to name a few.

Overview of a Blanket Mortgage

A blanket mortgage, also known as a blanket loan, is a single mortgage that covers multiple properties, which collectively[1] act as collateral for the loan. Instead of obtaining individual mortgages for each property, borrowers can consolidate their financing needs into a single loan.

This type of mortgage is particularly beneficial for real estate investors and property developers who own multiple properties in a specific portfolio or location.

Some key aspects of a blanket mortgage include:

- Core property types are land, mixed-use facilities, apartments, retail or office spaces, warehouses, and medical buildings across different places.

- The total loan amount is based on the combined value of all collateral properties.

- The interest rate is usually fixed for the entire loan term (typically up to 30 years)[2].

- Monthly loan payments cover the principal and interest on the entire amount.

- Default on the loan puts all collateral properties at risk of foreclosure[3].

- Like a traditional mortgage, you can refinance a blanket mortgage.

Additionally, you can consolidate existing properties with individual loans under a blanket loan, provided the borrower meets the lender’s equity and debt service coverage (DSCR) requirements. The new blanket loan refinances prior loans[4] and places a blanket lien on all properties.

RELATED: Mortgage vs. Land Contract vs. Deed of Trust: What’s Right for You?

How a Blanket Mortgage Works

A blanket mortgage functions similarly to a traditional mortgage but with a broader scope. Rather than securing a separate mortgage for each property, the borrower can use the equity in their existing properties as collateral to secure the loan.

To obtain a blanket mortgage, the borrower needs qualified properties that generate stable income streams (such as through leases or other commercial agreements). Some common property types include multifamily apartments, retail or office spaces, warehouses, and mixed-use facilities.

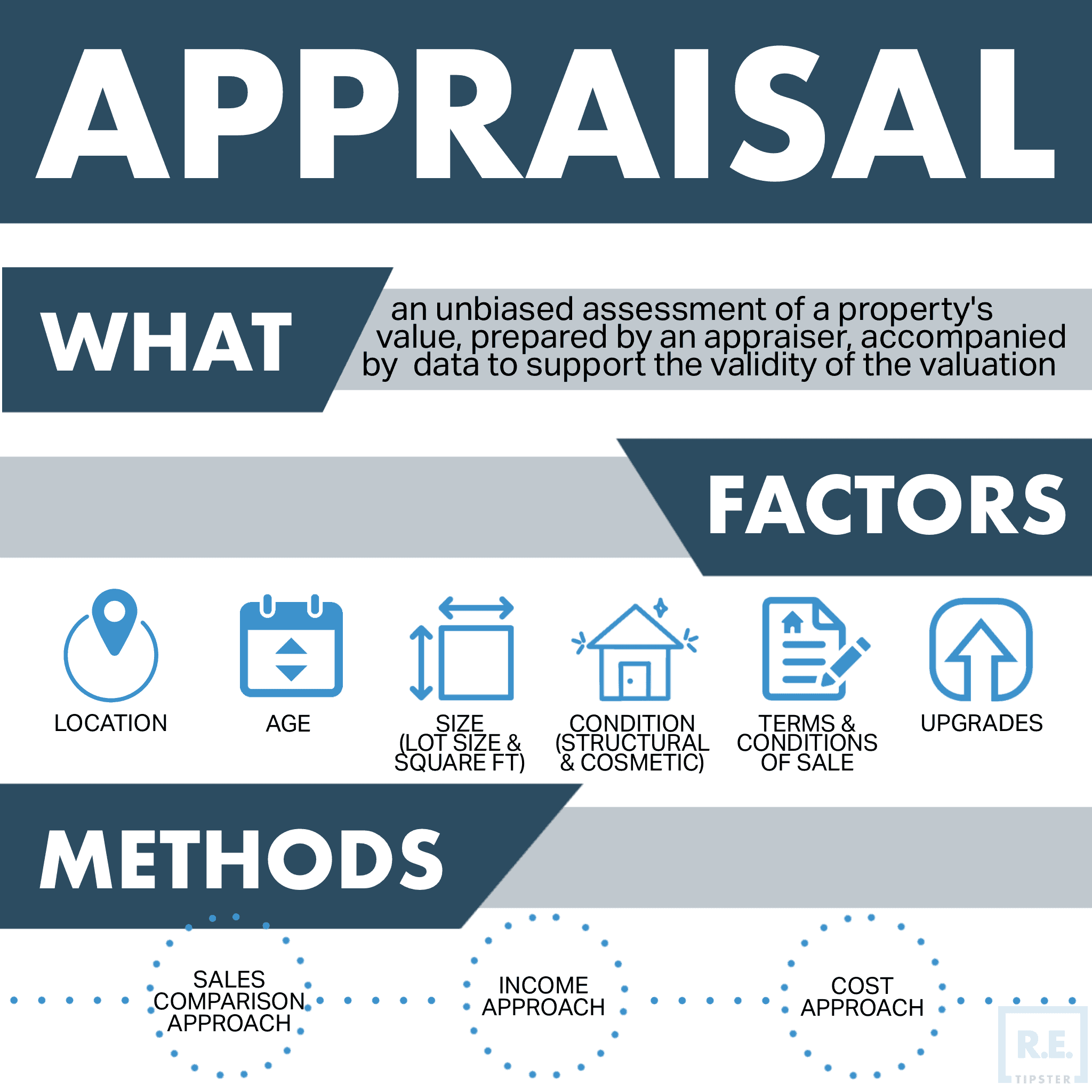

During an application, the lender will appraise each property to determine its fair market value and then combine them to establish an aggregate collateral amount. Lenders look at a maximum loan-to-value ratio of around 70% to 75%[5] of the total collateral value, especially for high-quality properties with strong leases or tenants in place.

If approved, the borrower will receive a single loan amount that covers all the properties included in the blanket mortgage. You can buy things, refinance loans, and make repairs on any property in the portfolio with the loan proceeds. Meanwhile, monthly payments cover the loan’s principal and interest, although terms may vary.

In a blanket mortgage, all listed properties remain under the ownership of the borrower but have a blanket lien[6] placed on them. On the other hand, defaulting on a blanket mortgage allows the lender to foreclose on any or all of the properties.

Alternatives to a Blanket Mortgage

There are alternative financing options for individuals or companies looking to finance multiple properties, such as:

Traditional mortgages

A traditional mortgage suits investors who want separate loans for each property in their portfolio. Traditional mortgages typically have fixed or adjustable interest rates, and the loan terms vary depending on the lender. This approach allows investors more control over each property and potentially negotiate better terms for each mortgage.

Portfolio loans

Real estate investors who have more than one property in their portfolio can get portfolio loans. Instead of having one loan cover several properties, each is financed individually, typically by the same portfolio lender[7]. This can make it easier to get a loan and give lenders more freedom in evaluating applicants.

Home equity lines of credit (HELOC)

For property owners who already have substantial equity in their properties, a HELOC can be a viable alternative to a blanket mortgage.

With a HELOC, the property owner can access a line of credit based on the equity in their individual properties. This allows them to tap into the equity of each property separately and use the funds for various purposes, including acquiring additional properties.

Commercial loans

If the properties in question are commercial, obtaining separate commercial loans for each property is an alternative to a blanket mortgage.

Commercial loans are specifically tailored for income-producing properties[8] and can provide more favorable terms and flexibility than blanket mortgages. Each property is evaluated individually, and the loan terms are based on property value, cash flow, and borrower qualifications.

Seller financing

In some cases, property sellers may be open to providing financing to buyers. This alternative, known as seller financing or owner financing, eliminates the need for a traditional mortgage or blanket mortgage. The property seller acts as the lender and extends credit to the buyer. This option can be advantageous for buyers who may have difficulty qualifying for a bank loan or want more flexible terms.

Private lending

Private lending or private money involves securing financing from individual investors or private lending institutions. Private lenders may offer more flexible terms and faster approval processes compared to traditional lenders. This option can be beneficial for investors who need quick access to funds or who want to explore alternative financing options outside of traditional mortgages.

RELATED: Beyond Traditional Financing: Creative Funding Options for Land Flippers

Advantages vs. Traditional Mortgages

Blanket mortgages provide an efficient financing solution for commercial real estate owners and investors with portfolios of income-generating properties. They offer cost savings and flexibility compared to obtaining individual loans. However, the cross-collateralization aspect also increases risk for borrowers.

Compared to obtaining individual loans for each property, a blanket mortgage provides several advantages:

- Lower or no origination fees per property financed.

- You pay closing costs only once.

- Potentially lower interest rates[9] due to using multiple properties as collateral for one large loan.

- Flexible use of capital for the overall portfolio instead of building-specific financing.

- It’s easier to manage just one debt and payment compared to separate loans.

However, there are also some disadvantages, such as the properties becoming cross-collateralized, which means that if one property goes into foreclosure, it could affect the others[10]. Additionally, lenders may also impose more stringent qualifying criteria given the higher loan amounts.

Frequently Asked Questions: Blanket Mortgages

Can I use a blanket mortgage to finance properties in different states?

No, you cannot use a blanket mortgage to finance properties in different states. The primary reason is that blanket mortgages have different guidelines and requirements in every state[4].

However, lenders may have specific requirements and limitations regarding the geographic scope of the mortgage. It is advisable to consult lenders specializing in blanket mortgages and understand the regulations and restrictions of the states involved.

Can I add or remove properties from a blanket mortgage?

Adding or removing properties from a blanket mortgage is possible[11], but it typically requires the lender’s approval. The lender will assess the new property’s value or the impact of removing a property on the overall loan structure. It may also involve adjusting the loan terms and repaying a portion of the loan.

It is crucial to communicate with the lender and understand their policies regarding property additions or removals.

Can I use a blanket mortgage for different types of properties, such as residential and commercial?

Yes, you can use a blanket mortgage for different types of properties[1], including residential and commercial. However, lenders may have specific criteria and requirements for each property type. It is advisable to work with a lender who specializes in blanket mortgages and understands the nuances of financing different property types.

Sources

- Chang, E. (2023, September 22.) Blanket mortgage: How it works and who should use it. Bankrate. Retrieved from https://www.bankrate.com/mortgages/blanket-mortgage/

- Odion-Esene, B. (2023, January 23.) What Is A Blanket Mortgage? Forbes Advisor. Retrieved from https://www.forbes.com/advisor/mortgages/blanket-mortgage/

- Sagert, K. (2022, September 20.) What Is a Blanket Mortgage and How Does It Work? SoFi. Retrieved from https://www.sofi.com/learn/content/blanket-mortgage/

- Nowacki, L. (2023, February 27.) What Is A Blanket Mortgage, And Should You Use One? Rocket Mortgage. Retrieved from https://www.rocketmortgage.com/learn/blanket-mortgage

- Sexton, M. (2022, February 25.) Blanket Mortgage: How It Works & When To Get One. Fit Small Business. Retrieved from https://fitsmallbusiness.com/blanket-mortgages/

- Blanket Liens & Their Effects on Small Businesses & Startups. (2023, July 12.) Excedr. Retrieved from https://www.excedr.com/resources/blanket-liens-and-their-effects

- Steinberg, S. (2023, April 1.) Portfolio Loan: What Is It, And When Is It A Good Option? Rocket Mortgage. Retrieved from https://www.rocketmortgage.com/learn/portfolio-loan

- Folger, J. (2023, June 7.) Commercial Real Estate Loan. Investopedia. Retrieved from https://www.investopedia.com/articles/personal-finance/100314/commercial-real-estate-loans.asp

- Carl, A. (2023, April 30.) What is a Blanket Mortgage and How Does It Work? Short-Term Shop. Retrieved from https://theshorttermshop.com/what-is-a-blanket-mortgage-and-how-does-it-work/

- Esajian, P. (n.d.) Cross Collateralization: What Investors Should Know. FortuneBuilders. Retrieved from https://www.fortunebuilders.com/cross-collateralization/

- Jones, J. (2022, March 21.) Blanket Mortgage Definition: What It Is and How to Use One. LendingTree. Retrieved from https://www.lendingtree.com/home/mortgage/blanket-mortgage/