A few months ago, Seth and I had the privilege of interviewing self-storage investing expert Scott Meyers in episode 28 of the REtipster podcast.

I remember walking away from that interview almost shell-shocked at the potential that self-storage facilities seemed to have as a real estate investment, and I wanted to really dive deeper and see if this investment strategy would be worth me pursuing.

You see, I think flipping raw land is one of the best real estate businesses out there — but I don't consider it a true investment, per se. The word “investment” implies that it's a source of passive income: having your money make money while you sleep, play video games, or hang out on a beach.

A real estate business, while it typically generates higher and faster returns than most, it still takes a lot more active effort to make it work.

I believe the best route for long-term wealth creation is to use a real estate business (flipping houses, investing in land, selling properties, etc.) to generate large amounts of capital so you can then invest it into some type of real estate investment, like triple net investing, professionally managed rental properties, or storage units.

But here's the thing: I'm not that interested in being a landlord. Coming from my background in wholesaling, I've seen the worst of the worst in tenants, and I just don't like what can happen when rental property investing gets ugly.

Honestly, it's been a little tough to figure out what type of passive investment strategy would work best for me. That's when Scott and his home study course entered the picture.

Around the time of this podcast interview, Scott graciously granted me access to his course for free — with the understanding that I would share my unbiased experience with the REtipster community.

The Quick Summary of Scott Meyers' Self-Storage Course

Fair warning: I'm about to go into quite a bit of detail on both the course AND all things self-storage in this blog post — and I go pretty in-depth. For those of you who just want the abbreviated version, here's my verdict in four simple points:

1. Scott is someone who has gained my trust.

Let's face it. There are a lot of real estate educators out there who are only slapping a product together so they can make money from it.

I don't believe this is Scott.

The vibe I get from him after watching his videos and reading his material is that he legitimately cares about his students and wants to teach what actually works and will make them successful.

He does provide an opportunity for his students to bring him deals and/or to come alongside him as financial partners, and this is a direct benefit to Scott personally. Having said that, I believe it's actually a great win-win scenario, and he doesn't seem to hold anything back if his students decide to not to do so.

All in all, Scott seems to have very strong character and high integrity — and I don't say that lightly.

2. This wasn't the most organized course I've taken.

I do have some pretty strong critiques of the program (and I'll get into all of them later in this post), but all the issues I bring up have more to do with the “packaging” of the content rather than the content itself.

In the world of self-storage, to my knowledge, it seems that there are only two educators who seem to really know their stuff, and Scott is one of them (the other is Mark Helm, though outside of his book, I haven't had any direct experience with him).

Scott, hands down, has some of the best content out there on the subject of self-storage. When taking the course, though, I found there wasn't a clearly defined “path” by which to get through it, which made it difficult and frustrating at times.

If you decide to take his course, I would recommend you check out the section of this post titled “My Suggested Road Map” for a simple guide as you approach the material.

3. I think the education is incomplete without attending Scott's live event: The Self Storage Academy.

The home study course definitely gives you everything you need to get started at a high-level, but I think the benefit of attending a live Q&A session to learn more about the tactics, insights, and best strategies for today's market is invaluable.

I haven't personally attended the live event yet, so I can't confirm this to be 100% true. I just know that, after I've journeyed through the material, I still have some unanswered questions that could probably be easily solved in a “real-time” event atmosphere.

I plan on attending the Academy this year when it's hosted in the Indianapolis area. Scott is from Indianapolis, and I still have a lot of connections there (as I lived there for three years) and tend to visit there often. Once I attend, I will either update this review to include my experience or write a second post solely dedicated to my experience of the event.

4. All things considered, I'd give my recommendation for Scott Meyers and his Self-Storage Home Study Course.

At the time of this writing, Scott's course is one of the best educational resources out there on how to get started in self-storage.

After seeing what self-storage investing has to offer, I think it's one of the best real estate investment strategies, and I'm looking forward to personally getting into the business.

I respect Scott as a person and an educator, and all in all, I think his content is incredible.

An Overview of Scott Meyers' Products

In this section, I'm going to provide a few things:

- An overview of Scott's suite of products and the Home Study System.

- My recommended road map is a guide for you to use if you decide to take the course.

- A summary and my feedback for each section of the Home Study System.

Let's jump right in.

Scott's Products and Their Prices

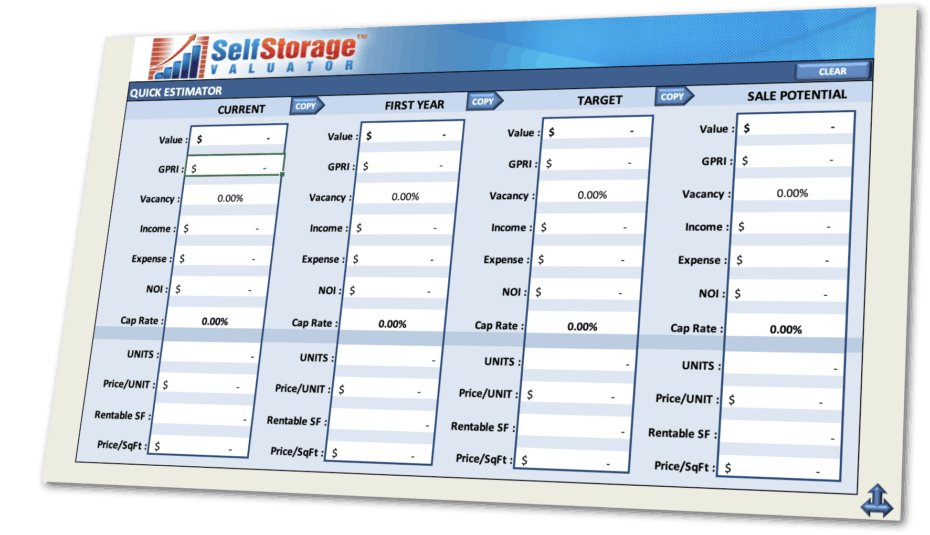

1. The Self Storage Valuator ($39 Per Month, $390 Per Year)

Taken directly from SelfStorageInvesting.com, it helps you

“Determine the NOI, Cap Rate, Monthly Cash Flow, Cash on Cash Return, cost per square foot, debt service coverage ratio, break-even point, Loan to Value, cap rate sensitivity, future projections, and much more.”

The Self Storage Valuator tool is included in the Home Study Study System, and I believe it to be one of the best values in the program.

2. The Complete Guide to Finding, Evaluating, Purchasing, and Managing Self-Storage Facilities Home Study System ($1,997)

- A 299-page manual

- A pre-recorded, one-day workshop

- The Self-Storage Valuator

- Two document libraries with almost any template you'd ever need

- 30 days of free access to specially trained virtual assistants

- Two tickets to the Self-Storage Academy Live Event

3. The Self Storage Academy Live Event ($1,997)

Due to the fact that I've not yet personally attended this event, the knowledge and experience I can share are limited.

Here's a summary pulled directly from Scott's website:

During the 3-day Self Storage Academy, you will receive approximately 20 hours of hard-hitting, no fluff content. Your average “online class” is 3 – 5 hours, so this is like spending 3 days to consume four or five massive classes!

I believe that, without attending the live event, the Home Study System is somewhat incomplete. There are some incredible insights and knowledge in the home course, but as I mentioned at the beginning of this post – being able to discover what's working in today's market and engage with a live Q&A would be invaluable, and you'll only get this by attending the Self Storage Academy Live Event.

I still have a lot of unanswered questions (even though I tore apart the course in preparation of this review), and I think the live event would probably address them in full detail.

4. The Self Storage Developer's Academy ($497)

This product features the recordings of past live events, which go into great detail on what it takes to build a storage unit facility from the ground up.

I've not personally gone through the material of this product, but here's a summary from the website:

The Self Storage Developer’s Academy is unique because it brings self storage developers, industry leading suppliers, and eager capital sources all together in the same room to network, share ideas and discover new opportunities…

We wanted to find out what would happen when the best developers, suppliers, and capital sources get together to:

- Discuss (and debate) the latest and most innovative business models across the

self storage landscape- Share groundbreaking trends and technologies, and…

- Collaborate and forge truly innovative partnerships and joint ventures

5. The Private Money & Syndications Summit ($497)

This, again, is the recording of a past live event that goes into detail on how to raise and facilitate private money as a real estate investor.

Here's the website summary:

This is your opportunity to see cutting-edge syndication strategies that are creating a killing for a “select group” of commercial real estate investors and self-storage professionals.

…Those that are clinging to the old methods of investing are slowly dying off. … But those that are quick to adapt are taking control of the marketplace and creating serious wealth right in front of your very eyes by tapping into the over 32 billion private money arena.

For this reason, I have put together a power team comprised of myself, my SEC syndication attorney, and my real estate 401k & self-directed IRA expert, for our annual Private Money & Syndication Summit. At this special mastermind with my POWER TEAM, we’ll be revealing what we’ve been up to that has resulted in 7 figures in “found money” for me and my team.

The Self Storage Facilities Home Study System

Finally, we get into the course itself. The course has eight sections that can be summarized as follows:

- Home Study System Written Manual

- 90 Day Fast Start Guide

- Forms & Documents

- The Valuator

- Manager’s Tool Kit

- One Day Workshop Videos

- One Day Workshop Audios

- Bonuses

Before I provide my feedback of the program section-by-section, I'll start by sharing a few thoughts.

My biggest critique of this course is how it's organized. About 90% of the material is provided through an online portal and, after logging in, there were entire sections with links that were broken.

I don't feel the way the course is laid out in the membership area is truly the best way to proceed through the material. There are sections that don't make sense until you complete other sections first, so if I could redesign this online platform, this is how I would do it…

My Suggested Road Map

This is how the current course material is laid out:

- Home Study System Written Manual

- 90 Day Fast Start Guide

- Forms & Documents

- The Valuator

- Manager’s Tool Kit

- One Day Workshop Videos

- One Day Workshop Audios

- Bonuses

I would reorder it as follows:

- Home Study System Written Manual

- One Day Workshop (Videos or Audio)

- The Valuator

- Bonuses

- Forms & Documents

- Manager’s Tool Kit

- 90 Day Fast Start Guide

Why would I put it in this order? Because the written manual and the one-day workshop material help explain what the Valuator is, what the Forms & Documents cover and they guide you through the rest of the material much more effectively.

The material didn't actually “click” for me until I watched the One Day Workshop Videos (and I waited until the very end to do this, because that was the way they were listed in the course).

With that said – now I'll dive into each section and give my feedback according to how they were originally listed in the program.

Home Study System Written Manual

There are two different versions of the Written Manual

- The “online” or PDF version

- The printed version comes in a three-ring binder

When comparing both, there were some discrepancies between the two.

The Table of Contents on the PDF version has an error, where it lists the “7” from Chapter 7 twice, off-setting the remainder of the chapters (so, the printed version has 17 chapters and the PDF has 16 chapters). It's a small error, but the effect ripples throughout the rest of the manual.

The PDF version also does not include the Appendix (even though the appendix is listed in the Table Of Contents).

As another small detail – this manual is advertised on the website as having 299 pages, but the printed version has 288 pages and the PDF has 206 (neither of which equals 299). There were also several spelling and grammatical errors throughout the material.

In terms of the core content, the two versions seem to be almost identical.

Table Of Contents and Chapter Summaries

Now I'll provide a list summary of each chapter next to the proceeding order of the Table Of Contents.

CHAPTER 1: Industry Overview

In this first chapter, Scott lays the groundwork of the self-storage industry, explaining the demographics of the tenants, the history, and so on.

CHAPTER 2: Investment Opportunities In Self-Storage

In this section, Scott lays out the 20 reasons self-storage investing is a superior asset class and also dispels certain “too-good-to-be-true” myths surrounding the industry.

CHAPTER 3: The Future of Self Storage

Scott shares his thoughts on where the industry is headed as a whole and what you need to focus on in your business in order to be “ahead of the curve.”

CHAPTER 4: To Buy or to Build

This chapter is just a one-page overview of the pros and cons of either buying an existing storage facility or building one from the ground up.

Note: I got the impression that if you're just starting out, buying and improving an existing facility is the easier way to go. Building a new facility from the ground up can have big potential to make a lot more money, but there are a lot more risks and factors involved with this approach.

Personally, I plan on getting my feet wet with an existing facility, then possibly exploring development in the future.

CHAPTER 5: How I Work

I found this chapter to be informative, but also a little random. It takes a break from the topic of self-storage investing to explore Scott's daily routine. It was nice, however, to get an in-depth look into his life and values.

CHAPTER 6: Where to Find the Deals

This is where you start getting into the real “meat” of the material. Up until this point, if you were in a rush, you could probably skip directly to this chapter and not miss much.

The top three ways he says to look for deals are:

- Through commercial real estate brokers who specialize in self-storage

- Through self-storage websites using the keyword “self-storage for sale” in Google

- Through direct mail

What's awesome about this chapter is that Scott gives you two examples of the exact mailers he uses in his business. Proven ad copy is a very high value, and he claims it has a very high conversion rate.

Scott also suggests sending out letters with hand-written addresses on envelopes with an individual stamp (i.e. – not a postage machine).

CHAPTER 7: Evaluating the Opportunities

This is another critical chapter. He provides an outline to help gather the initial due diligence of a lead.

This includes 27 questions to ask prospective sellers over the phone, how to look up property details online, and a number of other helpful insights.

(Side note: Chapters 7-10 essentially cover the same material that the videos in the Valuator section cover in greater detail.)

CHAPTER 8: Mastering Market Analysis

CHAPTER 8: Mastering Market Analysis

In this chapter, Scott shares what goes into determining the strength of a market. Essentially, it can be summarized in this sentence from the chapter:

“Follow the jobs and you'll find the people.”

One major takeaway is where he mentions industry reports, like the Online Self-Storage Demand Estimator available from the National Self-Storage Association (also known as ODESSA). This is an in-depth market report and you can purchase one from www.SelfStorage.org.

In self-storage, your market is only a 3-to-5-mile radius around your subject property.

CHAPTER 9: Making the Offer

In this chapter, Scott explains multiple aspects of making an offer, including aspects like,

- Spotting motivation

- Navigating through negotiations

- What paperwork to use (letter of intent, purchase agreement, etc.)

- How to justify your offer price using common metrics like the NOI and cap rate.

Scott provides a list of document templates you can use in the Forms & Documents section, but he also recommends you to seek legal advice before actually using these templates in your market.

CHAPTER 10: Due Diligence

I think this is arguably the most important chapter. It covers, in great detail, all the documents you must gather and rectify against your initial due diligence.

When you first start running your numbers to determine whether a property will work as an investment, you're basing all of your assumptions on the information you received from the seller or their broker (and as you can probably imagine, this information doesn't always match the numbers in their books).

Once you get the property under contract with a purchase agreement, there are a number of things you need to confirm prior to closing.

Scott says you need to actually visit each property in person, even if you're investing out-of-state because there are certain things you can only gather from doing an on-site inspection and walkthrough.

He also says you need to get eyes on every single lease agreement, regardless of how many units the building has.

In storage units, there is A LOT of paperwork and A LOT of accounting required to complete the necessary steps in your due diligence.

Luckily, Scott provides a Due Diligence Checklist in the Forms & Documents section as well as the Valuator Excel sheet to help you with this.

CHAPTER 11: Valuation

This chapter is simply a detailed look at how appraisers factor what a property is valued at, and how they primarily use the income approach for appraising self-storage units.

RELATED: How To Find The “Market Value” of Vacant Land

CHAPTER 12: Financing Your Facility

This is another highly valuable chapter.

Scott goes over 12 different ways to finance the acquisition of a self-storage facility, including some ways to do it with no money down.

His highest recommended funding sources are professional mortgage bankers and mortgage lenders, his personal preference being mortgage bankers.

It takes some work to find a few good ones on the front end, but Scott says there is nothing like having a professional fighting for you when it comes to lending institutions and programs.

CHAPTER 13: Creating Your Business Plan

The subject of this chapter covers another very important step.

In self-storage, your business plan is a critical piece of information that bankers and conventional lenders will refer to when deciding whether or not to extend financing to you.

Scott makes the point that after you drop it off with the banking professional, this document is a crucial piece of information that fights for you and the deal.

He gives you the exact details of what is needed to stand out and yield the highest chance of approval.

CHAPTER 14: Tax Planning

This chapter gives some basic explanations of how capital gains are taxed vs rental income. Scott also gives suggestions about talking to your CPA about how to reduce your capital gains tax. He also explains the difference between tax deductions and tax depreciation.

CHAPTER 15: Entity Selection

Scott covers the different ways you can structure the legal entity of your self-storage business, ultimately highlighting that his preferred method is through a limited liability company (LLC).

According to the material, unless you're doing a partnership, an LLC is probably the best option.

RELATED: How to Start Your Own Corporation or LLC (It's Easier Than You Think!)

Scott also highly recommends that if you do structure a partnership, do it in a way where one party calls all the shots and the other is simply a silent financial partner. This way, you avoid potential problems in the future.

CHAPTER 16: Asset Protection

This chapter is simply a suggestion to begin planning and structuring your business in ways that protect your investment in the future. Scott discusses the importance of educating your employees and how there is no shame in ethically structuring your business entity to pay lower taxes.

CHAPTER 17: Take Action (Scott’s Five Principles of Success)

The last chapter goes into Scott's Five Principles of Success:

- Overcome the Fear of Failure

- Setting Goals

- Establishing Priorities

- Perseverance

- Developing Your Purpose

He has some very strong values, and this is one of the reasons I've come to trust his integrity.

The 90-Day Fast Start Guide

The problem is, there isn't a video description (or even a written one, for that matter) on what exactly is' for or how to use it, so I found this piece a little hard to figure out, and, ultimately, I disregarded it.

Forms & Documents

In the manual, there were times when Scott mentioned, “In the appendix, I've included X document as a template,” but I didn't actually see it listed in the appendix. The majority of the forms and documents are listed here within this section of the course.

This section is one of the most valuable aspects of the entire course. To have a starting point for all the documentation needed for the self-storage business is an incredible value.

The entire list of forms and document templates includes:

- Articles of Organization for LLC

- Assignment and Assumption of Leases and Security Deposits Indemnity

- Business Broker Websites

- Confidentiality Agreement NDS

- Due Diligence Checklist*

- Leased Property Addendum

- Letter of Intent

- Market Survey (excel)

- Marketing Mailers*

- Operating Agreement For LLC

- Personal Property Addendum

- Personal Financial Statement Template (Excel)

- Promissory Note

- Purchase Agreement*

- Sample Business Plan*

- Self Storage Rolodex

- Site Visit Questions*

*Note: Some of these items were extraordinarily helpful and brought a TON of value to the table as standalone items, as I've indicated above with an asterisk.

The Valuator

This section is arguably one of the most beneficial in the entire course because Scott provides the custom-designed Excel sheet that does a lot of the heavy lifting in terms of walking you through the documents needed to analyze a deal and conduct due diligence correctly.

There are three videos that walk you through exactly how to use the spreadsheet in detail, and what you need to do when researching the local market of a self-storage facility and what steps you take when conducting due diligence.

As a side note – I think it's worth mentioning, the audio of the first video is pretty terrible. I had to listen to it with my headphones at full volume in order to hear it.

Here are the tabs of the Valuator Spreadsheet and an overview of their function:

Quick Estimator Tab

This tab allows you, within just a few minutes, to get a general idea of whether a property is worth continuing negotiations on or if you're too “far apart” from the seller in terms of a fair price or cap rate.

It can also give you an overview of whether or not this property might be worth pursuing even if you don’t have the exact cap rate you want and allows you to compare and contrast a “best,” “good,” and “worst” scenario with simply a few clicks.

Unit Mix

This is the tab where you input the data from the seller’s rent roll.

The spreadsheet allows you to adjust the type of unit (with options ranging from Standard, Temperature Controlled, RV & Boat, covered Parking Lot, Record Storage, Wine Storage, Retail or Other). It will give you the total number of units, a breakdown of which are occupied, vacant, or offline (the latter meaning not being rented for whatever reason).

After the spreadsheet is filled out it, it will provide you the potential rent and square footage amount, your actual rent income and square footage, and the value for your economic vacancy versus your physical vacancy (to understand the difference, check out this article).

Property Details

This tab essentially functions as your script, checklist, and guide when you’re on the phone with a seller, gathering all the initial information prior to getting the property under contract with a purchase agreement. This is your initial due diligence phase when you're first learning about the property to see if there is an opportunity with it.

Inc – Exp Tab (short for Income and Expenses)

This is where you plug in all the income and expenses from the actual statements themselves.

You use this tab during the due diligence process after you have a signed purchase agreement. This part of due diligence requires the seller to gather and provide a list of accounting statements to you, so you can confirm all the numbers are correct.

This tab is pretty awesome because it takes a pretty complicated process and allows you to follow a simple outline and enter the information line-by-line.

In addition, there are also “Coaching Tips” per each line item, so if you're ever stuck on something, there are guidelines to help you.

Finance Tab

This tab pulls from the Lender tabs (see below) and gives you an overview of which option is most optimal. It also allows you to change around numbers to compare and contrast different scenarios.

Lenders Tab (1, 2 & 3)

There are three different Lender tabs. They all allow you to input the information from different loan products and get an overview of your options. You can compare an Actual, Worst Case, Best Case, Average or Target scenario, as well as use one lender as a private or hard money lender and one as a seller-financing note (you actually set the criteria under the Finance Tab and then adjust the information on the Lender Tabs).

Manager's Tool Kit

When it comes to the Manager's Tool Kit, at first, I wasn't able to access this section. Every time I clicked on it, I got redirected to a page that said I was denied access. After contacting support and clearing my caches a few times, I was finally able to access it through the Firefox browser (for some strange reason, it never worked in Chrome).

Once I got access, on the page (or anywhere else in the course for that matter), there was never an explanation on what the point of this particular section was.

I don't know why these forms aren't included in the Forms & Documents section, but they seem to be geared more towards management and day-to-day operations.

Either way, an explanation as to what these are for, exactly, would have been a great addition to the program.

The list of documents included in this section are as follows:

- 11 Sample Property Management Agreement

- Auction Forms Index

- Auction Forms

- Business Forms

- Facility Audit (excel)

- Late Notice

- Legal Forms

- Management Agreement

- Monthly Marketing Plan

- New Owner Welcome Letter

- Operations Form

- Operations Manual

- Personnel Forms

- Property Management Agreement Sample

- Property Management Contract

- Sample Property Management Agreement

- Self Storage Rental Agreement Sample

- Self Storage Transition Checklist

- SS Employee Policy Manual

One Day Workshop Audio and Videos

This section was a crucial piece of the entire course. If you could only choose ONE aspect of the course to study, this would be it.

There are eight videos, comprised of various lessons that expound on what was in the written manual. All in all, there were some insights that are truly exclusive to these videos, so I highly recommend this section.

Now, let's go over each video lesson in detail.

Lesson 1: Reasons to Invest in Self Storage

This lesson was very similar to the introduction of the written manual as well as Chapter 2.

Lesson 2: Buying vs Building

In this lesson, Scott covers the four major ways to get into the self-storage business, as well as the pros and cons of each strategy. The four major ways to get into this business are:

1) Buying an Existing Facility

This is where you find an underperforming facility and increase its value by increasing its income.

The major benefits of this strategy are that it's fairly simple and straight forward. You have an existing facility, with documented, proven transactions and cash flow, verifying that it's a successful business.

Because it's an established business, lending is easier to obtain and your plans to increase profits can be somewhat streamlined and predictable.

Photo by Scott Meyers

The major drawback is that you may face growth limitations depending on the size of the lot (for example, if they've already developed the building on the property to the highest and best use) and the customs of the market.

For example – if the average occupancy rate for a particular market is 70%, and your subject facility is already at 70% capacity, you may be limited in your potential for growing the occupancy for that particular facility in that specific market.

2) Developing a Facility from the Ground Up

This is where you find a vacant parcel of land and build a self-storage facility from the ground up. The major benefits boil down to control and the potential for a much higher return.

If you build a facility from scratch, you'll have the benefit of riding the wave from investing in a facility at construction cost, all the way to selling it when it's a fully operating, proven facility.

You also have direct control over how the building is designed, so you can ensure everything is optimized for the property's highest and best use.

When you build, you're positioned for an incredibly lucrative return (assuming the project goes according to plan).

The downside, however, is that with high potential also comes high risk.

You'll be starting with no existing structure, business or track record to prove that you'll be able to successfully execute your business plan. This makes financing much harder and the potential to make a mistake or lose money a lot higher as well.

3) Converting an Existing Building

This is where you find an existing commercial building (e.g. – a pole barn, abandoned warehouse, retail store, old bowling alley, etc.), buy it, and convert it to a self-storage unit.

This is basically a hybrid approach between the first two methods listed above.

According to Scott's course, you might be able to convert a commercial building to a self-storage unit for around $15-$20 per square foot, whereas if you were to build from the ground up, it would likely cost between $40-$50 per square foot.

As you can see, it can be a lot cheaper this way, and a lot of the appropriate zoning for a self-storage unit may already be in place, saving you a lot of time and hassle in getting started.

RELATED: How to – Self Storage Conversion and Its Costs

4) Converted Shipping Containers

The last option Scott mentions in the course is pretty brilliant.

He covers the concept of buying (or leasing) a vacant parcel of land and then placing converted shipping containers (like this, this, or this) as storage units.

Scott also gives an example of a Uhaul facility that simply removed the enclosed beds of their moving trucks, lined them up side-by-side and used them as storage units (and honestly, it's hard to tell)!

The power of a creative, portable unit strategy is that it has far fewer costs for development and maintenance.

Not to mention, if your storage units are truly portable, your property tax bill will be MUCH lower, because it's essentially like parking several trailers on an unimproved vacant lot (the storage units are effectively equipment, not improvements to the land itself). This allows you to simply pay the property taxes on the land itself, saving you from having to pay taxes on a much more expensive piece of commercial real estate.

It's also worth mentioning that equipment can be depreciated much faster than improved commercial real estate, so if you're looking for larger, faster tax write-offs, that's another huge perk of this strategy.

Now, one of the major questions I have is how it affects the resale value of the facility in the future.

Does the fact that these portable units aren't attached to the ground negatively impact the overall value of the property if you were to ever resale or is the value of the facility truly solely-based on the income it produces (so it doesn't matter)? This is one of the questions I'll be asking at the live event.

Lesson 3: Where to Find Deals

In this lesson, Scott goes into detail on how to find motivated sellers and great self-storage deals.

One of the most notable things he covers in this section is what to say to commercial real estate brokers to get on their radar and to have them start sending you deals.

He covers a number of ways to get leads, including what criteria to look at on the MLS, how to structure your direct mail as well as a suggestion to explore business brokers and small business broker websites.

Exploring business brokers and their respective websites can be a great way to find deals because business brokers evaluate these facilities based on what's common in their industry, and this is very different than the way real estate evaluations are done.

Typically, business-based evaluations come out much cheaper than the evaluations used in real estate investing, so, naturally, if you're looking at these as investments, this can be a very cool source of inventory!

Also note – in the Forms and Documents section, Scott provides a list of 63 different business broker websites for you to explore.

Lesson 4: Evaluating Opportunities

In this section, Scott goes over the “first phase” of due diligence – when you're simply exploring whether a property has any potential as an investment.

He gives you tips on how to navigate the conversation with the seller, how to pre-frame them for seller financing, as well as how to do initial market value.

This section is essentially the entire Valuator section expounded on.

Keep in mind, that this is the phase when you're simply seeing if a property has any potential as an investment. You'll do all the in-depth due diligence later in the process, once you have a signed purchase agreement in place.

Lesson 5: Making the Offer

Here, Scott gives incredible insight into how to navigate negotiations with the seller and he shows you exactly how to present and justify your offer based on the current financials.

My biggest takeaway from this section is this:

Never buy a property based on the seller's pro forma. Only buy a property based on 12-month actuals.

A pro forma in real estate is defined as,

“A future projection or prediction of financial performance for a business or income-producing property.”

Scott says that if a seller or broker is asking you to make your offer based on pro forma (whoever put the numbers together), they're basically asking you to pay the seller for the work YOU are going to put into the property to increase its value.

Never do this! Only buy a property on the income it's actually provided in the past, or in other words, based on 12-month actuals.

Lesson 6: Financing Your Facility

In this lesson, Scott essentially recaps chapter 12 of the written manual.

In the video, he emphasizes the power of seller-financing, leveraging mortgage brokers and mortgage bankers, as well as the SBA 7(a) Program — a particularly useful loan program that can be used to finance storage-unit facilities.

In short, this is very much worth looking into with your local banker.

Lesson 7: Due Diligence

In this super-important lesson, Scott takes you step-by-step through every aspect of conducting due diligence correctly.

This, coupled with the Due Diligence Checklist, the Valuator tool, and Chapter 10 of the manual, are probably the most valuable aspects of the home study course.

Lesson 8: Five Keys to Success

Here, Scott wraps up the videos with an expounded version of chapter 17 in the written manual. He just shares from his experience, what it takes to be truly successful.

Bonuses

Now, for the final section of the course, the bonus section gave me a lot of trouble. Originally, when I clicked on the bonus section, it kept redirecting to the homepage. It corrected itself eventually, though I don't know exactly what caused the change.

There are a couple of different sections that are pretty self-explanatory like how to submit a deal to Scott's team, a link to sign up for the Live Events, and so on, but I want to highlight the areas that may need a little more explanation.

1. The Quick Start Webinar

This video is essentially a high-level explanation of the opportunity in storage units, with a large emphasis on how their referral program works.

Scott's team will pay a $10,000 referral fee for students who bring him deals, which is a pretty incredible opportunity.

In the video, Scott mentions that in the welcome email, there was a way to sign up for a free “30-minute coaching” call with his team. This sounds like a great value but, personally, I never saw this link in the welcome email I received.

He also mentioned that, in the welcome email, there was a link to sign up for the live event, but I found the way to sign up for the live event within the bonus section, not the welcome email (it's possible that I received a different email because I was moonlighting the course in exchange for a review, but whatever the reason, I never saw either of these in the welcome email).

Concerning the “Quick Start Webinar PDF”, the link doesn't work. It's broken. Literally, nothing happened when I clicked on it.

3. The Self Storage Valuator Webinar

I don't know why this is listed in the bonus section, as all it does is redirect to the Valuator section.

Again, the Valuator section is one of the best values in the entire program, I just don't understand why it's listed here when it's clearly listed elsewhere.

Self Storage Academy

(Update: May 2019)

This review would not have been complete without the REtipster team attending a Self Storage Academy live event.

In May 2019, Seth and I did just that, so I wanted to update this review with my thoughts.

I’ve put a lot of study into marketing over the past year or so, and throughout the event, I saw a lot of marketing tactics aimed at one major goal: to get the attendees of the event to partner with Scott and his team.

Whether the students bring in a deal or provide the financing for a deal, my biggest takeaway was that Scott’s goal in providing self-storage education is to leverage his students.

At first, I was disappointed by this, because I expected his program to be more about providing great information with no agenda.

As the event continued on, I realized some things that softened my disappointment.

First, I realize there is value in the fact that Scott provides guidance and mentorship through his partnership program.

If I was going to invest in self-storage, I’d be looking to partner with someone experienced on my first deal, so they would be there to make sure I don’t make a mistake.

The truth is, there isn’t much difference between that and Scott.

Granted, there may be extra costs with Scott’s program, where you may need to spend money for coaching on top of sharing your profit through the partnership… but depending on your situation, that may not bad thing.

If the education delivers the expected value, then there isn’t anything inherently wrong with charging for it.

Secondly, Scott doesn’t try to hide his intent – which is respectable. One of the first things he said at the event was,

“Now, we like to help people and give them good information, but the reason why I keep doing these live events year after year is that hopefully, if we teach you how to do the business, you’ll run into deals that are too expensive for you to take down by yourself, so you’ll end up bringing your deals to us.”

So it’s not like he’s trying to manipulate people, he’s honest about it.

Lastly, I still believe Scott’s material is the best that’s available on how to get started in self-storage… but I'll also say, just because something is the best available, doesn’t mean it can’t improve.

Scott’s material is not methodically laid out and it’s not the easiest to get through… but to the best of my knowledge, there isn’t much of an alternative right now.

If you’re looking to get started in self-storage in 2019 you’ll be hard-pressed to find anything that can beat the education he provides.

Final Takeaway

From everything I've seen of Scott's education program, it seems his intent is to use education to build rapport with you and to gain your trust so that ultimately you’ll end up partnering with him and his team.

As long as you’re aware of that underlying agenda, I don’t think that’s necessarily a bad thing.

Scott seems to be an honest guy and for good or for worse, his education is the best on the market right now.

So, my encouragement is to be vigilant but also to be open. For the right person, what he offers can be a great value and I don’t want to diminish that in any way.

Have you been through Scott's course? What did you think of it? Let us know your thoughts in the forum!