REtipster features products and services we find useful. If you buy something through the links below, we may receive a referral fee, which helps support our work. Learn more.

One of the primary objectives of my real estate business is to acquire income-producing rental properties that ROCK.

What makes a rental property “rock,” you might ask?

It doesn't need to pump millions into my bank account each month, and it doesn't need to be a “no money down” deal (although either of these things would certainly sweeten the pot).

To put it simply, a great rental property makes every one of my investment dollars work hard. I want every penny to work overtime, producing as much revenue as possible while simultaneously paying off any debt associated with the property. When you buy properties with this goal in mind, there is no limit (mathematically speaking) to how far you can grow your net worth and personal income.

The Problem

When I started as a real estate investor, I spent a lot of time trying to find these properties.

I remember spending hours upon hours scanning my local MLS listings, desperately trying to find a deal that would make financial sense.

After running the numbers on dozens of properties, I was shocked at how difficult it was to find even one property that would justify my investment.

At the time, it was 2005, and housing prices were through the roof – which made this a very difficult task (especially when I limited myself to ONLY the properties that were “listed” with a realtor's sign in the front yard). It was an extremely discouraging time in my journey.

I eventually realized I was dealing with two fundamental problems:

- I didn't have an effective way to find motivated sellers. I was relying ONLY on unmotivated sellers holding out for top dollar. This was a losing strategy that wasn't going to cut it.

- I didn't have an effective way to analyze properties or determine their potential profitability. I needed a basic, easy-to-understand calculator that could help me decide on an offer price without wasting a lot of time.

After a lot of research and learning, I found effective ways to solve BOTH problems.

Both issues are equally important, but for obvious reasons, problem #2 cannot be addressed until problem #1 is dealt with.

In other words, you can't start working on your analysis until you have something to analyze. This may seem obvious, but it's important to get clear about this, so you can prioritize and deal with first things first.

The Reason For This Case Study

I will show you the entire process I go through when buying a rental property.

If you're reading this, you may fall into one or more of these categories:

- You don't know how to find a legitimate, profitable rental property.

- You understand the theory, but you've never actually purchased a rental property before.

- You don't understand how to analyze and evaluate a rental property properly.

- You need a better understanding of how the entire process works, from start to finish.

- You aren't clear on how much income a rental property produces and why investors buy them in the first place.

This blog post is intended to show you exactly what steps I go through, my expectations, and how I ensure my (or my client's) return on investment.

I'm a big fan of “on-the-job training”, so I figured out the most practical way to show you with a real-life example I dealt with just a few short years ago.

1. First Contact with the Seller

One day in early December, I received a voicemail in response to one of my direct mail campaigns (I had used Template #3 for this particular mail campaign, and I pulled my list using the same process I described in this blog post).

This postcard had been sent out the previous summer (over a year earlier) – and this guy had simply held onto my postcard and called me about 16 months later (gotta love the residual benefits of direct mail).

(note: caller's name and address have been removed from this recording for privacy)

2. Quick Rental Property Evaluation

Once I got this message and learned the basic details about this property (i.e. – the owner's full name and property address – edited out of the above audio clip), I went to work.

I was fortunate because I was very familiar with this neighborhood. I had sold a similar house a few blocks away for $88,900 in late 2009 (by which time the market had already dived), so I had some perspective on what a house like this would legitimately be worth.

Before I called the prospect back, I went through my quick property research process and learned the most pertinent details about this property. It was a single-family home with two bedrooms & one bathroom. According to the seller, it generated approximately $750 monthly rent. Using DataTree, I learned that the seller had purchased this property eight years earlier for $55,000 – which gave me some perspective on where he was coming from.

Armed with this basic information, I called the prospect back.

After roughly 4 minutes on the phone with the property owner, I asked him (point-blank) if he would sell his property for $30,000 – $40,000.

He replied very quickly,

“Yes, I would consider that.”

Later that week, I called the seller back and told him our offer would likely be for $25,000. He said he would think about it.

A few days later (after hearing nothing from him), I called again to see what he was thinking. He said he was hoping for something more in the $30K – $40K like I initially stated (*kicking self*). I realized pretty quickly I should have suggested an even lower number, to begin with. Setting his expectation in the $30K – $40K range right out of the gate probably wasn't smart (it's generally easier to start low and negotiate up than to start high and negotiate down). Lesson learned.

Eventually (after a few more discussions), we settled verbally on a price of $27,500 cash, with all closing costs paid by the buyer. In other words, the buyer (aka – me) would have to cough up another couple of thousand dollars to close the deal (this includes title insurance, closing fees, property insurance, pro-rated property taxes, etc.).

Show Me The Money!

Now, most people don't have $27,500 sitting in their checking account at any given time and at the time, I was no exception. Luckily, I knew some other investors who did.

I called one of my cash buyers and gave them a quick overview of the deal. They were very interested in finding out more. Like most people, they were stuck with Problem #1 (above). They had plenty of money to invest but didn't know how to find good deals. These are excellent people to have on your buyers list because, in their minds, any property at 70% or less of market value is an AMAZING deal that will get them very excited.

RELATED: What Is the 70% Rule?

Luckily, I had mastered the art of finding cheap real estate in my area (FAR below 70% of market value), so I quickly got their attention when I told them about this property. I gave them a general overview of the property (“a two bedroom, 1 bathroom house on the southeast side of town, a 1.5 stall garage close to the local public school, etc.”). I also prepared a Rental Property Analysis to show them exactly what kind of ROI they could expect from this property as a rental unit (more details below).

After seeing my property prospectus report, my buyers said they were ready to go with cash in hand, contingent on an acceptable home inspection and verifying all my assumptions.

3. Running the Numbers On a Rental Property

One of the most important things you MUST do while evaluating a new property is your projections.

“Projections” are a series of highly informed guesses about how profitable a property may (or may not) be in the future. To figure this out, you'll have to do a little homework and develop a thorough understanding of what the income and expenses will likely be from this property in the future.

It's not difficult, but as with any real estate transaction, there are several things you need to pay close attention to. As you research a property and learn more about what you're getting into – certain things matter greatly, and others matter very little. As we walk through this process, I hope I can give you a good idea of what to look out for.

Many of the deals you'll see regularly won't have positive cash flow (in fact, that's almost exclusively what I saw in my first year as a real estate investor) – and there are a lot of things that can sabotage the profitability of a rental property. Things like:

- Paying too high a price for the property

- Excessive Property Taxes

- Excessive Interest Expense

- Insurance Costs

- Maintenance, Utilities, and Upkeep

- Unforeseen Disasters

- Homeowner's Association (HOA) Fees

If a deal doesn't cash flow, don't buy it. PERIOD. This is why you must nail down your projections and accurately depict its profitability – because, frankly, your “GO” or “NO GO” decision usually boils down to the answers you get after going through these motions.

Dealing With Imperfections

Are your projections going to be perfect? Not likely. We aren't fortune tellers, after all, so it's impossible to know EXACTLY how things will pan out in the coming months and years.

Projections rarely come to fruition exactly as we plan. Still, when they're done correctly, using realistic data and assumptions, they will almost always set you up with reasonably accurate expectations that won't lead you astray. The numbers may turn out better or worse than you estimated, but they should at least be somewhat similar to what you had originally predicted.

Challenge Your Assumptions

- So you think rent will be $750 per month? Says who?? Is this a reliable and unbiased source of information?

- Do you think the vacancy rate will be 10%? What makes you think so? Do you have any experience or market data to back this up?

- What kinds of maintenance and repairs will you have to take care of? How certain are you about what the costs will be?

- What if one or more of your assumptions turn out to be wrong? Does the property still perform to an acceptable standard?

You need to be armed with the right information to come up with your best possible guess of what the future will look like. Your inputs will determine everything here, so remember the theory of “garbage in, garbage out”. If you start with bad information (or just guess at the numbers without getting them from a credible source), you will not have a very reliable number.

The last thing we want is to invest our life savings into a property that loses money hand-over-fist.

It's an easy-to-use, web-based app that allows you to plug in a few basic inputs and (assuming your numbers are reasonably accurate) will show you some very clear results to help you determine if/when you're looking at a worthwhile real estate investment.

In the example below, I'll show you how I used this calculator to go through the motions of running the numbers so I could understand whether I was looking at a solid deal for an investor to pursue.

(Note: DealCheck is a free tool, but they also have a paid version of the service that will open up access to more tools within the system. If you want to try the paid version, be sure to use Promo Code: RETIPSTER at checkout, and you'll get 25% off for the life of your subscription).

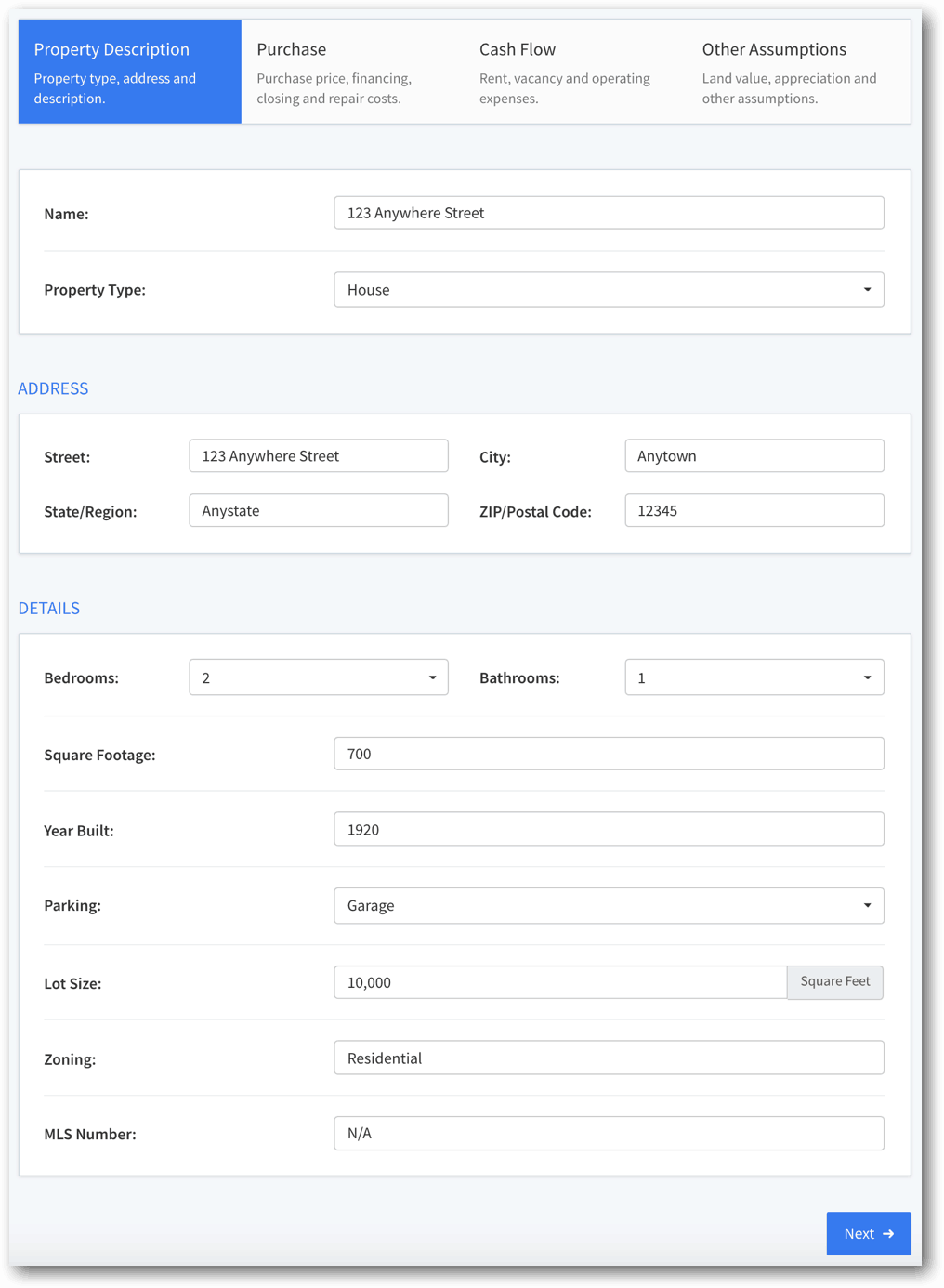

Step 1: Property Description

For the sake of organization, the DealCheck app starts every new property evaluation with a simple property description, where you can enter all the basic details about the property.

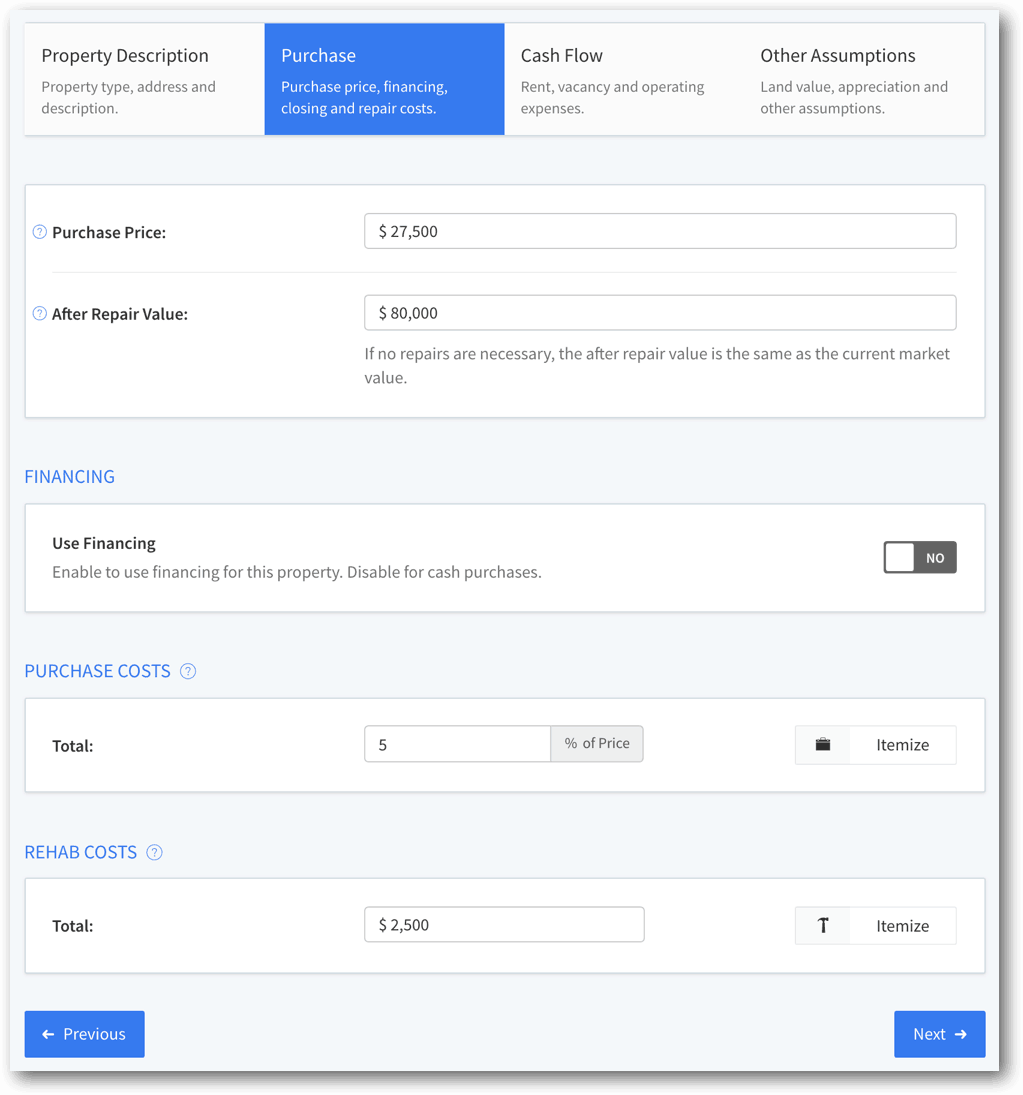

Step 2: The Purchase Price, Financing, and Closing Costs

As I mentioned earlier, with this deal, we agreed to a sale price of $27,500, with the buyer paying for all the closing costs.

This was an incredible deal from the standpoint of getting free equity. Since this seller was highly motivated and willing to accept a deeply discounted price, the investor walked away from the closing table with a massive amount of free real estate equity.

Normally, you'd have to make significant improvements and put “sweat equity” into a property to see this kind of “after repair value“… but in this case, the value was built into the deal because of our ability to negotiate such a low price (which underscores the power in your ability to find motivated sellers).

RELATED: Understanding the Motivated Seller

Now, depending on whether the property is being purchased with a loan or purchased outright as an all-cash deal – the financing picture will have a big effect on your calculations.

In my example, the property was being purchased with cash – which greatly simplified this portion of the calculator.

Why was this property being purchased with cash instead of financing? A few reasons…

- The property was relatively inexpensive.

- The investor had the cash available.

- The investor was more concerned about generating more cash flow than making their cash work harder for them (which we'll get to in a minute).

For this deal, the closing costs (i.e., purchase costs) came out to approximately $1,500 (closer to 5.5% – but not a huge variation from the 5% shown above). The deferred maintenance costs we planned for were $2,500 (the furnace was in rough shape. The previous owners had no idea how to replace furnace filters, so we assumed it would need to be replaced shortly after closing).

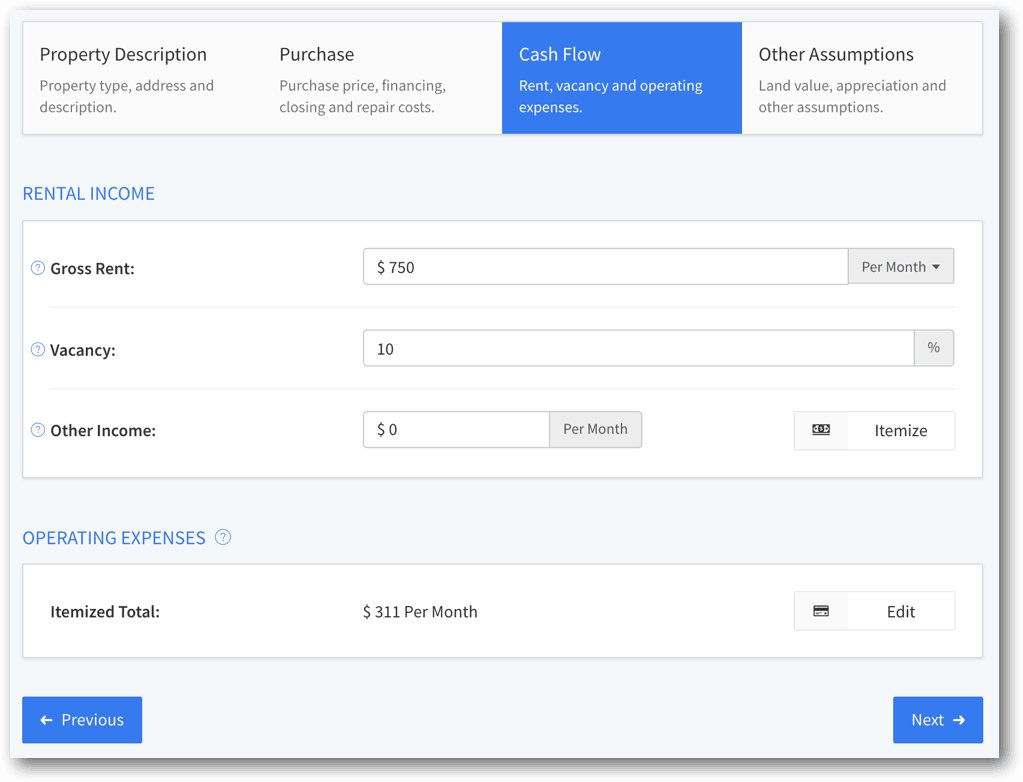

Step 3: Determine the Rental Income

The rent revenue is one of the most important numbers you'll plug into this calculator.

An investor needs to be very confident about how a property is likely to generate every month (and remember, we're talking gross income before any/all expenses).

In my first conversation with this seller, he told me the current tenant was paying $750 per month.

Can we trust him? There are a couple of ways to find out.

I started by asking him to send me Schedule E of his past two years of tax returns (Schedule E is an income statement, showing the revenue and expenses he reported to the IRS for this particular rental property). After reviewing this information, it turned out that the $750/mo number was accurate.

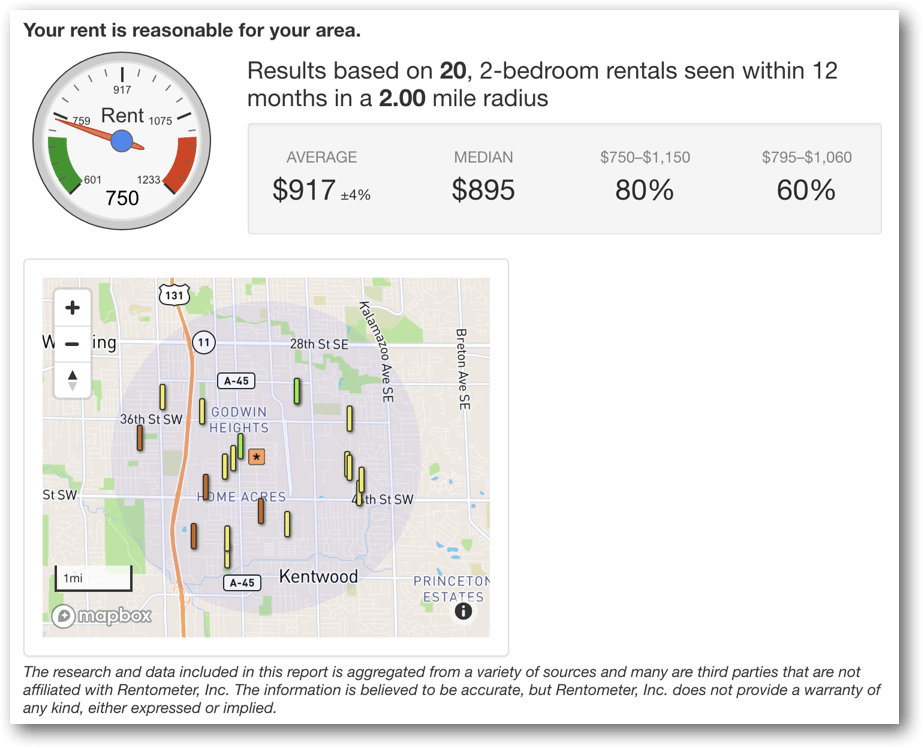

I also ran the numbers on Rentometer – which gave me a quick look at what similar properties were renting for in the immediate vicinity. I found that $750 was on the low-end for the area, which made me more comfortable with this number.

In the end, since I had verifiable proof that $750 was attainable based on the seller's tax returns, a copy of the lease, and the rental comps in the market, I decided to use this number in my calculation.

I also assumed the property would have no other sources of income (i.e., no vending machines or coin laundry), a vacancy rate of 10% (i.e., the property will be vacant and/or between tenants for five weeks out of the year… a pretty conservative estimate in this market).

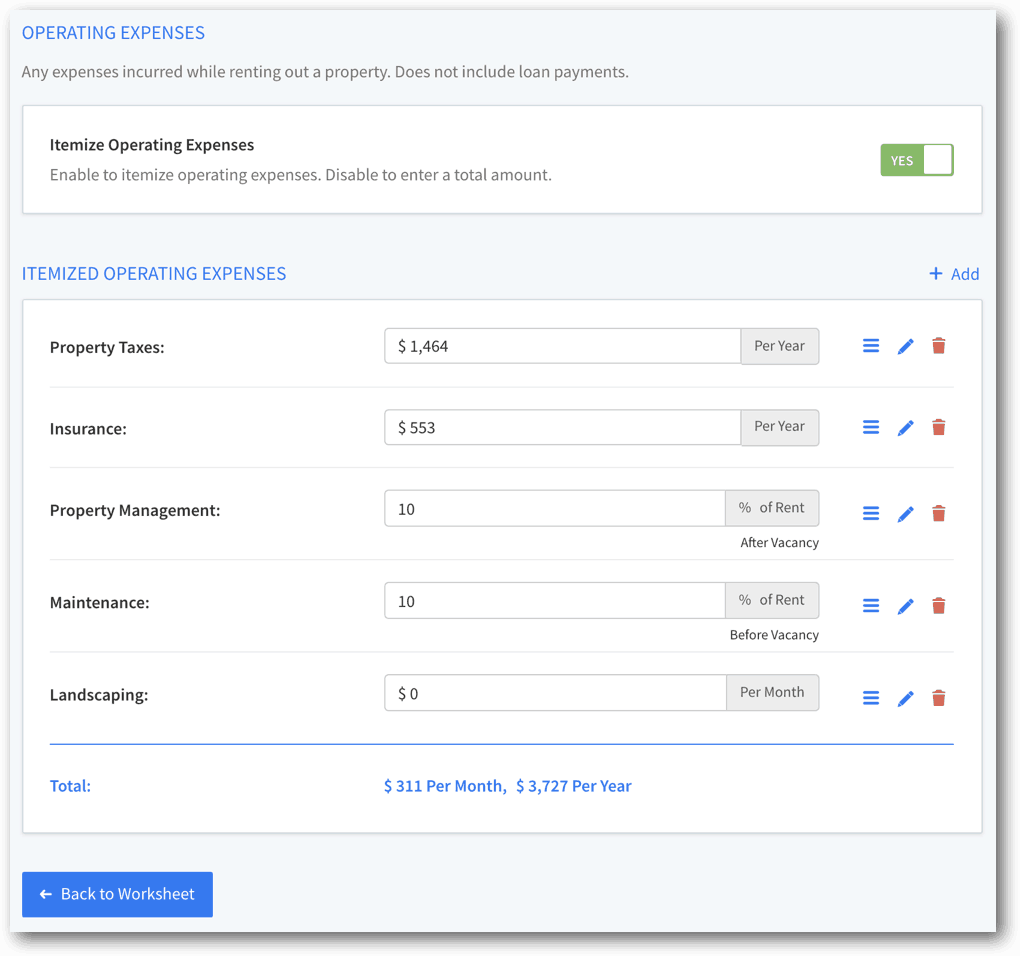

Step 4: Operating Expenses

Understanding a property's expenses can be a painful dose of reality… but it's much better to embrace these realities BEFORE you've purchased a property than after you're stuck with it.

Most sellers tend to downplay the expenses associated with their property (or just fail to mention them altogether)… but these numbers are CRUCIAL to getting an accurate and reliable rental property analysis.

Operating expenses are very real and will play a major role in your rental property's profitability (or lack thereof). You’ll have to do your homework in this section, and it’s important not to slack off during this process because if you use the wrong numbers, you'll only be fooling yourself and hurting your (or your buyer's) financial future.

Property Taxes: Property taxes have always been a depressing subject for me. Why? Because regardless of whether you purchase a property with financing or buy it free and clear, you will always have to pay property taxes. Since this expense is permanently attached to the property, you must find the correct number and factor it into your calculation. I found this number by checking the seller's Schedule E and the City Treasurer's website for the total annual property taxes over the past two years. This property owner paid $1,464 in property taxes the previous year, which was the number I used here.

Insurance: This one is pretty easy. You can call any property insurance agent (I recommend trying at least a couple to compare prices), and they will be more than happy to tell you what the annual cost will be. I called my property insurance agent and gave him the rundown, and he indicated an annual cost of $550 – $600 for this type of property. Given that the seller had paid $553 – I decided to use that number for this part of the calculation.

Utilities: For most residential rental properties in my town, utilities are set up so that the landlord pays the water bill, but everything else is covered by the tenant. The utilities can be set up in several ways, but whatever your arrangement is, you need to get a good idea of what this number will be on an annual basis.

In this situation, the seller also arranged the utilities so that he paid ONLY the water bill. Looking at his Schedule E, I could see that he had paid an average of $900 per year for the past two years. Based on my experience with other rental properties in the area (and based on my property manager's opinion), I knew this was a solid, legitimate number to work with.

Advertising: I use a great property management company for all my rental properties (and I recommend all my buyers do the same). Most property managers will handle the placement and eviction of all tenants as part of their service.

HOA Fees: This property is not part of a homeowner's association, so this step is easy. ZERO.

Property Management: Even if you’re not going to hire a property manager as I do (most property managers will charge around 10% of your gross rent revenue), you still need to pay yourself for your trouble. Somebody, in some way, will ALWAYS have to manage this property, so regardless of who is doing the job, this is a real expense that ought to be accounted for.

Maintenance & Repairs: Another absolute must that you need to include in your expense column is a reserve for maintenance and repairs. I always plan to set aside at least 10% of my gross rent revenue to cover the issues that will come up when my properties start falling apart (because sooner or later, it will happen). Even if you have a year or two where no extraordinary expenses come up, you need to let these funds accumulate. All it takes is one roof replacement or one pipe to burst in the basement, and ALL of this money will be needed immediately – so let this money build up and don’t drain this account.

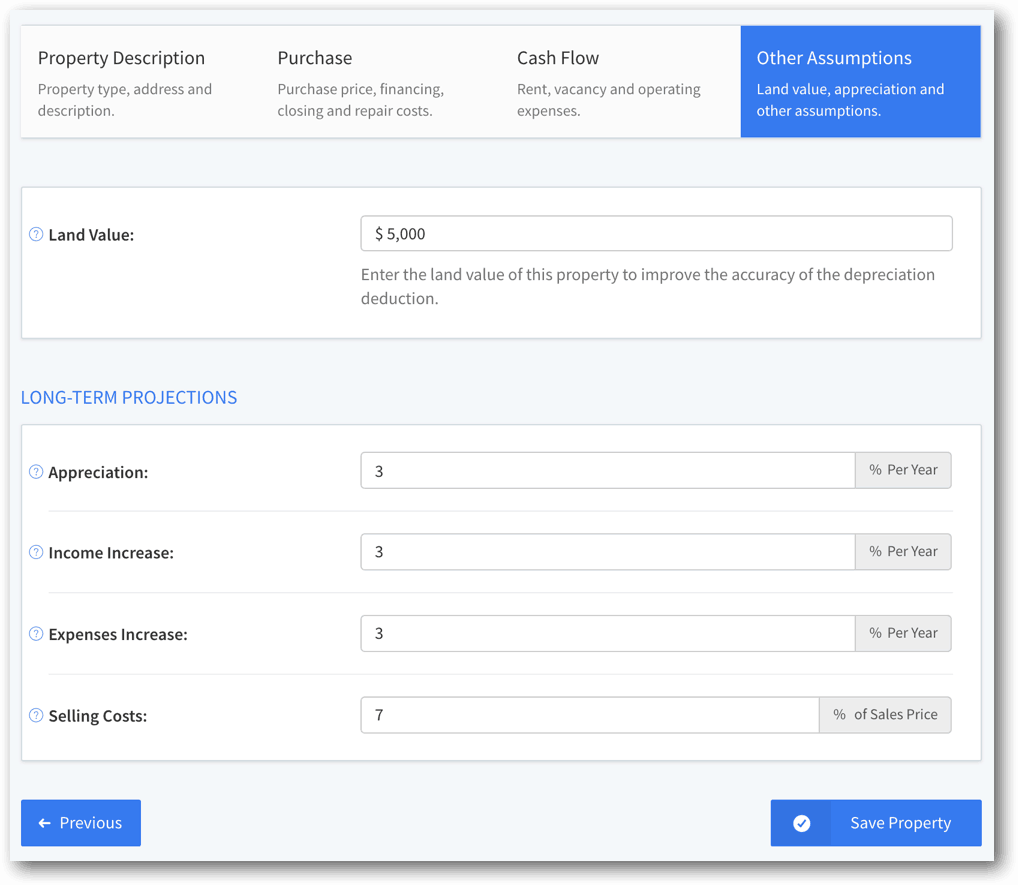

Step 5: Other Assumptions

This next step is pretty simple. You can plug it in if you know what effective tax rate you're working with (this will depend on the investor's situation). The calculator will factor this into the final calculations of your annual cash flow after taxes. I used 20% in my example.

As part of this process, you'll also have to designate the Land Value for your property. Why? Because while the “improvements” (i.e., house) portion of a property can be depreciated over 27.5 years (thereby giving you a nice annual tax write-off), the land portion cannot be depreciated.

In this example, I gave this property a Land Value of $5,000.

Furthermore, there are a few other long-term projections you'll want to think about…

Appreciation: As an investor considers the next 5, 10, 20, 30 years they'll own a property, one detail they may want to think about is appreciation. This is the way a property increases in value over time. The problem with appreciation is, nobody knows how much a property will increase in value (or for that matter, how much it will decrease in value). As such, I don't put much weight on this number when I'm analyzing a property and making a buying decision… but as far as predictions go, 3% is usually a pretty reasonable estimate to start with.

Income Increase: As time goes on (barring any sudden, unforeseen economic collapse), there's a good chance most rental properties will be able to generate a slightly higher rent price, year after year. In this example, I went with 3% (and considering the previous owner was charging significantly less than market rent, this seemed like a conservative amount).

Expenses Increase: In the same way that inflation causes expenses to go higher each year, it's only wise to make room for this in this kind of rental property projection. Unless I know of some significant reason why this number will be higher, I typically use 3% in most of my rental property calculations.

Selling Costs: Whenever the day comes that an investor sells their property, it's smart to account for whatever selling costs will come into play (like realtor commissions and other closing costs). Since most realtors will charge a 6% commission, I pegged this number at 7% to ensure these basic costs would be more than covered.

Step 6: Summary

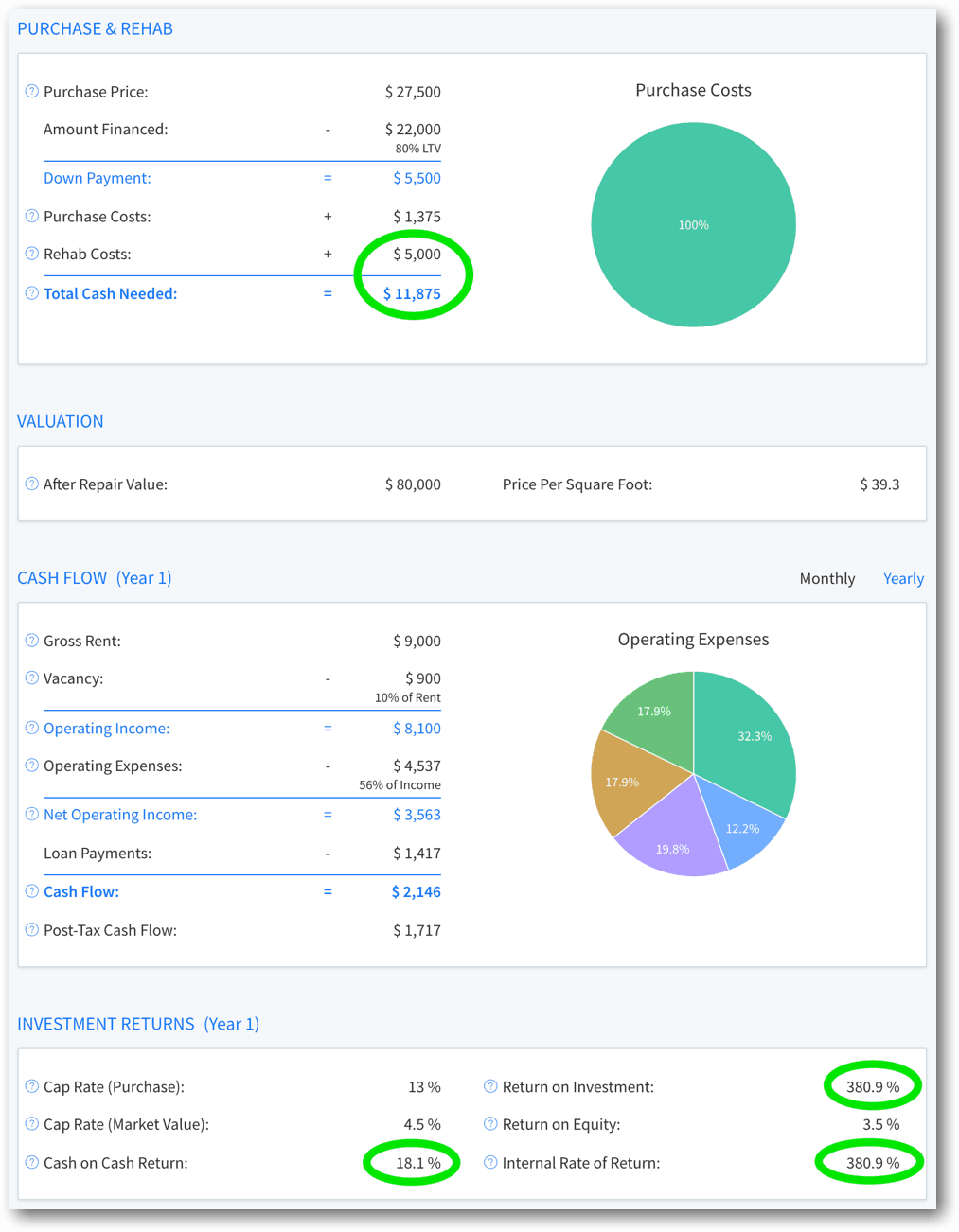

When all the inputs have been filled out, DealCheck will compile a summary showing all the critical details that pertain to the investment in question.

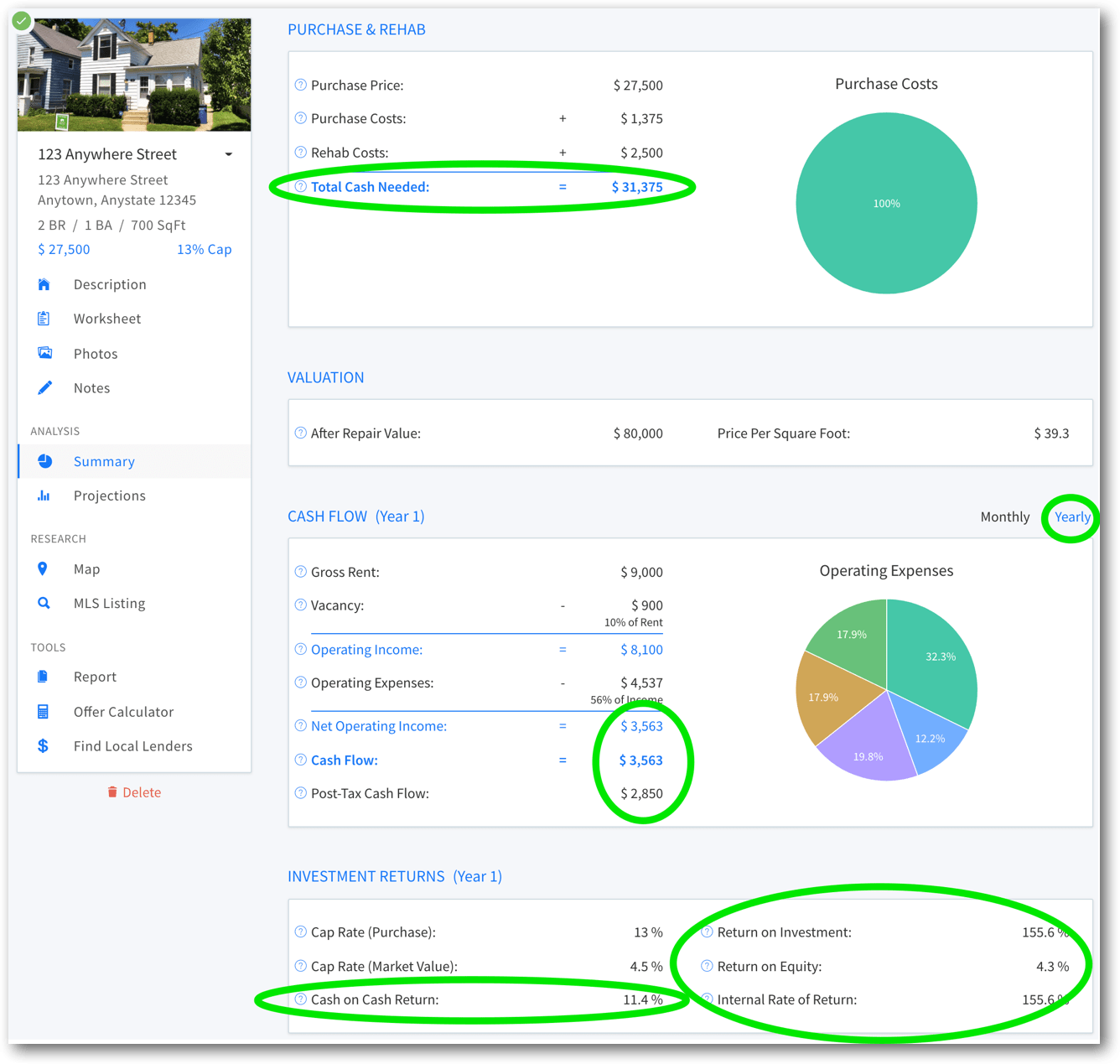

Since this was a cash deal, the summary shows the total cash required to purchase the property (taking the purchase price of $27,500 + closing costs of $1,375 + deferred maintenance of $2,500 = $31,375 cash required to close).

This is usually a very revealing part of the calculation process because it gives us a good look at what kind of net operating income the property can be expected to generate (both before and after taxes).

In the example below, the calculator tells me that after all expenses, the investor would add another $3,563 to their annual income, and then the amount they would keep in their pocket (after their taxes are paid) would be $2,850.

In a very real way, this information is your final decision-making data, and depending on whether the property is being bought with cash or with financing – the results can vary widely.

Some of the numbers I always watch very closely are the Annual Cash Flow, the Cash Required to Buy, and the Cash on Cash Return.

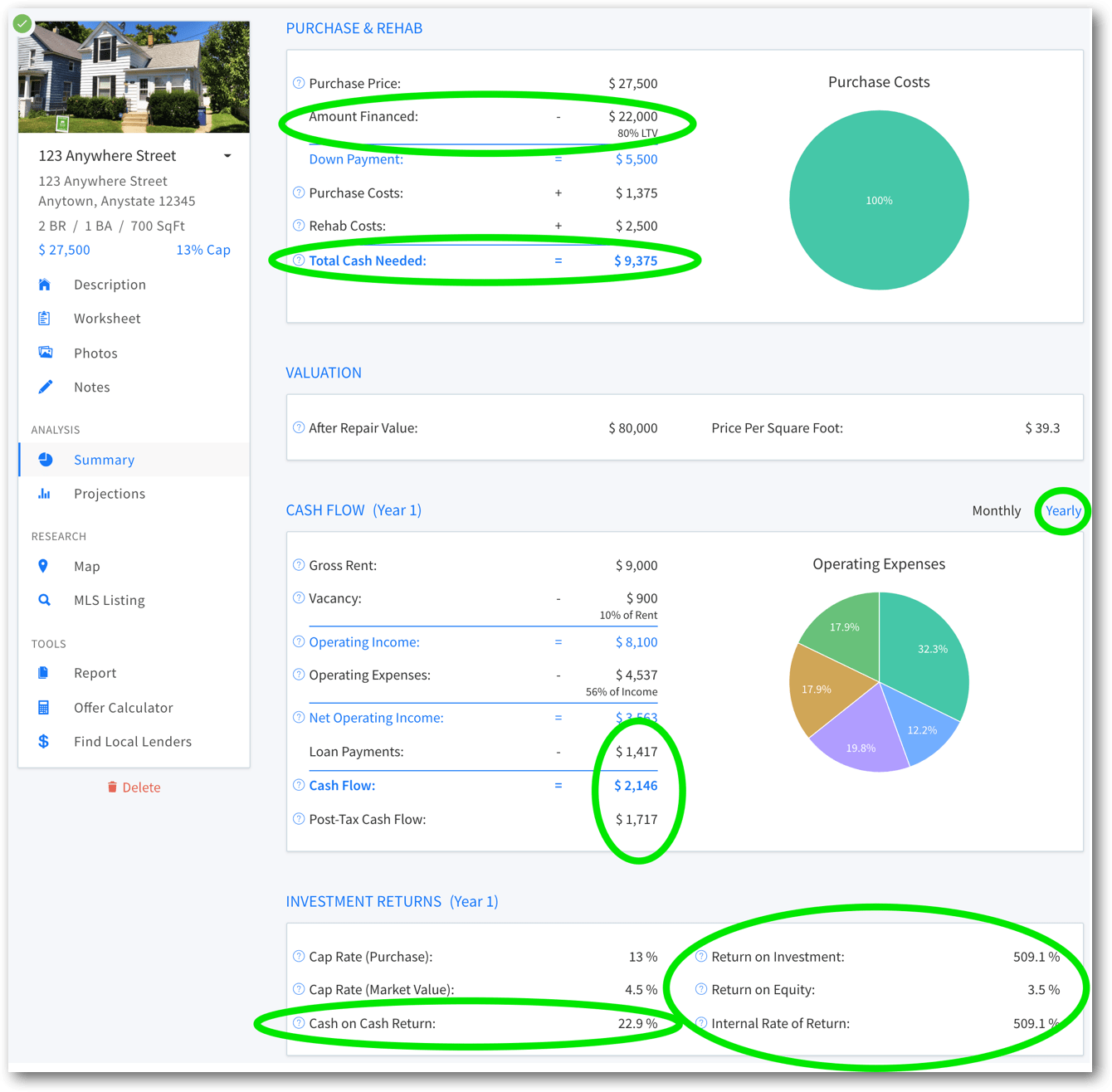

For example, let's go back to the worksheet and change our financing strategy to buy this property with a mortgage. If we put down 20% and get a 30-year mortgage at an interest rate of 5.00% – we now have to add monthly loan payments of $118 ($1,417 per year) into the mix.

What does this do to our numbers? Check out the differences…

When we use the financing for a property like this, it comes with some tradeoffs. Let's look at the pros and cons of using a loan to buy this property.

Pros:

- If we utilize financing, this property (and the income source) will require significantly LESS cash to buy upfront.

- The Cash on Cash Return is over 2x higher when we use the power of “OPM” (Other People's Money). In other words, every dollar we put into this property from the investor's pocket will work MUCH harder than if the investor had to cover the full purchase price without financing.

- It also significantly increases the Return on Investment and Internal Rate of Return (because, again, we're using less of the investor's cash and more of the lender's).

Cons:

- Since the investor will have to make monthly loan payments for the next 30 years, the annual cash flow is going to be significantly less. Even though the property will require less cash up front, it will produce less cash flow after the debt service is paid each month.

- If an investor is scared to death of debt and/or if they have a personal philosophy of avoiding debt at all costs – this approach will conflict with that mindset.

The great thing about financing is that it has the potential to supercharge the growth of your real estate portfolio. When you can purchase properties quickly without tying up your finite sources of cash, it can be shocking how quickly you can build up a MASSIVE source of wealth and income.

4. Is This a Good or Bad Deal?

The bottom line is this…

If we purchase this property and pay all cash for it, we can reasonably expect to be $2,850 richer at the end of each year… and it will cost us $31,375 to create this income stream.

If we purchase this property with financing, assuming 20% down and 5.00% interest over 30 years, we can reasonably expect to be $1,717 richer at the end of each year after taxes… and it will cost us $9,375 to create this stream of income.

If you want a closer look at how I plugged all of these numbers into the DealCheck calculator – I'll walk you through the entire process in this video below…

Want to use the DealCheck Calculator?

You can get it at DealCheck.io. And remember – the app is free to use, but if you want to pay for the upgraded version, be sure to use Promo Code: RETIPSTER at checkout for a 25% discount for the life of your subscription.

5. Offer and Acceptance

When you know a deal makes sense on paper, it's time to make an offer.

On December 15, I prepared a very simple, one-page written offer for $27,500.

A couple of days after I emailed this offer to the seller – he called me, and we spent some time negotiating the price on the phone. He wanted as much as possible – but $27,500 was my ceiling (if the price went any higher, I wouldn't have had a buyer on the other end – and I made this very clear to the seller).

On December 18 – I received the seller's acceptance via fax.

6. Due Diligence

Whenever you're making an offer – you have to make some assumptions. There's no practical way around this.

It's okay to assume some things (if your purchase agreement gives you the necessary wiggle room to get out of the deal) – but once your offer is accepted, you need to go through the motions of verifying that those assumptions were correct.

As you conduct your due diligence, there will almost always be some “findings” that come up in your research process (i.e. – things you weren't aware of when you made your offer). The key is to know when these findings are acceptable and when these findings are a deal-breaker.

Once we had this seller's official “go ahead”, I ordered a home inspection report from a company called House Master (for a total of $385 – which my buyer agreed to reimburse me for). HouseMaster is one of many home inspection companies that operate in my area.

While the inspector was there, I dropped in to do a quick visual inspection.

I don't always do this (in most cases, I can trust my inspector and property manager to give me an accurate assessment), but since I live just on the other side of town, I figured it would be prudent to swing by.

Here are a few pictures I snapped of the interior and exterior with my iphone:

As you can see – it was a pretty simple, small house. Not enough for anyone to retire off of, but not a bad property for a newbie investor to get their feet wet with.

A couple of days after the inspection, the folks at HouseMaster emailed me their full, 51-page report, giving a VERY thorough overview of every observable issue that could come up with this property (honestly, it was more than I ever wanted to know – and considering their job, this was a sign of a job well done).

Their report brought some pretty important issues to light – all things the seller didn't tell me about, and things that would likely impact the cash flow of this property within the first couple of years after the acquisition.

The most pressing issues were as follows:

- The furnace was still functional but was near the end of its life (it was over 20 years old). Replacing it would definitely be a necessity in the near future, and it wouldn't be cheap.

- The bathroom shower was leaking and needed some attention to fix the issue.

- The roof needed some patchwork.

- Some of the siding had holes in it and needed to be replaced.

- The kitchen faucet was leaking and the countertop had some chips in it.

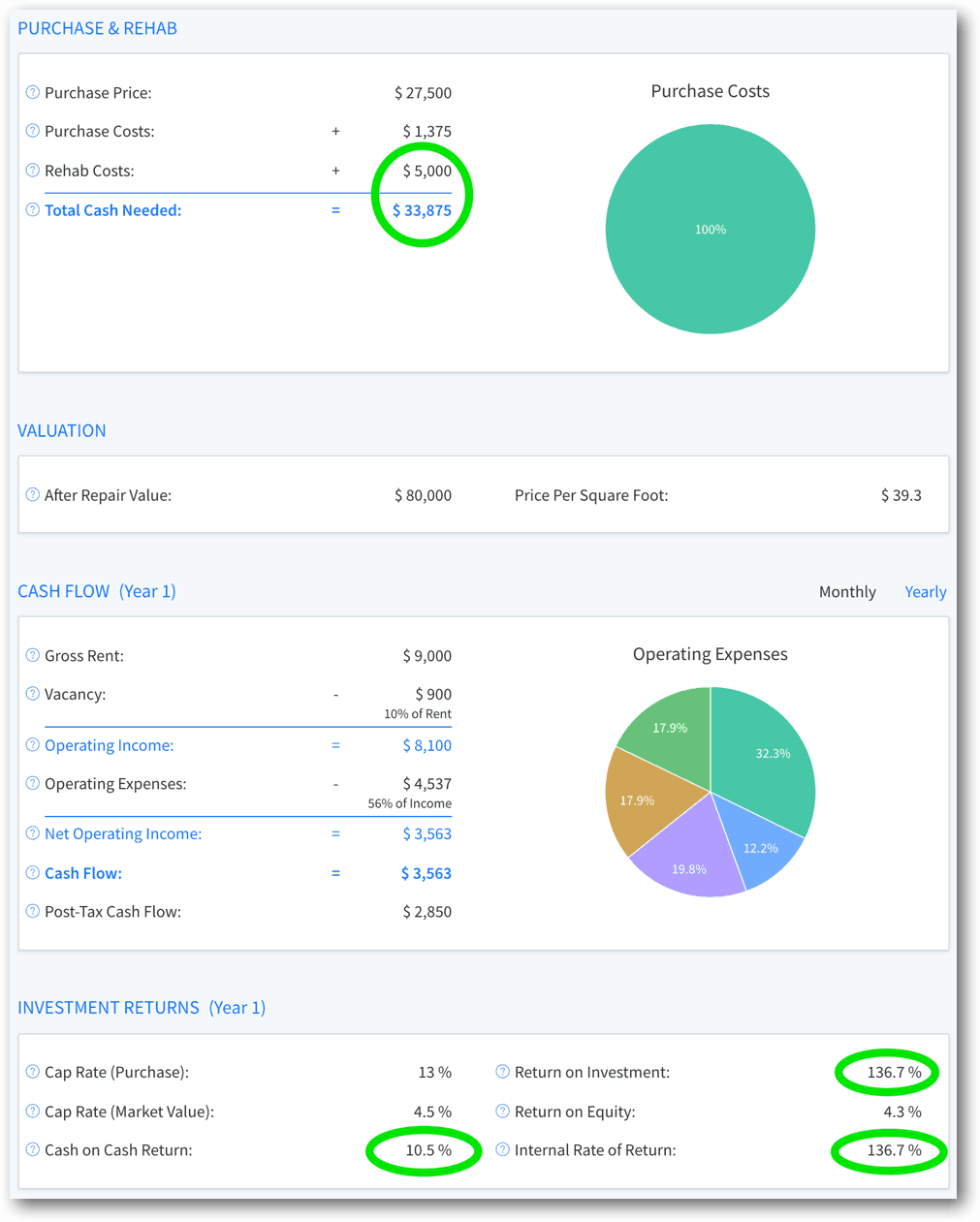

Altogether, we figured these repairs would cost approximately $5,000 to fix.

Obviously, I don't expect any property to be 100% free of problems, but I expect to understand what those problems are BEFORE anybody goes through with buying it (whether I'm buying it myself, or assigning the deal to another investor).

This was a tricky case because I knew the seller had already come down quite a bit with his asking price, and he had no intention of going any further.

In most cases – I would keep pressing the seller to move further down (depending on their level of motivation), but rather than continuing to push this guy, I decided to adjust the “Rehab Costs” in the DealCheck calculator from $2,500 up to $5,000 to see what the deal would look like after accounting for these extra costs.

Cash Scenario:

Financing Scenario:

RELATED: Cash on Cash Return Calculator

On both accounts, it was still a good deal… the numbers would just take a slight move in the wrong direction (though not enough to be a deal-killer). Given this, we decided to take the hit and move forward (something I don't do often, but the deal was good enough that it warranted this kind of concession from our standpoint).

The benefit we had, in this case, was awareness. When these problems need to be addressed – we DON'T want to be surprised or feel “stabbed in the back” by the seller after we (or our investor) owns the property and they're stuck with it.

7. Closing On A Rental Property

Now – when I'm pinching pennies, I do have the option of doing my own title search – but considering that my buyer was going to pay a significant amount of money for this property AND it involved an assignment of contract AND we needed someone to facilitate the signing of the closing documents, handing this job over to a title company was an easy decision.

With this property, I intended to “assign the contract” to a third-party buyer.

In other words, I planned to take my purchase agreement and sell the paper to another investor (a process that some refer to as “wholesaling”).

A Note on Assigning Contracts

When I signed this contract with this seller, they gave me the legal right to purchase this property for $27,500 within a specified time.

If, for any reason, it's not convenient for me to buy this property for $27,500 (e.g. – if I don't have this kind of cash in my pocket at any given moment), I know another investor who would LOVE to get this deal, I am allowed to sell this contract to them.

This is allowed because the seller gave me their written permission to do this (it is stated very clearly as an “assignment clause” in our contract).

This kind of transaction is completed with a 1-page form called an “Assignment Agreement”. This document is signed by ME (the “Assignor”) and the end buyer (the “Assignee”). The end buyer pays me a set amount of cash for the contract and in exchange, they can jump into my shoes and take my place as the Buyer in the original purchase agreement.

RELATED: The Ultimate Beginner's Guide to Wholesaling Real Estate

When Does Assigning the Contract Make Sense?

This type of transaction tends to work best when a property is being purchased in an all-cash transaction (i.e. – the buyer doesn't need a bank loan to purchase the property).

Why? Because whenever a bank gets involved with a real estate transaction, they tend to add a lot of restrictions and rules that make it very difficult (if not impossible) for the wholesaler (i.e. – ME) to get paid.

Luckily, I was dealing with a cash buyer in this situation – which is part of what made the whole project possible.

The Assignment Fee

There are a couple of different ways that I charge assignment fees.

Method 1: If I have a property under contract for a ridiculously low price (say, 20% of market value), I generally feel comfortable charging a sizable fee simply because I have a HUGE profit margin available can pull from. If the deal makes sense, the seller will gladly pay it because even with the cost of my fee, they are still getting an awesome deal that they wouldn't have found without my help.

Method 2: If I have a property under contract for a respectably low price (say, 50% of market value) – I will charge a 6% – 10% assignment fee (similar to a realtor commission).

Now to clarify… I am NOT a real estate agent (nor do I intend to become one). There is a distinct difference between what an agent does and what I (as a wholesaler) do.

When I structure a deal like this, a purchase agreement is signed between ME and the seller. Once this contract is signed, I have a marketable interest in the property.

A realtor doesn't have this kind of arrangement. Instead, they are signing an agreement whereby the seller authorizes them to market the property on their behalf in exchange for a commission if/when the property sells.

Selling property on behalf of a property owner without a license isn't legal. However, this is a completely different scenario if you're selling your marketable interest in the property (via your executed purchase agreement). This is a key difference between these two types of business arrangements.

At The Closing Table

The closing process went very smoothly. The seller met at the office of our title agency in the morning, and my buyer met at the same office later that afternoon. During this process, the following things were transferred from the seller to my buyer:

- Current building inspection certificate

- Copy of the Current tenant lease

- Tenant Unit Condition Checklist

- Original Tenant Application

- Tenant Security Deposit

- Keys to the House

My buyer then had to complete the following items with their new property manager:

- Execute a Management Agreement

- Execute a W-9 (IRS form)

- Sign Up for Direct Deposit (the easiest way to get paid by their property manager)

- Hand Over the Keys to the House

- Hand Over the Security Deposit

The transaction was seamless, and there were no major hiccups along the way.

What to Expect

During their first month of operations – my buyer earned a whopping $10 of rental income from this property (yippee).

There were a few reasons for the lackluster start:

- The tenant only paid $600 of their $750 rent to the previous owner

- Some small but immediate repairs needed to be done

- The property management company had to recoup their initial start-up costs

This is the reality of owning rental properties. It would be very atypical for an investor to come blasting out of the gate with the best possible outcome for the first month. It just doesn't work that way.

It's not unusual for the first month of operations to be disappointing, but there are a few things to keep in mind.

- Oftentimes, rental properties suck wind in the beginning. When you're acquiring an older property with an existing tenant… be patient. Dealing with deadbeat tenants, repairing things that should have been fixed years ago, and paying for the previous property owner's sins are all real possibilities immediately after you buy. For this reason, ALWAYS be conservative when creating your projections on a rental property. Not all sellers are “liars,” but as a general rule of thumb, don't ever assume they're telling you everything you need to know. I've dealt with many reasonable, respectable sellers – but they still didn't tell me 100% of the details. Allow some room for error when you're evaluating the deal.

- Maintenance is something you'll always have to save for. Maintenance will be an even bigger issue to factor into your cash flow if you're purchasing a property over 50 years old (which accounts for almost every property I look at). This is okay IF you buy the property for a low enough price. Remember – when you buy an older property, you need to allow some room in your cash flow for some “question marks.” Be conservative and allow some small, bad things to happen without putting you in the red.

- Build up a 6-month reserve and maintain it. You should always have a reserve of cash available to cover the costs of your property when it doesn't cash flow. For example, if the tenant in this property decides to stop paying his rent altogether – he will get evicted, no questions asked. If this happens, the property will be without revenue for at least 2 – 3 months, best case scenario (maybe even longer).

When I bought my first rental property, my property manager was very upfront with me and said:

“Plan for a net loss your first year.”

Even though I was getting a great deal and the projections looked awesome – he was still right.

When you're dealing with some of the issues listed above, there are a lot of unknowns, and things inevitably don't go as planned. Be prepared for this.

RELATED: Roofstock Review: Is This the Easiest Way to Buy Turnkey Rental Properties?

A Look Back (One Year Later)

In this case study, we analyzed this property using the same process that many highly successful real estate investors have proven. Our evaluation was thorough, we verified our assumptions and considered every feasible issue.

My buyer ended up having a lot of costs during their first year (judging by the age and known issues in the house) and eventually lost their tenant. However, in the months and years since, the rent price was adjusted upward to account for the stronger market for rentals that followed with the rebound of the real estate market.

Some of the known issues did take a toll on the property's profitability during their first few months of ownership – but once the repairs were made and the right tenant was in place, they could consistently generate the projected monthly cash flow in our initial evaluation. They were also able to benefit from the additional tax write-offs that came with owning rental real estate like this.

Again – this is not (nor will it ever be) a property that throws off massive cash flow, but for someone's first experience with a rental property, it's an ideal way to get started in the business.

It generates some small supplemental income for the new owners and will be relatively easy to sell whenever they decide to liquidate the property (because this is a very generic, affordable property in a densely populated part of town). When it comes time to sell, these are great attributes to have in a property.

Final Thoughts

As with any real estate investment – buying rental properties takes a lot of homework. Rental properties don't necessarily come with the glamour and huge paychecks that “flipping houses” is known for – but it is a proven method of building multiple streams of permanent income.

If you're looking to supplement your retirement income with something that comes with significant opportunities for appreciation, passive cash flow, and tax benefits – buying properties (the right way) is a great way to do it.