The real estate investing industry is rife with insider lingo. It’s enough to scare off many would-be investors.

But as in most industries, the barriers disappear once you learn a few dozen terms and abbreviations. What sounds like a foreign language contains just a few new vocabulary words.

In fact, the terminology is the easy part. Finding great deals on properties or managing contractors? That’s the hard part.

54 Real Estate Abbreviations for Investors

As you learn the language of real estate investing, keep an eye out for these common real estate abbreviations.

1. ARV

After-repair value, or ARV, refers to a property's (drum roll please…) value after repairs are completed.

House flippers, in particular, use ARV to calculate the potential profit on a flip.

2. BPO

A broker price opinion is a report prepared by a real estate broker or agent, estimating a property’s value. It’s less comprehensive—and less expensive—than a full property appraisal.

3. Cap Rate

A property’s capitalization rate or cap rate is the ratio between its income and its value or price. Specifically, it’s net operating income (NOI) divided by the cost or value.

It offers one of many ways of calculating the return on an income property. A cash buyer for a $100,000 property that nets $8,000 per year would earn an 8% cap rate on the property. Buyers willing to accept lower cap rates pay more money for the same property.

Or play around with our cap rate calculator to get a better sense of how cap rates work.

4. CCIM

The National Association of REALTORS® (NAR) offers the certified commercial investment member designation to Realtors who specialize in working with commercial real estate and investment properties.

5. CC&R

In planned communities and homeowners associations, the term “covenants, conditions, and restrictions,” or CC&R for short, refers to the governing rules in that community. Read them before buying, because you’re stuck with them once you purchase a property.

6. CMA

Real estate agents perform a comparative market analysis, also known as a competitive market analysis, to inform sellers about the market value of their property. It features comparable homes (“comps”) that have sold recently.

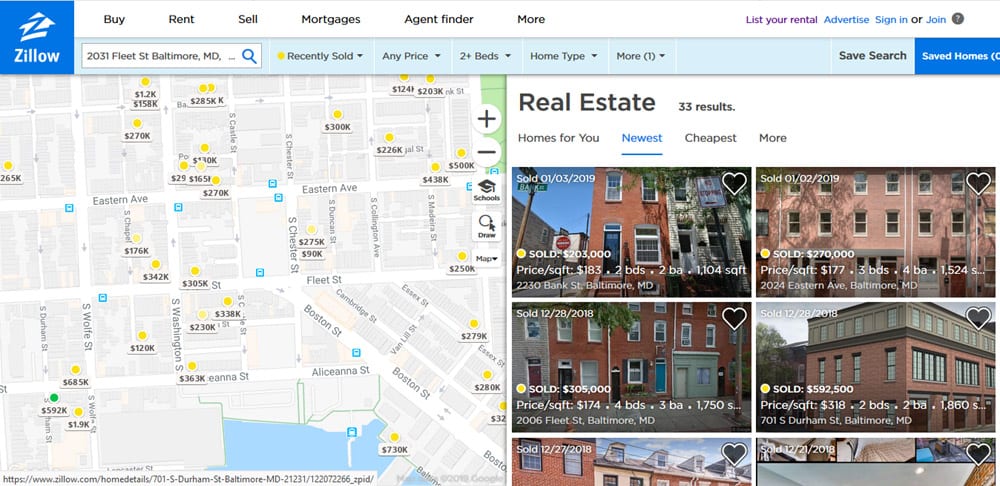

A screenshot of “comps” using Zillow.

7. CoC/CCR

Cash-on-cash return refers to the annual income yield you earn on your personal cash invested in a property or fund.

For example, if you invested $50,000 as a down payment on a property that nets $5,000 annually, you’d earn a 10% cash-on-cash return. The same calculation applies to real estate syndication investments: CoC refers to the income yield you earn on your cash investment.

Try our cash-on-cash return calculator to get more comfortable with the concept.

8. COF

Most commonly used by lenders, cost of funds (COF) reflects their cost to acquire the money they need to fund loans. If you invest in private notes, for example, and you can borrow money at 5% and lend it at 10%, then your COF is 5%.

9. Comp

A comparable property or comp is precisely like it sounds: a similar property very close to the property that has recently been sold or rented. You use comps for market research and determine a property's value or market rent.

The perfect comp would be an identical property right next door that sold yesterday. Obviously, that almost never happens, but the more similar and closer the property, and the more recent the sale or leasing, the better the comp.

Also see CMA above.

10. COO

A certificate of occupancy (COO) documents that a property is rented out and physically occupied.

11. CPM

Another designation by the National Association of Realtors, a certified property manager (CPM) has completed the licensing required by the NAR.

12. CRE

Commercial real estate. ‘Nuff said.

13. DSCR

Debt service coverage ratio or DSCR is a calculation used to measure an income property’s cash flow. Simply divide the property’s annual net operating income (NOI) by the annual cost of its debt service (principal and interest). For example, a property that generates $12,500 in net annual income and costs $10,000 in debt payments has a DSCR of 1.25.

14. FHA

You probably already know the Federal Housing Administration—they’re known for their famous FHA mortgage program requiring just 3.5% down for borrowers with credit scores above 580.

15. FMR

“FMR” stands for fair market rent, for people too lazy to write “market rent.”

16. FMV

Likewise: fair market value, or a property’s estimated market value.

17. Fannie Mae (FNMA) and Freddie Mac (FHLMC)

Fannie Mae and Freddie Mac are two quasi-governmental lending institutions that issue standardized mortgage loan programs, buy loans that conform to those programs, and then bundle and sell them as mortgage-backed securities on the secondary market. If you’ve ever heard the term “conforming loan,” it refers to loans that meet these loan program rules.

18. FSBO

You probably know this one too: for sale by owner. For sale by owner (FSBO) refers to property whose owner is selling it directly without the assistance of a real estate agent or broker. In an FSBO, the owner assumes the responsibilities typically handled by a real estate agent.

19. Ginnie Mae (GNMA)

Ginnie Mae operates similarly to Fannie Mae and Freddie Mac, with a few differences. It’s owned by the federal government and guarantees loans but doesn’t buy them. Read more about Ginnie Mae here if you just can’t live without understanding all the differences and similarities.

20. GP

A general partner or GP on a real estate syndication is the primary investor who found the deal and will oversee acquisition, renovation, property management, and eventual sale. Read more about the legal structure of a general partnership for more details.

21. GRM

Gross rent multiplier (GRM) helps investors compare at a glance the ratio of a property’s gross rent versus its price or value. You calculate GRM by dividing the price by the gross annual rental income. For example, a property that sells for $150,000 and generates $15,000 in gross annual rents has a GRM of 10.

22. HELOC

A home equity line of credit (HELOC) is a rotating line of credit secured against your home with a lien. You can also take out lines of credit against a rental property, but it’s not called a HELOC, because it’s not secured by your home/primary residence.

23. HML

In real estate investor-speak, an HML refers to either a hard money lender or hard money loan, depending on the context. These private loans stay with a single lender rather than bundled and sold on the secondary market like conventional mortgages.

24. HOA

A homeowners association (HOA) is a community-run organization that manages common property and provides services for its members, who are residents of the community.

25. HUD

The Department of Housing and Urban Development, or HUD, is the bureaucratic agency in the federal government that oversees all things housing-related.

26. HVAC

Short for heating, vacuum, and air conditioning, HVAC can refer to either these mechanical systems in a property or a contractor who specializes in repairing them.

27. IRR

New investors find internal rate of return (IRR) one of the more confusing concepts in real estate—largely because the formula is so complex—but it’s not as scary as it sounds. IRR refers to the annualized return that an investment delivered, if you adjust for compounding.

For example, imagine you buy a property, break even on cash flow for two years, then sell it for a 40% profit. The average annual return is 20%: 40% divided by two. But if you had actually earned 20% in the first year and were able to reinvest that extra money, you’d have earned a higher return in the second year, right? Taking into account the compound returns you would have earned if you’d collected those returns along the way, the IRR in this example would be 18.32%.

28. JV

No, it doesn’t stand for junior varsity. In real estate investing, JV refers to a joint venture, where two or more investors go in on a project together. That project could be a property investment, or it could be a marketing initiative, or something else.

29. LLC

A limited liability company or LLC is a simple legal entity many investors use to buy and own investment properties. If you want to start your own, Seth shows how in the video below.

30. L/O

A lease option agreement offers the renter the right to buy the leased property at a specified price.

31. LOC

Property owners can take out a line of credit against their investment properties, not just against their homes.

32. LP

A limited partner or LP invests passively in a real estate syndication or fund. In other words, they act as a “silent partner” investing money only and don’t take on any labor or responsibilities. They’re also protected from legal liability and can’t be named personally as a defendant in a lawsuit.

Read more about the legal structure of a limited partnership here.

33. LTC

Loan-to-cost ratio or LTC refers to the ratio of a project’s debt over its total costs. It’s often used for construction or heavy renovation projects. If a project will cost you $1 million and you can borrow $800,000, it has an LTC of 80%.

34. LTV

The corollary to LTC, the loan-to-value ratio is the percentage of a property’s value that you can borrow. For example, if you borrow $150,000 to buy a rental property worth $200,000, you borrow at 75% LTV.

35. MLS

Real estate agents use the multiple listing service or MLS as an open marketplace platform for listing properties for sale. Read more about how the MLS works here.

36. NNN

A triple net or NNN lease leaves the renter responsible for property taxes, property insurance, and repairs and maintenance. It’s commonly used in commercial real estate but not residential real estate.

37. NOI

Net operating income or NOI refers to the annual net income that a property produces after accounting for ownership expenses (but not debt service).

For example, say a property rents for $1,000, but comes with $500 in monthly expenses, not including the mortgage payment. It generates an annual gross income of $12,000, but the NOI is only $6,000.

38. NOO / OO

Real estate professionals sometimes specify whether a property is owner-occupied (OO) or non-owner-occupied (NOO). For instance, Realtors might tout that until recently being vacated, a property was OO for the last 20 years. Alternatively, hard money lenders might state “NOO only” to describe their loan eligibility.

39. O/F

The real estate abbreviation “O/F” stands for owner financing (also called seller financing). In a real estate listing, it indicates the seller will consider offering it for qualified buyers.

Here's how seller financing can work to your advantage and practically set off a chain reaction in land investing, as explained by Eddie Speed:

40. PITI/PITIA

In the context of mortgage financing, PITI stands for principal, interest, property taxes, and insurance.

Many lenders offer a cheaper interest rate for borrowers who agree to let the lender escrow and collect funds in each monthly payment for property taxes and insurance. The association fees are often included for a property belonging to a homeowners association or condo association, adding an “A” for PITIA.

41. PMI

Private mortgage insurance or PMI protects the lender if you default on your loan and they take a loss. Conforming loans typically require it if you borrow more than 80% of the property’s value. They typically allow you to drop it once you pay your loan below 80% LTV.

Note that FHA loans come with their own mortgage insurance requirements under the moniker of mortgage insurance premium (MIP). Unlike conforming loans, FHA loans now require you to keep paying for MIP for the entire life of the loan, even after you pay the loan balance below 80%.

42. POA

A power of attorney (POA) lets you authorize another person to act on your behalf in legal matters. For example, a hospitalized property owner might sign a power of attorney authorizing their adult child to review and accept purchase offers for a property and sign at the settlement table.

43. Pref

The preferred return or “pref” on a real estate syndication deal or fund sets a certain return percentage that LPs are entitled to before the GP starts collecting their portion of returns. For instance, a 7% pref means that passive LP investors have rights to the first 7% of returns that a deal generates each year before the GP takes any profits.

44. Promote

The “promote,” on the other hand, is a percentage of a syndication’s profits that the GP earns to compensate them for their labor, aside from the returns on any of their own money they invested. In an 80/20 profit split, financial investors (including LPs) are entitled to their proportion of 80% of the deal’s profits—but 20% gets skimmed off the top to compensate the GP.

45. PUD

Homeowners get access to shared community features in a planned urban development or PUD. However, they must also pay homeowners association fees for that right; participation is mandatory.

46. REIA

A real estate investors’ association or REIA is a private networking group of local investors. They meet regularly (such as monthly) to discuss market trends, share information, network, and otherwise help each other succeed in what can otherwise be a lonely business.

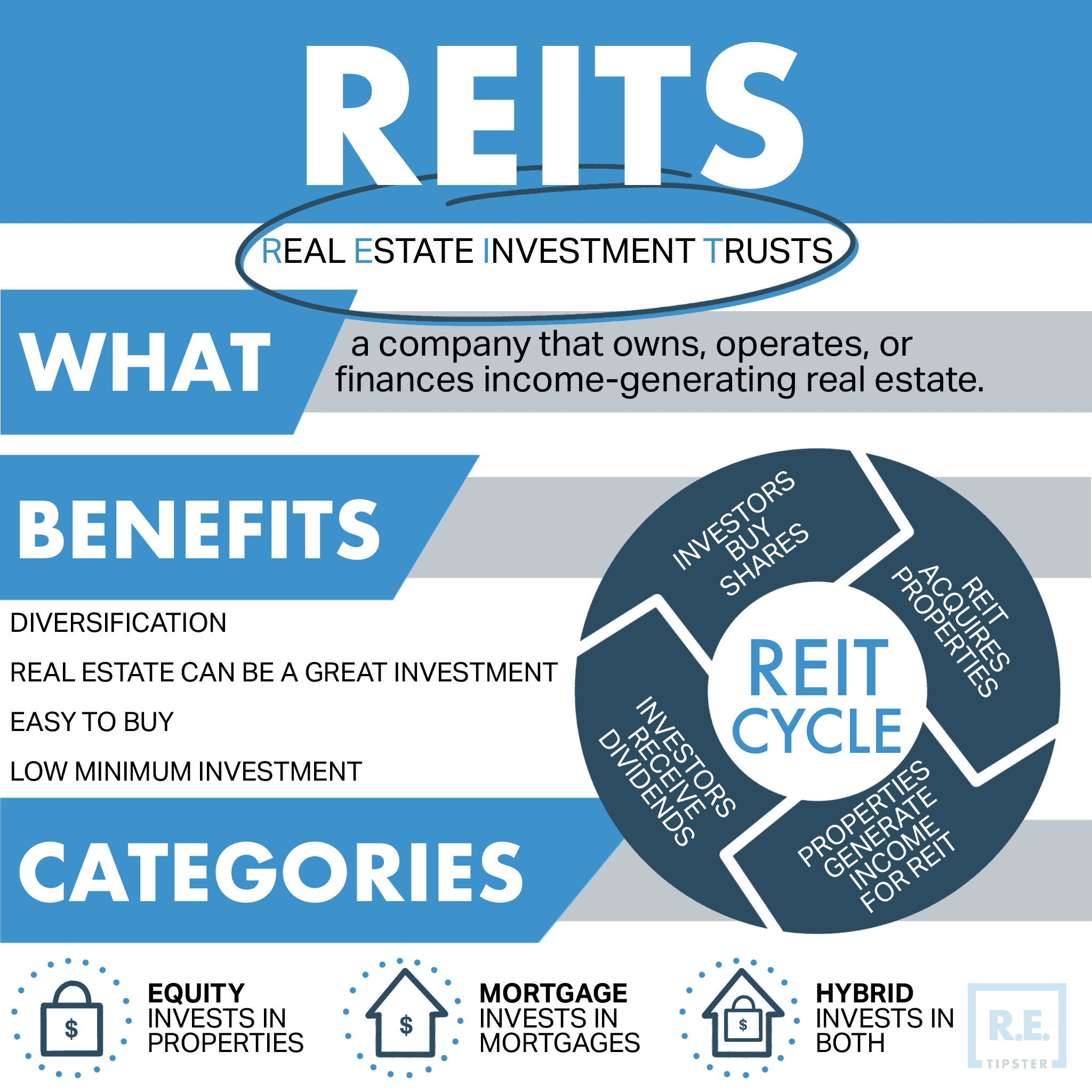

47. REIT

As a passive investment in real estate, you can buy shares in a REIT or real estate investment trust. These companies must hold at least 75% of their assets in real estate (or loans secured by real property), earn at least 75% of their income from real estate, and payout at least 90% of their net profits each year to investors in the form of dividends, among other requirements.

Traditionally, investors bought and sold REIT shares like stocks through their investment brokerage accounts. Today, investors can also buy shares in private REITs directly from real estate crowdfunding platforms as well.

48. REO

When mortgage lenders take back properties at foreclosure auctions, they refer to them as real estate-owned or REO properties. In most cases, lenders aim to sell REO properties quickly to get them off their books.

49. ROI

Return on investment, or ROI, refers to (you guessed it) the financial return you earn on an investment. Imagine you have $200,000 of total costs wrapped up in a house flip, and you sell the property for $250,000—you earn a return of 25% ($50,000 profit divided by $200,000 invested).

50. RTO

Rent-to-own homes allow the tenant to buy the property, often with a portion of their rent going toward their eventual down payment.

51. SDIRA

A self-directed IRA (individual retirement account) lets you invest in almost anything you want. Real estate investors particularly like them as a tax-advantaged way to invest. Read more about SDIRAs to fully understand their limitations and rules.

An IRA, whether self-directed or otherwise, is one of the best ways to get started in the land investing game. If you've got some cash sitting in the bank, do these nine money moves now to put your foot in the door.

52. TLC

When a real estate listing says the property “needs TLC,” they mean it needs updating or renovations. The acronym TLC stands for tender loving care.

53. VA

A virtual assistant works remotely for a relatively affordable wage, taking on any tasks you give them. Read up on how to use VAs to streamline your real estate investing business for ideas.

54. VA Loan

The Department of Veterans Affairs (VA) offers one of the best mortgage programs for military servicemembers and their families. The VA loan program famously lets some borrowers put 0% down on a home purchase.

Final Thoughts

Don’t be intimidated by real estate abbreviations and lingo. The concepts are usually simple, and you don’t need a math degree for real estate calculations, either.

In fact, that’s one of the most significant advantages to real estate: anyone can master the basics and reproduce others’ success. Take the time to learn the fundamentals, and never pass on a chance to learn from investors with more experience than you have.