REtipster does not provide legal advice. The information in this article can be impacted by many unique variables. Always consult with a qualified legal professional before taking action.

For several years, my real estate investing business followed a simple model that worked extremely well about 80% of the time.

I would find boatloads of motivated sellers, make deeply discounted offers to them, and when I found a seller willing to accept, I could buy their property outright and pay cash for it.

Once I owned a property, I could list it for sale (usually within 24 hours) and flip it for a MUCH higher price than I paid.

In a lot of cases, the process worked perfectly. Going through these motions, I could squeeze a lot of free equity out of each property. In the best-case scenario, I could move through the entire process in just a few weeks.

The Problem With a Cash Business

Even though this business model was pretty effective, I found it had some limitations.

It was surprisingly easy for me to find cheap properties and buy them free and clear with the cash I had, but the real challenge was getting these properties sold quickly.

After my first dozen deals, I learned that some properties were MUCH harder to sell than others, and I didn't always have the foresight to know which properties would take significantly longer to sell.

This was a big problem for two reasons:

1. I had a limited supply of cash to work with.

Even if I knew how to get every property on earth for 20% of market value, I didn't have enough money to buy them all. At some point, I had to be smart about which properties to pour my limited resources into.

2. It was hard to know when a property would sell.

One of the unpredictable elements of land investing is that some properties will sell quickly, and some will sit on the market for months on end, and the situation usually ISN'T obvious until you list the property for sale and see how the market responds.

Of course, a few indications can give off some warning signs, and some markets are known for selling faster than others, but when you're working in an unfamiliar territory (like I was most of the time), this can be a tough nut to crack.

RELATED: How to Find the Perfect Market for Flipping Vacant Land

Once I started pushing up against the limitations of my finite supply of cash AND my inability to predict the future, I started thinking to myself,

“There MUST be a better way to monetize these deals without tying up my cash!”

I kept seeing deal after deal hit my desk – and they were great deals – but they just weren't great enough to justify investing my own money.

Buying a property for 60% of market value is great for the average investor, but if I couldn't get a property for a next-to-nothing price tag, it just wasn't “risk-free” enough to tie up my limited funds!

Wholesaling Through Assignments

Around this time, I started exploring how to assign contracts (i.e. – wholesaling, arbitrage, etc.).

Rather than signing a purchase agreement and buying each property outright, I had heard other real estate investors talking about this ingenious way of signing a purchase agreement and selling that contract to another investor so that THEY could close on the deal – with me just acting as a middleman and collecting an assignment fee in the process.

In short, I would effectively be selling a piece of paper because that paper (i.e. – the purchase agreement) represented a TON of valuable real estate equity that would go to whoever closed on the deal and took ownership of the property.

In some ways, assigning a contract wasn't all that different from acting as a real estate agent because I would be wearing many of the same hats and doing some of the same things an agent would do for their client.

The difference was that I had a signed purchase agreement between myself and the seller, giving me an equitable interest in the property. I wasn't selling a property on behalf of someone else, I was selling a contract that entitled me to close on the deal and could be assigned to any other investor who wanted to jump into my shoes.

This contract was like a paper asset I could sell to a third party and get paid an “assignment fee” without owning the property myself.

Legal Disclaimer: In some states, this process of assigning a contract is considered synonymous with working as a real estate agent. Even though it's technically a different type of agreement, some jurisdictions don't distinguish between the two. If you decide to pursue this strategy, check with the laws in your area to make sure you aren't required to have a real estate license to complete this process. If a license is required, you don't want to attempt this without your real estate license.

This presented a few obvious benefits:

- I didn't need to put up any of my own cash.

- I didn't need to shoulder any liability as a property owner.

- I didn't need to stress out if I couldn't find a buyer immediately (because once the purchase agreement expired, I was free to walk away from the deal).

As I became increasingly strapped for cash (all while the opportunities continued to pour in faster than I could handle), this whole “Assignment” business sounded like the PERFECT solution to my problem.

The Mechanics of Assigning a Contract

Now, the idea of assigning contracts (aka – “wholesaling”) always sounds great on paper – but let me tell you, I struggled for YEARS to understand the mechanics of how this process really worked.

I understood the “20,000-foot-high” concept of assignments, but when it came down to figuring out the real, nitty-gritty details (for example)…

- What kind of Purchase Agreement was I supposed to use?

- What kind of Assignment Agreement needed to be signed?

- How was I supposed to get the deal closed?

- Where could I find the right closing agent to work with me?

- When would I get paid in the process?

- What if the buyer went behind my back and talked to the seller?

- What if I couldn't find a buyer before the original contract expired?

…I had heard so many different opinions from so many different people about how the process was supposed to work. All the advice I saw on the various real estate forums and blogs would constantly contradict each other, making it even harder for me to nail down the “correct” way to move through this process.

Since I struggled with it for a long time, I will save you a ton of hassle and confusion by laying it all out below.

The 4 Stages of Assigning Contracts

Assigning a contract is (in theory) a pretty simple concept.

When an investor (we'll call this the ‘middleman') finds a great real estate deal and signs a Purchase Agreement with the Seller, they have the option (if their Purchase Agreement contains the right language) to “assign” (aka – sell) this piece of paper to an outside investor.

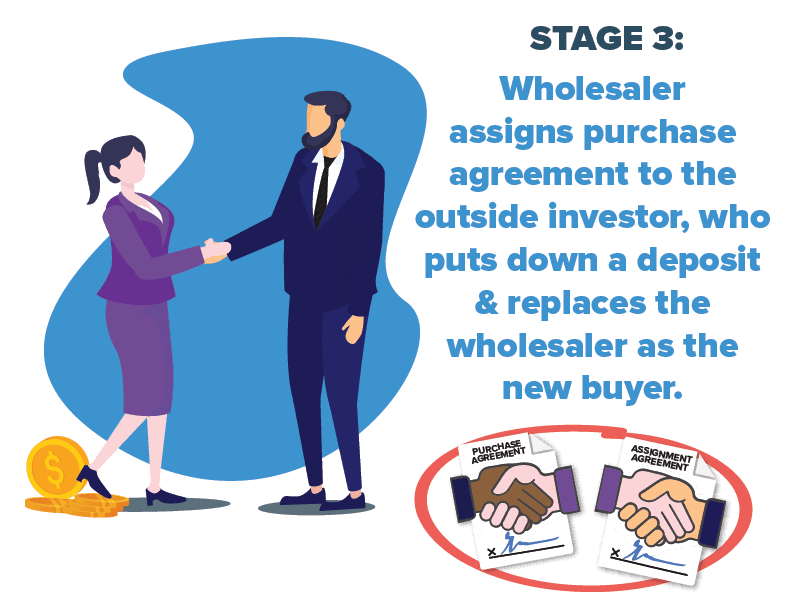

When the wholesaler/middleman assigns the Purchase Agreement to the outside investor, they can do it with a simple, 1-page document called an Assignment Agreement. This document legally transfers the original buyer's rights (as written in the original Purchase Agreement) to the new buyer. It also releases the original buyer (i.e. – the “Assignor”) from any liability or obligation and substitutes the new buyer (“Assignee”) in their place.

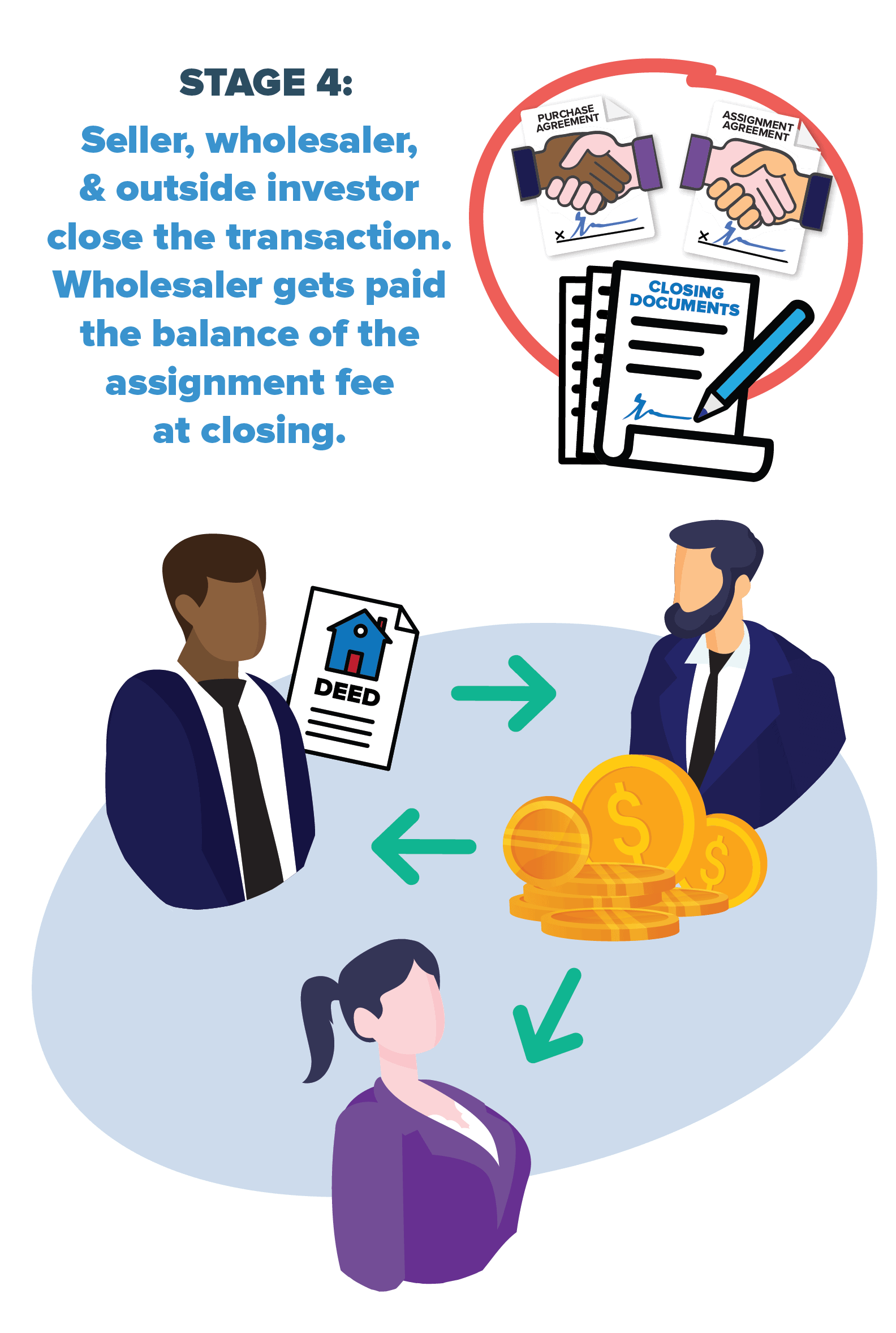

Essentially, the outside investor is jumping into the shoes of the wholesaler and can purchase the property directly from the Seller, at the same price, at the same terms, with the same deadlines, exactly as the terms were stated in the original Purchase Agreement. The only difference is that it now applies to the new buyer (Assignee) instead of the original buyer (Assignor).

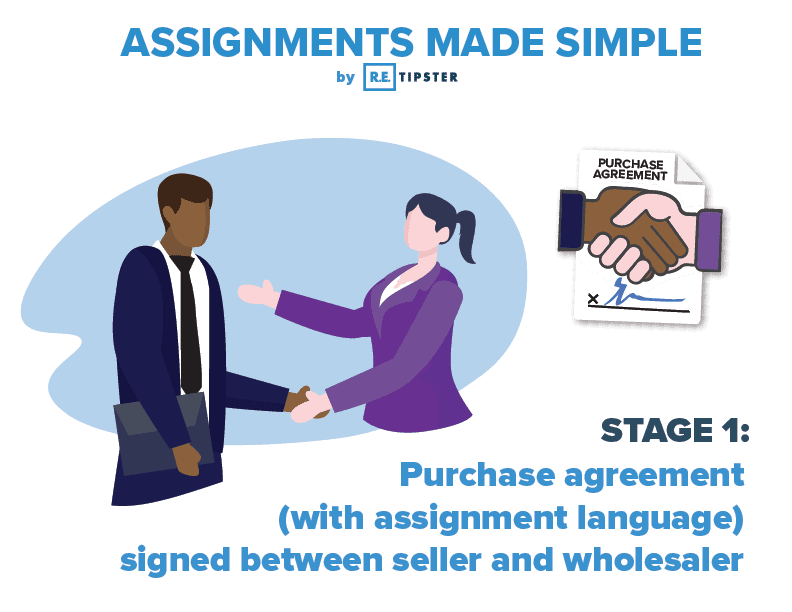

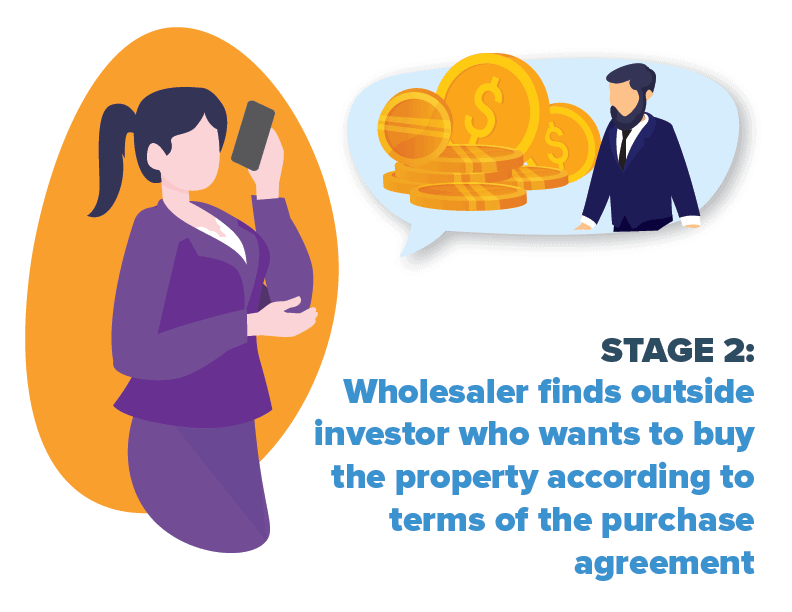

I always find that visual aids are helpful, so here's my best attempt at showing you another representation of how the process works:

Stage 1: Contract Signed between Wholesaler and Seller

Stage 2: Wholesaler Finds an Outside Investor to Buy Under the Terms of the Original Purchase Agreement

Stage 3: Wholesaler Assigns the Contract to the Outside Investor and Gets Paid a Deposit

Stage 4: Seller, Wholesaler, and Outside Investor Close. The Wholesaler is Paid the Balance of the Assignment Fee at Closing.

As you can see, the Wholesaler (Original Buyer or Assignor) is acting as the “middleman” (or middlewoman, in this case), getting paid in the form of an Assignment Fee from the Outside Investor (Assignee).

In the process I follow (which I'm about to explain further), a portion of this payment is made when the Assignment Agreement is signed by both parties (Stage 3 – above), and the remainder is paid when the deal is closed, and the property officially changes hands (Stage 4 – above).

How the Process Works

Over the years, I have heard numerous explanations (all of which were different) about how the wholesaling process is supposed to work.

Most of these explanations only got me 80% there. They never closed the loop on how to get through the closing process, abide by the law, get paid, AND not be a scumbag.

The process outlined below seems to check all of these boxes and get the job done.

Finding the Motivated Seller

I've already thoroughly explained these techniques in several articles throughout this blog. If you aren't sure where to start, you can reference these posts below:

- How I Find Motivated Sellers – Step 1, Step 2, Step 3

- How to Create a Buying Website

- Million Dollar Postcard Templates That Work

- How Much Should You Offer For That Property?

- How To Write Offers That Get Accepted (With 3 Simple Pages)

- Everything You Need To Know About Getting Your County's Delinquent Tax List

- The Ultimate Negotiation Technique That Nobody Talks About

- How to Avoid the Guilt Trip When Sending Low Offers

- Understanding the Motivated Seller

- Getting People To Say Yes

Explain Your Intent & Get the Contract Signed (IMPORTANT)

When you start making offers to motivated sellers, your offer must be accompanied by a thorough explanation of what you intend to do.

Assigning a contract is very different than buying a property outright with a traditional closing. The Seller needs to know what you plan to do (because by itself, your Purchase Agreement doesn't imply your intent to assign the contract, it just says that you CAN assign it… and that's not enough guidance for the seller).

If you don't explain your intentions to the Seller, any rational person will get confused (and probably upset) when they see what happens.

It doesn't need to be this way. All it takes is a clear explanation from you so they understand what to expect.

There are a few key points your Seller needs to be aware of:

- You're not planning to buy their property yourself.

- You plan to sell the contract to someone else, and then THEY will buy the property from the Seller.

- You will communicate with the Seller throughout the process (they won't ever be left in the dark), so they know what's happening.

- If you can't find an outside buyer for the property, the contract will expire, and the transaction won't happen.

Given that a wholesale transaction involves a couple of additional steps, it might be tempting to over-complicate this explanation as you're trying to explain things to the Seller. I had this problem when I started wholesaling with assignments.

Avoid Information Overload

It's important to explain all the basics to the seller, but you don't want to bombard them with the information they don't need to know.

Nobody likes to feel confused. Rather than being made to feel stupid, most confused people will just say “No” to save their pride (even if this arrangement is in their best interests).

When I explain the process to a potential Seller, it looks something like this:

“Thanks for contacting us! After reviewing the details of your property, we would be interested in marketing your property to our nationwide network of real estate investors.

For the next 180 days, we would be willing to invest our time and resources to find a cash buyer at no cost to you. If we are able to find a buyer, we will coordinate with you and the buyer to schedule a closing and ensure you are paid the full amount listed in this purchase agreement.

You will not incur any costs in this process. We will be compensated by the buyer (which we will find) and when the transaction is closed, you will receive the full sale price stated in the attached purchase agreement.

In order to start the process, we will need a signed copy of the attached purchase agreement. In this contract, our company will be listed as the Buyer and our intent will be to assign this contract to another cash buyer in our network.”

To assign your purchase agreement (as explained above), you need to ensure your contract contains an “Assignment” clause, allowing you the right to assign the contract to a third party. Without this clause, you will be the only one allowed to close on the purchase, and the rest of this process won't work.

There are many different ways to state this in your contract, but if you need an example, this is what my Assignment clause looks like:

ASSIGNMENT: Buyer has an unqualified right to assign its rights under this contract to a third party. No notice to the Seller of an assignment is necessary. Such an assignment will create a novation and release the original Buyer from this contract and substitute the assignee in its place.

Reminder: Whatever documentation or language you use, you'll want to make sure you run it by an attorney in your area to ensure it's valid and abides by your local, state, and federal laws.

Due Diligence & Property Prospectus Report

Since you're not the actual end-buyer, you don't need to learn every intricate detail about the property you have under contract.

However, you need to know the basic, relevant details about it because you're going to market this thing to the public, to your buyers list (if you have one), and to anyone else who may be a potential cash buyer.

So how much do you need to know?

As a general rule, I try to uncover any potential disasters that would kill a deal if I were buying it outright (i.e. – what kinds of things would make ME turn and run the other direction?). I also try to gather enough information to complete a property prospectus report.

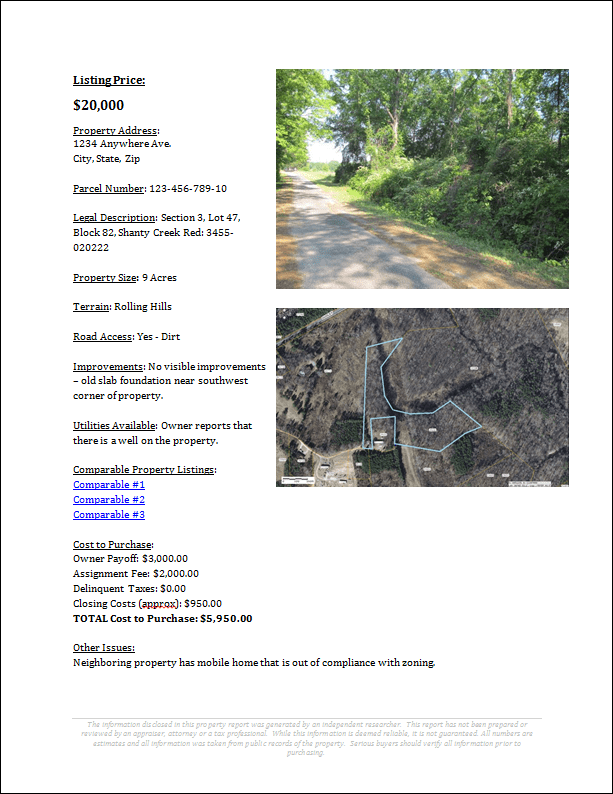

What is a property prospectus report? Mine looks something like this…

It's just a single page that lists all of the basic details about the property:

- Listing Price

- Property Address

- Parcel Number

- Legal Description

- Property Size

- Terrain & Surroundings

- Road & Utility Access

- Parcel Map

- On-Site Photo(s)

- Breakdown of Costs

- Comparable Listings (to give a basis for my asking price)

…and that's pretty much it. Here's a video overview of how I fill it out:

Also see: One Weird Trick to Find the Size, Shape, Location & Dimensions of Your Property and The Fastest Way to Research Any Property in the United States

The goal of this document isn't to inform my cash buyers of every last detail about the property. The point is to give them just enough information to make it obvious that the deal has great potential and huge value (if it's a good deal, this shouldn't be difficult).

That being said, if I do find any big problems in my due diligence process, I'll either walk away from the deal (if I don't think I'll be able to sell it for a profit) or at the very least, I'll be sure to disclose any “Other Issues” that I'm aware of at the bottom of the report.

(Note: If you want a copy of my Prospectus Report template, you can get it at the bottom of this blog post.)

Find the Buyer, Assign the Contract, Collect the Deposit

When you start getting calls and emails from interested buyers, you'll likely find that there are A LOT of tire-kickers out there. People will get your hopes up, only to go AWOL when it's time to sign on the dotted line.

People are extremely flakey, so if someone wants you to take their offer seriously, they'll have to agree to it in writing AND put their money where their mouth is.

When I find an interested buyer, this is how I would communicate the next steps to them:

“Thanks for your interest in this property! If you'd like to move forward with this purchase, I'll need two things from you:

1. Please sign the attached Assignment Agreement and fax, email, or text it back by 5:00pm today.

2. Please send us a $______ deposit by 5:00pm today via wire transfer.

Note: This property will not be reserved until both items are received.

Once both items are received, the property will be reserved in your name and we will contact <<Title Company Name & Location>> to begin the closing process. They will contact you in the next few days and will send you the closing documents and preliminary title report for your review and approval.

Our tentative goal is to close this transaction by <<30 days later>>. This means you will need to submit your funds and all the required paperwork to <<Title Company Name>> by (or before) that time.“

When it comes to the earnest deposit, when the total purchase price is $10K – $30K, I'll usually ask for approximately 10% of the total purchase price, and I round it to the nearest $1,000. If the sale price is less than $10K, then $500 is usually sufficient. The idea is just to collect something to show that the buyer is serious and not blowing smoke.

If you're closing with a title company or attorney, this money should be sent to your closing agent, who will disperse it appropriately when the deal closes (or if it falls apart). Your end buyer can either send the funds directly to your closing agent, or they can send the funds to you, and YOU can give it to your closing agent.

Unfortunately, all kinds of obstacles can get in the way of closing (clouds on title, funding issues, inspection issues, you name it), so you don't want to get too excited about this money until the deal is closed.

Note Regarding the Assignment Agreement

You might find that some people (buyers, sellers, closing agents, etc.) tend to overthink this document simply because they don't have experience with assignments and aren't familiar with how they work.

As I explained above, this is a relatively simple document that takes your rights as the original “Buyer” of the property and transfers them to a third-party (i.e., the new person or entity that has the cash and desire to jump into your shoes and become the actual end buyer of the property).

This video offers a straightforward explanation if you ever encounter an individual who just doesn't get it.

Deliver Documentation to Title Company, Close, Get Paid

Once you have both the Assignment Agreement and the funds required for your deposit, you'll need to deliver the following documentation to your Closing Agent (i.e., Title Company or Closing Attorney):

- A copy of the fully executed Purchase Agreement.

- A copy of the fully executed Assignment Agreement.

- The funds from the end buyer's earnest deposit.

This should be everything they need to prepare the necessary paperwork for all parties to sign and move forward with closing the transaction.

Given that this is a cash deal (with no mortgages or outside financing involved), this shouldn't be a complicated transaction for your closing agent to pull off. That said, I should warn you that not all closing agents are created equal.

When I started trying to assign contracts, I found that some title companies had no idea what they were doing. They acted like I was asking them to move heaven and earth or do something illegal. I found that MANY title companies were particularly incompetent with assigning contracts, which threw a huge wrench in my progress for a long time.

If you run into this dilemma, keep calling around to various title companies or closing attorneys in your area until you find someone who understands what you're talking about. Don't let their ignorance act as an obstacle to your business.

Advantages to Assigning Contracts

When I look back on all the properties I've listed and sold on my behalf, most sold in 6 months or less (assuming they were desirable, usable, priced right, and I was marketing them consistently).

Whenever a property took longer than six months to sell, it was usually because of one or two issues:

- My assumption about the property's market value was WAY off (and I didn't have the profit margin I thought I would).

- Something was fundamentally wrong with the property (e.g., it didn't perc, it wasn't buildable, the location was terrible, etc.).

As you can imagine – neither of these issues is fun to realize, but whatever the case may have been, I found that when a property sat on the market for more than six months and the sale still hadn't occurred, something big needed to change.

This is one of the huge benefits of assigning a contract. By the time I realized I had made a pricing or due diligence mistake with one of my properties, it was clear that if I could do it all over again, I wouldn't have bought this property at the price I paid for it.

It would have been far better for me to get it under contract and then assign the purchase agreement (if I even could) rather than buy it outright.

As you can imagine, if there's ever something wrong with a property, this problem should stay in the seller's lap instead of mine.

Here are some issues that make me consider wholesaling through an assignment rather than buying a property outright:

- When I'm not very confident about the property's true market value.

- When there are potential problems with the property that I can't get resolved.

- If I don't have the money to invest and buy the property outright.

- The seller isn't willing to lower their asking price to my liking (but it's still a good deal, with enough profit margin to be a good deal for someone else).

- The property isn't local, and I don't want to take on the liability of ownership.

It's important to remember that even when you have money to buy a property, it doesn't necessarily mean you should.

All kinds of menacing issues can come up with any property – and in some cases, these issues can become MAJOR obstacles to selling it.

For many investors, this uncertainty is more than enough reason to stick to wholesaling them with an assignment exclusively.

Drawbacks to Assigning Contracts

While there are a lot of benefits that can come with assigning contracts, there are a few drawbacks you should be aware of as well.

When you intend to assign a contract, you'll have to deal with a few limitations (which may or may not be a problem – depending on what you're trying to do). For example:

- You won't be able to improve the property (because you don't own it, and it's not yours to improve).

- You won't be able to offer seller financing (because you're not the owner, and it's not yours to finance).

- You'll have a shorter window of time to finish the deal (because your contract won't last forever).

- The closing process will require more attention to detail than the simplicity of a cash closing.

- Your buyer MUST be able to pay all cash (because most mortgage lenders aren't willing to deal with the complexities of an assigned contract).

It's also worth noting that some states (like Ohio, for instance) have laws and statutes that essentially make it illegal to market a property you don't own in your name. It's considered the “brokering of real estate,” if you don't have a real estate license in that state, you could get fined and/or charged with a misdemeanor for working outside of this box.

Even in states where the legality of assigning contracts isn't an issue, it's still a good practice to make it abundantly clear in your listing that you are selling a CONTRACT to purchase the property, not the property itself.

For example, you could include a short paragraph in your listing that reads something like this…

“This property is available via our Assignment Program. We have entered into a purchase contract with the current owner to buy the property for $________ (this price includes payment to the owner and all associated fees and estimated closing costs) and for an assignment fee of $_______, we will sell our rights in this contract to a third party. A reputable title company and/or attorney will be enlisted to handle the closing and transfer of title.”

With this kind of statement included in your listing, it should be clear to interested parties that you are not the current owner. You are simply selling a piece of paper that gives you (and, ultimately, your end buyer) the right to purchase the property for a certain price.

When you decide to buy a property outright and flip it (i.e., the old-fashioned way), there are a lot of freedoms you'll have that simply aren't available when you choose to assign the contract.

So, before you swear off buying properties outright, remember that every deal has different considerations you need to think about. Depending on your end goals, these issues may or may not make the property an ideal fit for wholesaling with an assignment.

It's An Ongoing Education

I'll be completely honest; I still don't consider myself an “expert” in wholesaling via assigning contracts because it isn't been my primary strategy.

On the same coin, I can say that I've been through enough wholesale assignment transactions to know that this process works.

Wholesaling is a great way to make money in real estate, but assigning contracts isn't my primary technique for handling most deals.

That being said, wholesaling is an extremely helpful sidearm at my disposal when I come across deals that don't fit perfectly inside the “cookie-cutter mold” that I like to see (and as you can probably imagine, this happens pretty frequently).

I think it's great for any real estate investor to be familiar and comfortable with this strategy because there are PLENTY of scenarios where assigning the contract is a much better fit than buying a property outright.

Want Access to My Wholesaling Toolbox?

As I mentioned earlier, I spent YEARS of my life trying to nail down the right process and documentation for wholesaling real estate. The ability to pull some huge profits out of properties I didn't even own was a major revelation, and it could be a big deal for you too.

If you want to try your hand at assigning contracts… I've got something I think will help:

- A copy of my Assignment Agreement template

- A copy of my Purchase Agreement (which is fully assignable)

- A copy of my Property Prospectus Report template

- A copy of my Wholesaling Checklist (to walk you through each step of the process)

- Detailed Video Tutorials explaining how to use each document

Again, there's no “magic” to the documents I use. You can easily call up your local attorney, and I'm sure they'd be happy to charge you $600/hour to give you a similar set of documents and instructions.

Go ahead and call them… I'll wait.

It took me a long time and a lot of tedious conversations with various legal pros to fine-tune this product. These docs were designed to be both simple and user-friendly, all while including all of the pertinent details I needed to see in my wholesale deals.

My goal was to AVOID confusing Buyers, Sellers, and Closing Agents about how this process works and to give myself the freedom I needed to feel comfortable doing these types of transactions. Over time, I've found that these attributes went a long way in getting these deals done. If you’re serious about adding wholesaling to your growing repertoire of real estate investing strategies – the opportunity is sitting right in front of you.

When you consider how many more deals you'll be able to do, the risk you'll be able to avoid, and the amount of money you'll be able to make here (all while investing none of your cash), this information is easily worth 50x than the price tag I'm putting on it – I'm not exaggerating.

Note: When you sign up as an REtipster Email Subscriber, I’ll send you an instant $20 off “Discount Code” for this item, and if you enroll in the Land Investing Masterclass, you'll get access to this item for FREE. There's no pressure – I just want to make sure you're aware.